Imports and exports both decelerating indicates a weaker global economy, and weak US retail sales indicates domestic consumer spending growth is slowing: Highlights First-quarter GDP looks to get a major boost from improvement in the nation’s trade deficit which, for February, came in at much lower-than-expected .4 billion. And the positives are more than just a technical calculation as exports, driven by aircraft, jumped 1.1 percent in the month on top of January’s 1.0 percent gain. Exports of goods rose 1.5 percent to 9.5 billion as civilian aircraft rose .2 billion in the month. Outside of aircraft, however, gains are less striking with auto exports up %excerpt%.6 billion and with monetary gold and consumer goods showing marginal gains. For farmers, the results are

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

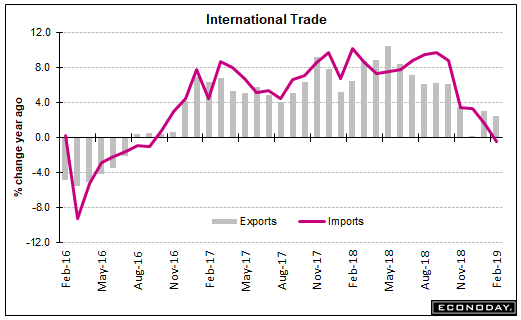

Imports and exports both decelerating indicates a weaker global economy, and weak US retail sales indicates domestic consumer spending growth is slowing:

Highlights

First-quarter GDP looks to get a major boost from improvement in the nation’s trade deficit which, for February, came in at much lower-than-expected $49.4 billion. And the positives are more than just a technical calculation as exports, driven by aircraft, jumped 1.1 percent in the month on top of January’s 1.0 percent gain.

Exports of goods rose 1.5 percent to $139.5 billion as civilian aircraft rose $2.2 billion in the month. Outside of aircraft, however, gains are less striking with auto exports up $0.6 billion and with monetary gold and consumer goods showing marginal gains. For farmers, the results are slightly in the negative column with exports down $0.2 billion. But exports of services, at $70.1 billion in the month and usually a reliable plus, rose 0.3 percent.

Imports rose only 0.2 percent in the month, totaling $259.1 billion but with consumer goods showing yet another large increase of $1.6 billion in the month. Imports of industrial supplies fell $1.2 billion despite a 0.8 billion rise in the oil subcomponent. Imports for other categories were little changed.

Bilateral country deficits show a sharp decline with China, down $24.8 billion in unadjusted monthly data that are hard to gauge given strong calendar effects during the lunar new year. But year-to-date, the deficit with China is at $59.2 billion and down sizably from $65.2 billion in the comparison with the 2018 period. February’s deficit with both the European Union and Canada narrowed while deficits with Japan and especially Mexico, at $7.4 billion vs January’s $5.8 billion, deepened.

Today’s results are certain to lift first-quarter GDP estimates which had been roughly at the 2 percent line. The average deficit for the first two months of the quarter is $50.3 billion which is well under the $55.6 billion monthly average in the fourth quarter. And the easing deficit with China may well ease immediate tensions in U.S.-Chinese trade talks.

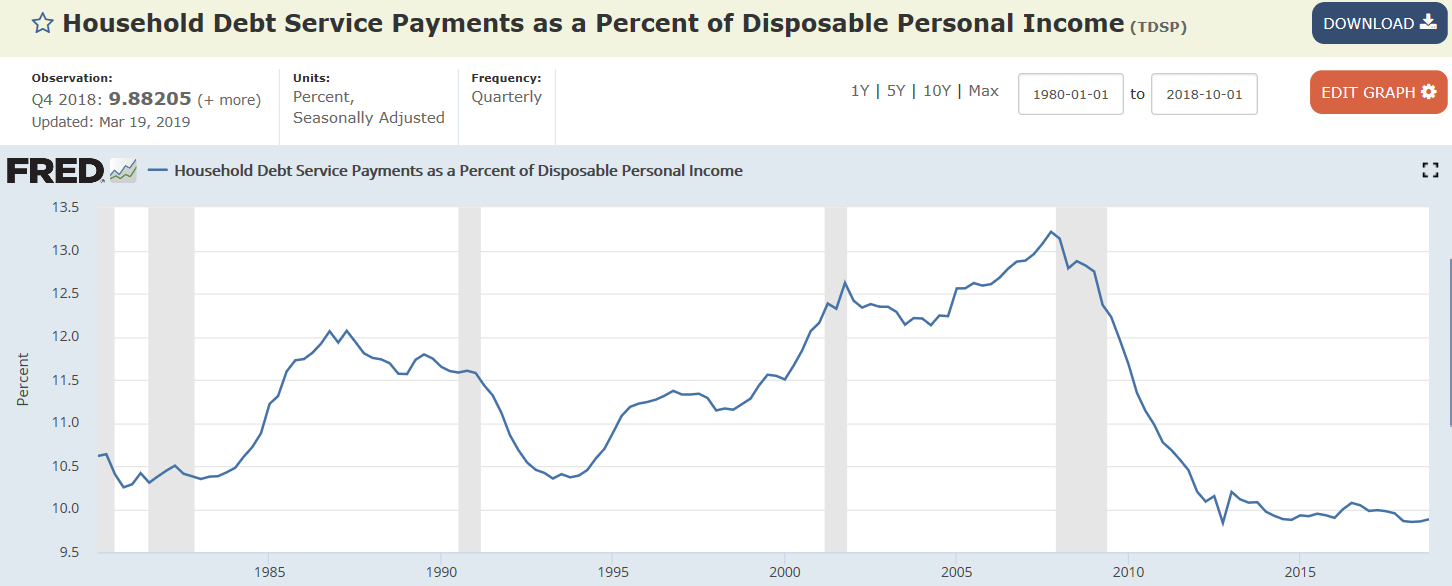

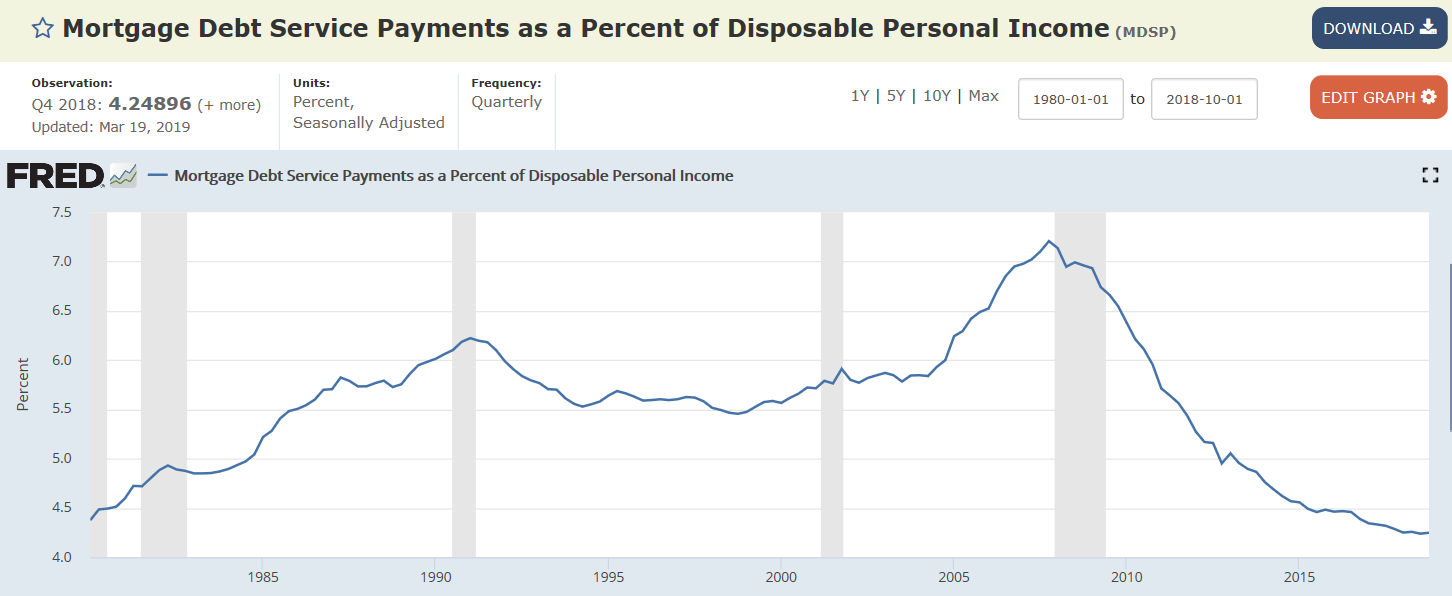

Interesting as debt service and financial burdens ratios remain historically low:

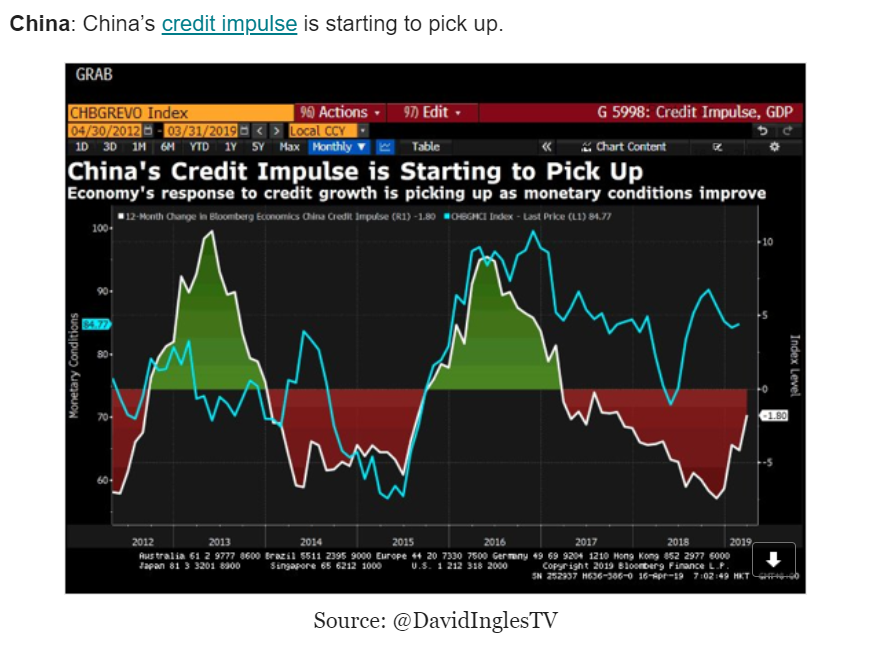

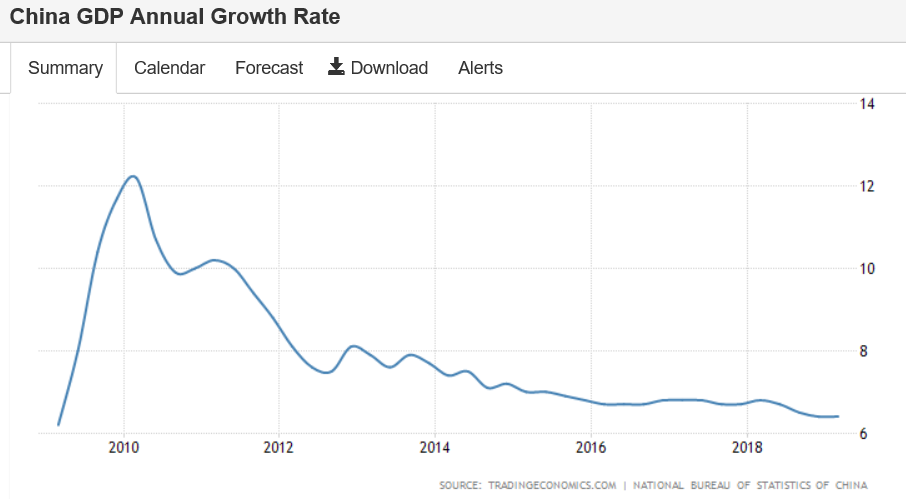

They’ve made fiscal adjustments that may be kicking in:

Bank of Japan to be top shareholder of Japan stocks

Bank of Japan to be top shareholder of Japan stocks (Nikkei) The BOJ held over 28 trillion yen ($250 billion) in exchange-traded funds as of the end of March — 4.7% of the total market capitalization of the first section of the Tokyo Stock Exchange. Assuming that the bank maintains its current target of 6 trillion yen in new purchases a year, its holdings would expand to about 40 trillion yen by the end of November 2020. This would place it above the GPIF’s TSE first-section holdings of more than 6%. The BOJ has likely also become the top shareholder in 23 companies through its ETF holdings. It was among the top 10 for 49.7% of all Tokyo-listed enterprises at the end of March.

This could explain why same store sales have been growing by about 5% year over year:

CNN: American retailers already announced 6,000 store closures this year. That’s more than all of last year.