While there’s no dispute that there’s been a substantial global economic slowdown, stocks have been doing well due to investor belief that Fed will be there with lower rates to stem the deceleration and reignite growth. However, seems obvious to me that the Fed’s tools- low rates and QE- aren’t all they are cracked up to be, as per Japan, the euro zone, and the US for the last 10 years. To the contrary, seems to me the Fed may be confusing the accelerator with the brake, as the govt. is a net payer of interest to the economy on + trillion of outstanding treasury securities and interest bearing reserves. That means rate hikes add interest income to the economy as they increase the federal budget deficit, and rate cuts likewise remove interest income from the economy.

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

While there’s no dispute that there’s been a substantial global economic slowdown, stocks have been doing well due to investor belief that Fed will be there with lower rates to stem the deceleration and reignite growth.

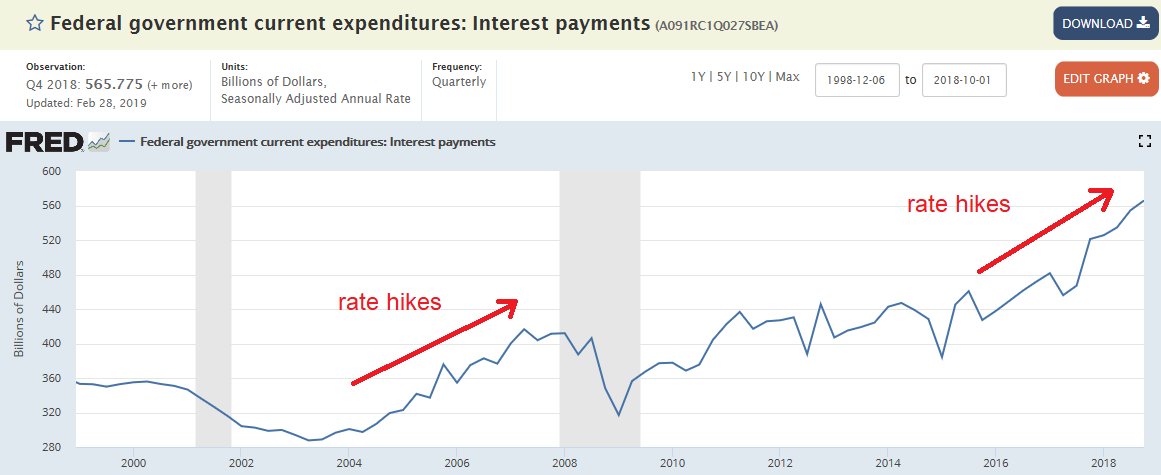

However, seems obvious to me that the Fed’s tools- low rates and QE- aren’t all they are cracked up to be, as per Japan, the euro zone, and the US for the last 10 years.

To the contrary, seems to me the Fed may be confusing the accelerator with the brake, as the govt. is a net payer of interest to the economy on $20+ trillion of outstanding treasury securities and interest bearing reserves. That means rate hikes add interest income to the economy as they increase the federal budget deficit, and rate cuts likewise remove interest income from the economy.

Highlights

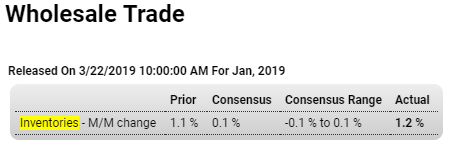

There are few indications of economic slowing that are more convincing than an unwanted build in inventories — and that apparently is what’s underway in the wholesale sector. Wholesale inventories jumped 1.2 percent in January to far exceed anyone’s expectations and are up 7.7 percent year-on-year. Confirmation that this is unwanted comes from sales in the sector which did rise 0.5 percent in January but follow a long stretch of contraction. Year-on-year, sales are up only 2.7 percent. The sector’s stock-to-sales ratio continues to climb, at 1.34 vs 1.33 in December and against 1.28 in January last year. Today’s data confirm the wisdom of the Federal Reserve’s cautious outlook.