Income and spending both weakening: Income: Ratcheting down with each setback: Spending: Highlights Consumer spending in January wasn’t able to meet Econoday’s consensus, up only marginally at 0.1 percent even against the easy comparison of December which is now revised yet 1 tenth lower to minus 0.6 percent. Weakness in January spending is centered in durable goods and reflects the month’s very sharp drop in vehicle sales. The Bureau of Economic Analysis is still catching up following the government shutdown and today’s report is a split between lagging data on spending and prices and up-to-date data on personal income which was also subdued, up 0.2 percent in data for February though the wages & salaries component did manage a respectable 0.3 percent gain. Turning to

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

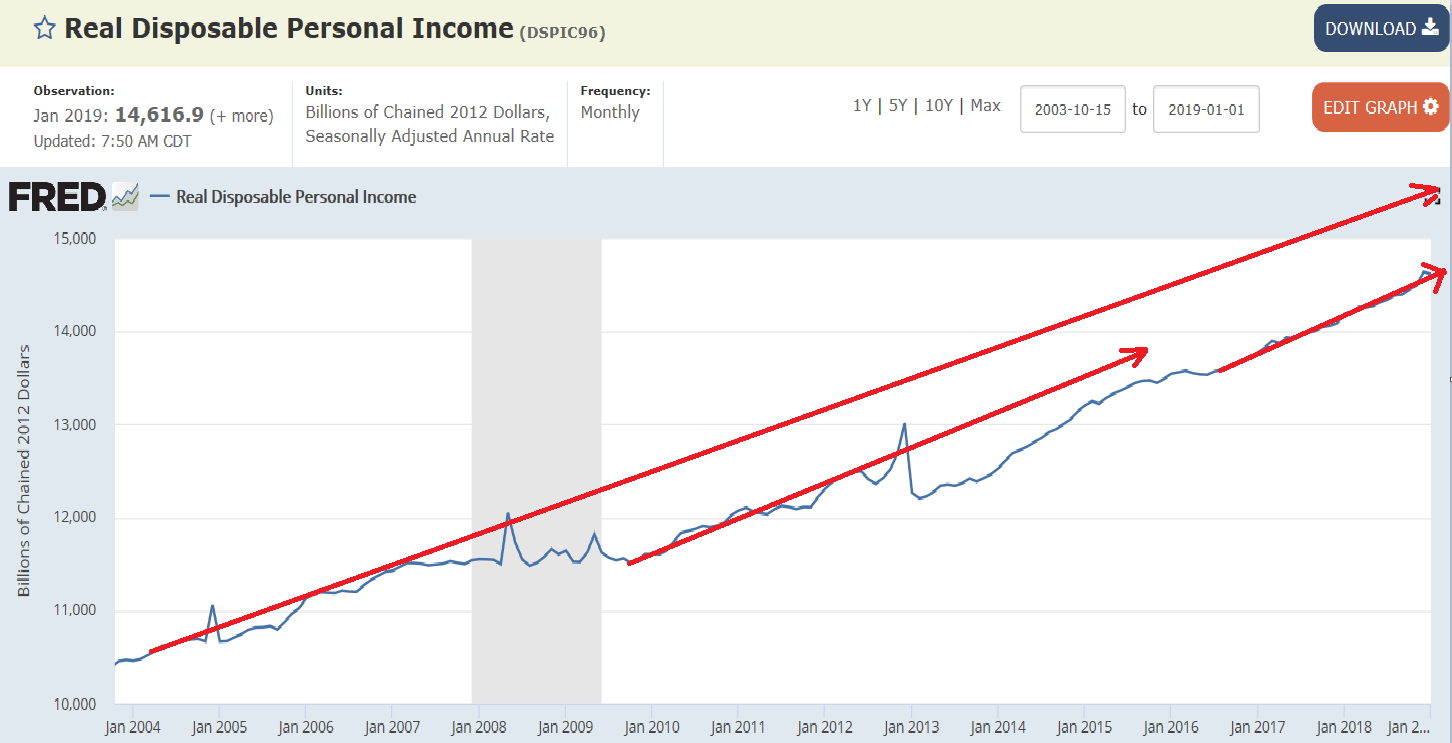

Income and spending both weakening:

Income:

Ratcheting down with each setback:

Spending:

Highlights

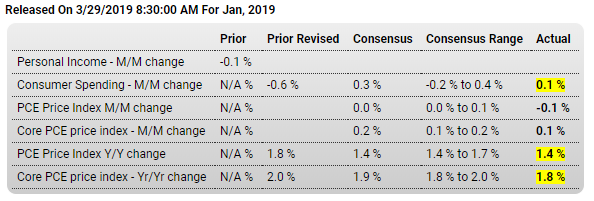

Consumer spending in January wasn’t able to meet Econoday’s consensus, up only marginally at 0.1 percent even against the easy comparison of December which is now revised yet 1 tenth lower to minus 0.6 percent. Weakness in January spending is centered in durable goods and reflects the month’s very sharp drop in vehicle sales.

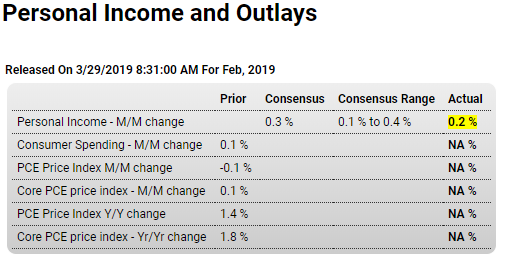

The Bureau of Economic Analysis is still catching up following the government shutdown and today’s report is a split between lagging data on spending and prices and up-to-date data on personal income which was also subdued, up 0.2 percent in data for February though the wages & salaries component did manage a respectable 0.3 percent gain.

Turning to prices they are also subdued, down 0.1 percent for the PCE price index in data for January and up only 0.1 percent for the core. Both of these miss the consensus forecasts. Year-on-year rates are at 1.4 percent overall with the core slipping back 2 tenths to 1.8 percent.

Nearly all the readings in today’s set of data miss the consensus with January consumer spending pointing to opening trouble for first-quarter GDP and the weakness in core prices raising the risk that the Federal Reserve may soon be defending the downside of its 2 percent inflation target. On both scores, the balance for neutral monetary policy tilts, however slightly, toward the rate-cut side.

This would slow things down further, for example: