Weak income and employment growth tends to coincide with weak retail sales growth, as the global trade collapse continues: Highlights The consumer cooled but not enough to not knock back a still rising trend for retail sales which in September fell an unexpected 0.3 percent. All the breakdowns also came in well below expectations including a 0.1 percent dip when autos (one of September’s weaknesses) are excluded and no change when also excluding gasoline. Perhaps the best gauge to this report is the control group, which is part of the GDP mix and which came in flat. Limiting the unwelcome message from September is a revision to the upside for August, up an additional 2 tents to 0.6 percent, and also a look at the total year-on-year rate which did ease 3 tenths in

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

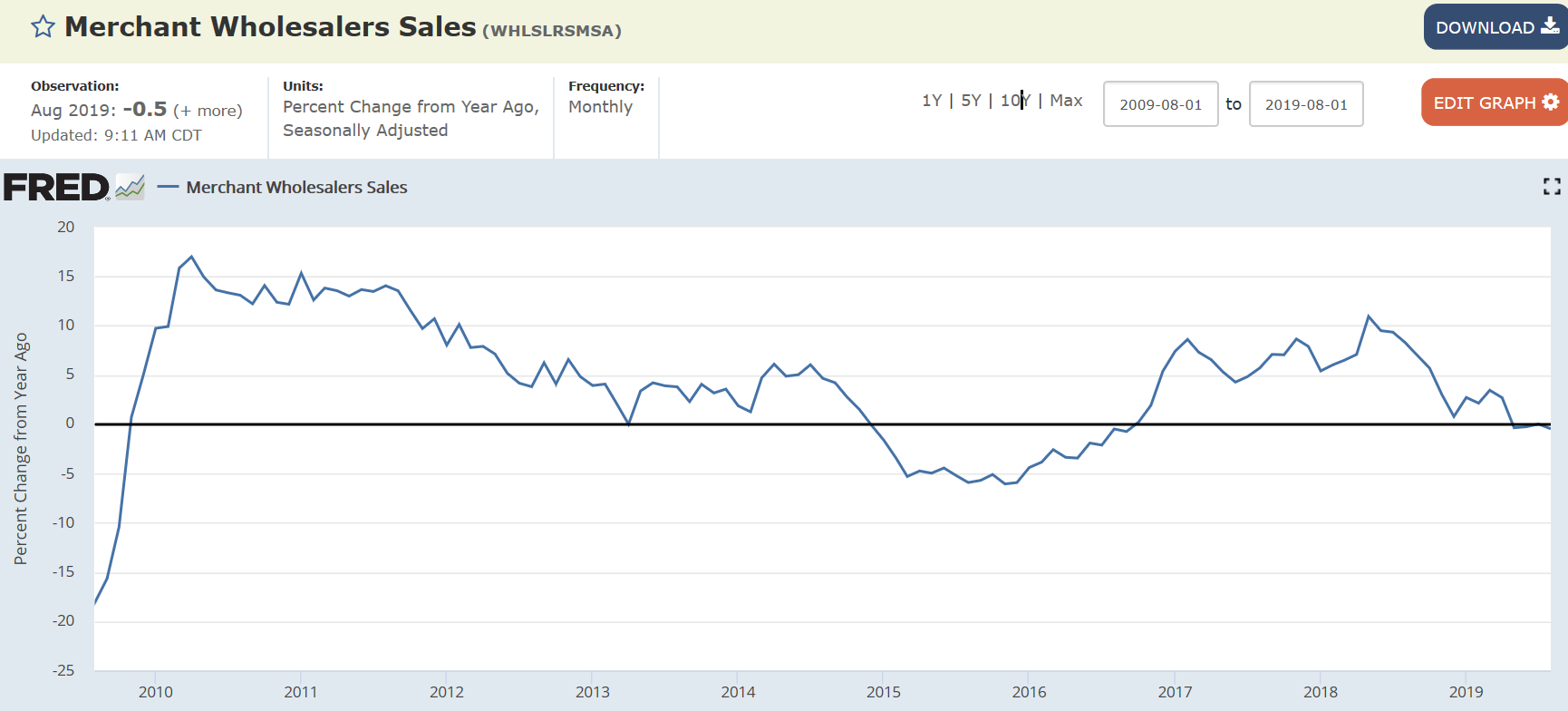

Weak income and employment growth tends to coincide with weak retail sales growth, as the global trade collapse continues:

Highlights

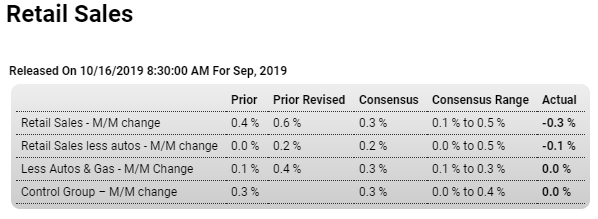

The consumer cooled but not enough to not knock back a still rising trend for retail sales which in September fell an unexpected 0.3 percent. All the breakdowns also came in well below expectations including a 0.1 percent dip when autos (one of September’s weaknesses) are excluded and no change when also excluding gasoline.

Perhaps the best gauge to this report is the control group, which is part of the GDP mix and which came in flat. Limiting the unwelcome message from September is a revision to the upside for August, up an additional 2 tents to 0.6 percent, and also a look at the total year-on-year rate which did ease 3 tenths in September to 4.1 percent that, next to August’s 4.4 percent, is still the second best rate since October last year.

Auto sales (in contrast to a rise in previously reported unit sales) fell 0.9 percent though this does follow a 1.9 percent jump in August. Year-on-year growth for autos did slow, down 1.4 percentage points yet to a still favorable 5.6 percent. Gasoline sales, held down by low prices, once again pulled down total sales, falling 0.7 percent in the month after August’s 1.3 percent drop.

Nonstore retailers (dominated by e-commerce) are also in the negative column in September, down a monthly 0.3 percent though year-on-year growth continues to easily top all categories at 12.9 percent. Building materials fell 1.0 percent in September while general merchandise fell 0.3 percent. One of the positive showings is by apparel stores at 1.3 percent and furniture stores at 0.6 percent. Restaurants posted a 0.2 percent monthly gain for very respectable yearly growth of 4.9 percent that, like yearly growth in auto sales, underscores the fundamental strength of the consumer.

Today’s report will limit expectations for the third-quarter contribution from consumer spending, which nevertheless remains favorable and the central underpinning for economic growth. For the Federal Reserve, consumer slowing could make policy more vulnerable to the slowdown underway in global demand and the US manufacturing sector, and in turn strengthen the arguments of the doves who are pushing for more rate cuts.

Highlights

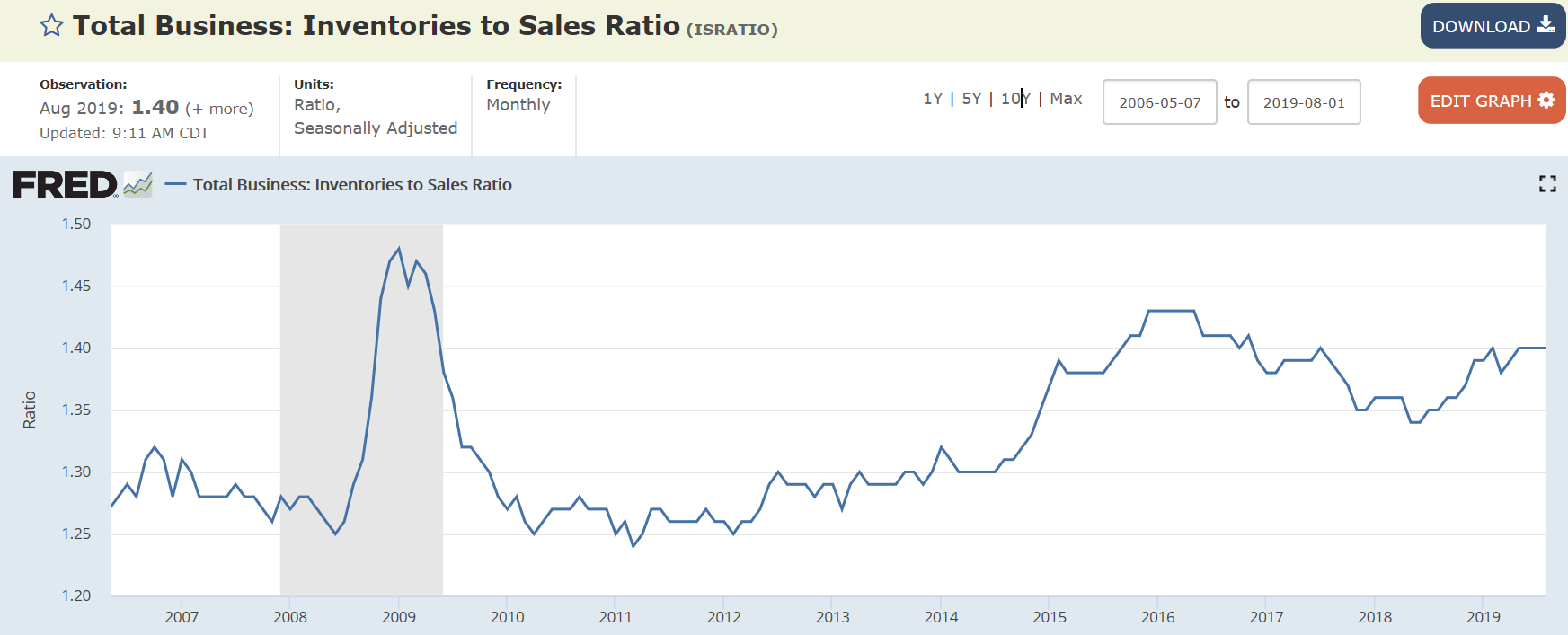

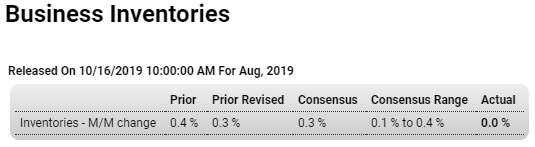

Businesses are holding back inventory growth as sales growth stalls. Total inventories were unchanged in August against only a 0.2 percent rise in sales, a modest mismatch that isn’t enough to move the inventories-to-sales ratio which held unchanged at a lean and favorable 1.40.

Inventories relative to sales look stable right across components with retailers showing the only change and that’s downward, with this ratio a bit more lean at 1.44 versus 1.45 in July.

When it comes to production and employment, nimble inventory management helps smooth out disruptions from economic ups and downs, yet however positive this may be for general economic health a slowing inventory build does hold down GDP growth.

Annual sales growth is negative:

Inventories remain elevated: