The ‘labor market’ is not a ‘fair game’ as people need to work to eat, and business only needs to hire if it likes the return prospects, so real wages should be expected to remain depressed without some form of outside support, which broke down in the 80’s with globalization policies, and the share of GDP going to capital began to rise: General weakness continues: US imports way down, as reflected in general global weakness, and same for weak US exports. And also indicative of US weakness: Highlights A sharp pull back in imports, not strength in exports, led a much sharper-than-expected fall in November’s trade deficit to .3 billion. Imports, reflecting price declines for petroleum as well as a .3 billion drop in consumer goods especially cell phones, fell .7

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

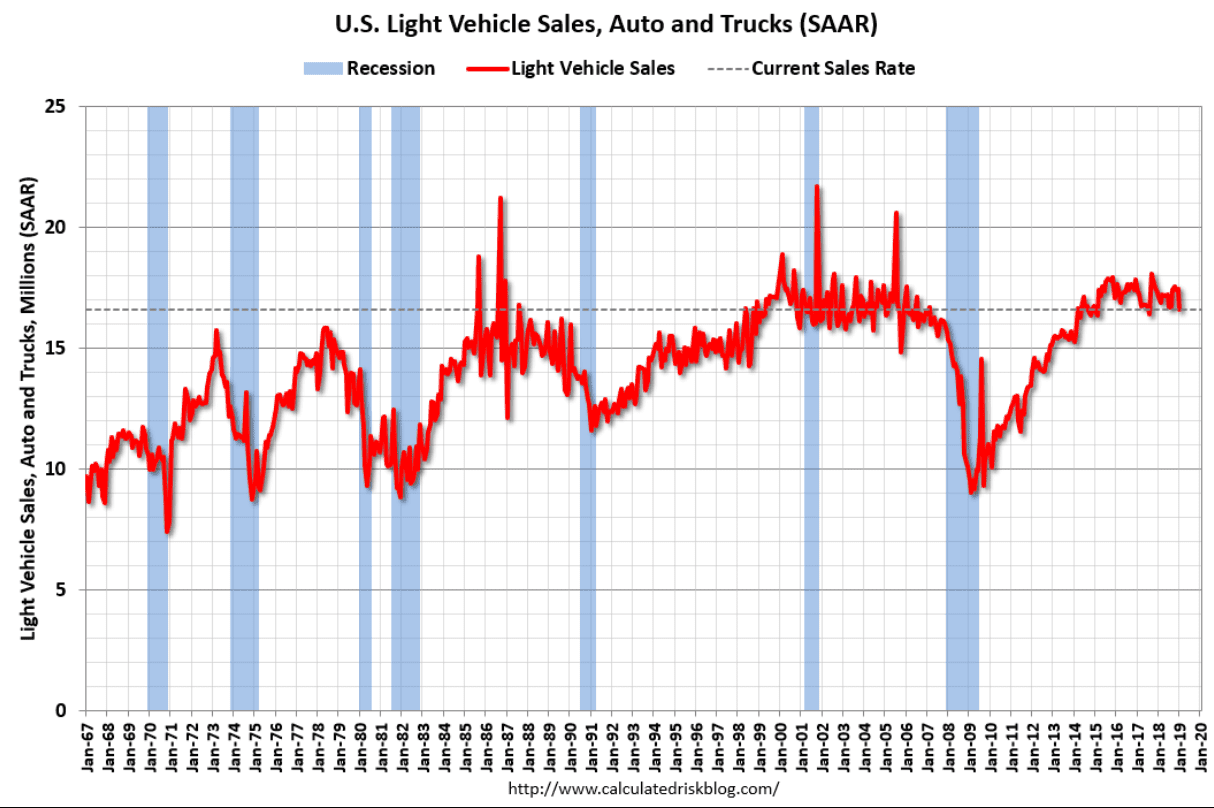

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

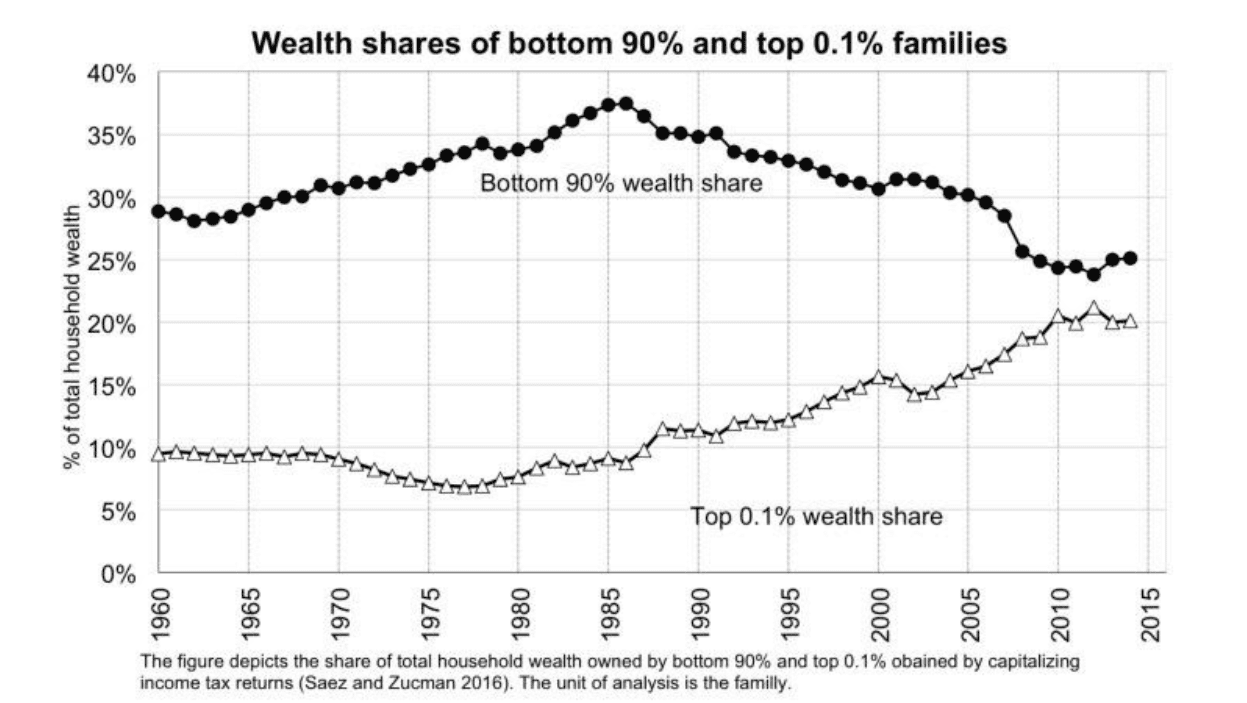

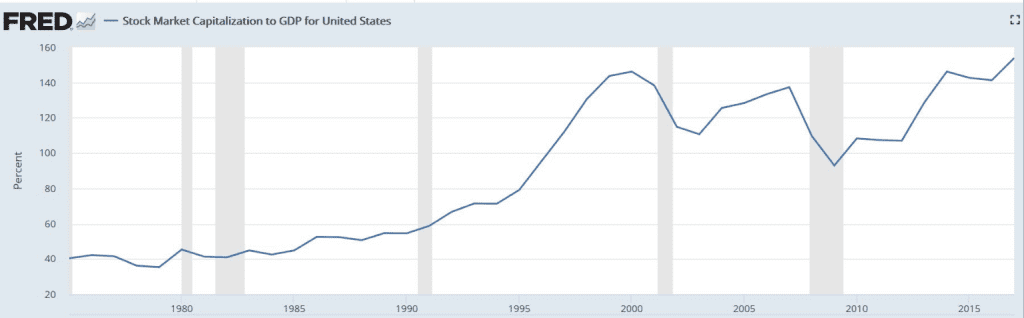

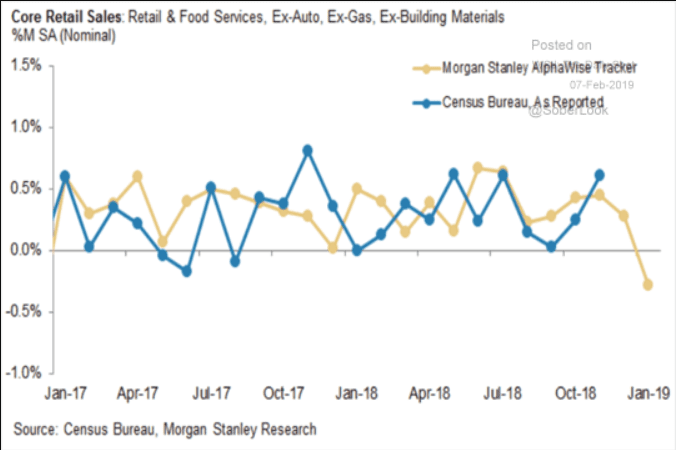

The ‘labor market’ is not a ‘fair game’ as people need to work to eat, and business only needs to hire if it likes the return prospects, so real wages should be expected to remain depressed without some form of outside support, which broke down in the 80’s with globalization policies, and the share of GDP going to capital began to rise:

General weakness continues:

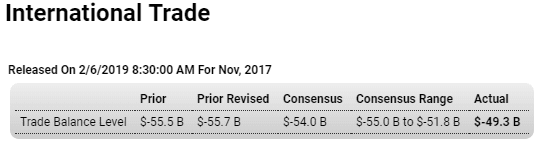

US imports way down, as reflected in general global weakness, and same for weak US exports. And also indicative of US weakness:

Highlights

A sharp pull back in imports, not strength in exports, led a much sharper-than-expected fall in November’s trade deficit to $49.3 billion. Imports, reflecting price declines for petroleum as well as a $4.3 billion drop in consumer goods especially cell phones, fell $7.7 billion in the month while exports also fell, down $1.3 billion and largely reflecting oil-related declines for supplies and materials.

Germany Balance of Trade

The German trade surplus decreased to EUR 13.9 billion in December 2018 from EUR 18.4 billion in the same month a year earlier. It was the smallest trade surplus since January 2016, mainly due to a sharp decline in exports.

Hong Kong Private Sector PMI

The seasonally adjusted Nikkei Hong Kong PMI inched higher to 48.2 in January 2019 from 48.0 in the previous month and marking the tenth straight month of contraction. New orders fell again, accompanied by lower sales to overseas markets, including China. At the same time, output continued to decline, while firms scaled back on purchasing activity and hiring.

Bank of England sees weakest UK outlook since 2009 on Brexit, global slowdown

The Bank of England said Britain faces its weakest economic growth in a decade this year as uncertainty over Brexit mounts and the global economy slows.

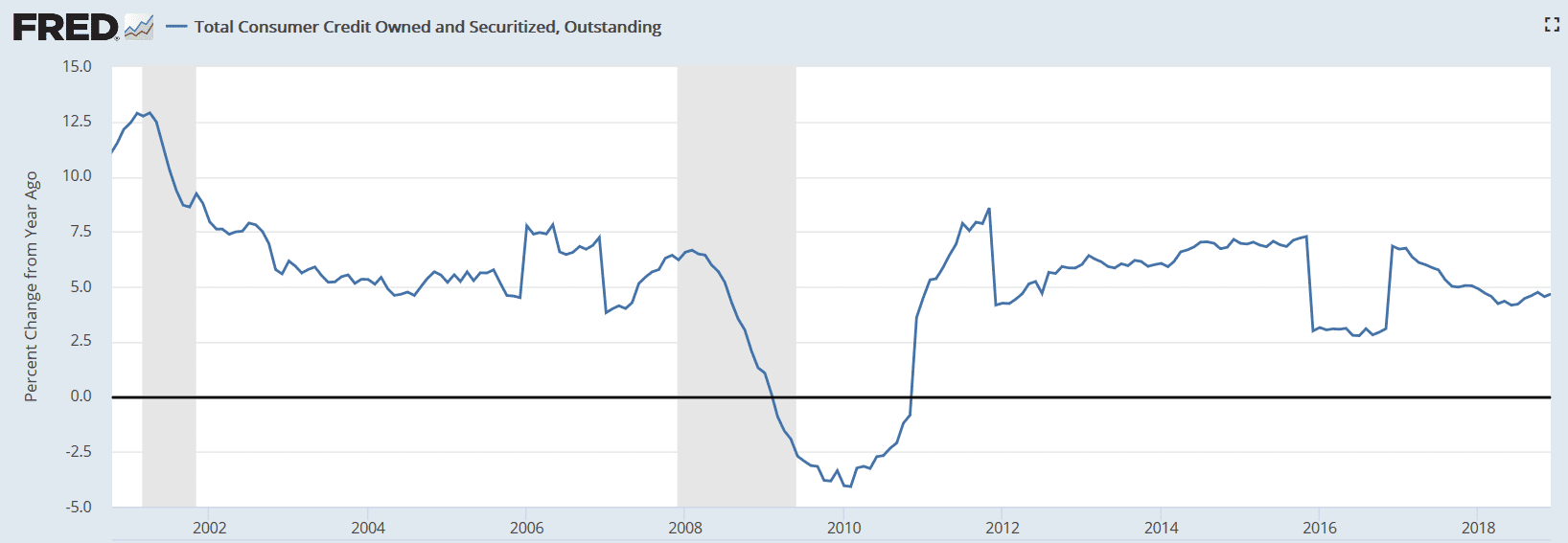

United States Consumer Credit Change

Consumer credit in the United States went up by USD 16.55 billion in December 2018, down from an upwardly revised USD 22.41 billion gain in the previous month and slightly below market expectations of a USD 17.0 billion rise. It was the lowest increase in three months. Revolving credit including credit card borrowing climbed USD 1.7 billion, compared to an upwardly revised USD 4.9 billion advance in November. Meantime, non-revolving credit including loans for education and automobiles jumped by USD 14.9 billion, after rising an upwardly revised USD 17.5 billion in the prior month.