-40% is about a .5 trillion loss for the quarter, which is more than the fiscal adjustments for the same quarter, which means to me a very slow start for q3 unless further fiscal adjustments are made: Not as low as the 2008 recession, as Federal transfers have been supporting consumer buying plans: This does not include the private equity deals financed via debt that assumed earnings would more than cover debt service: Seems it’s all downhill from here for a while:

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

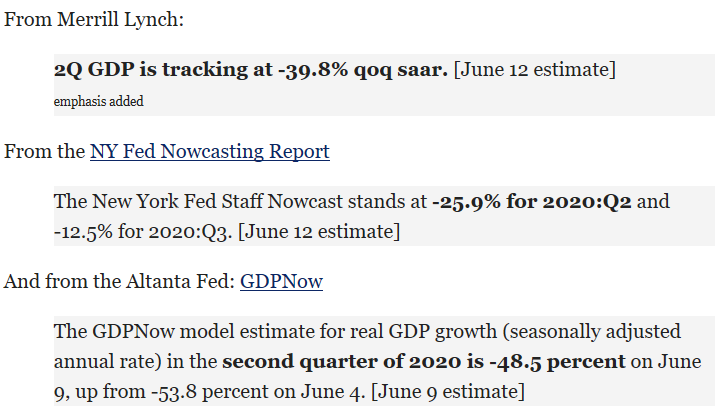

-40% is about a $2.5 trillion loss for the quarter, which is more than the fiscal adjustments for the same quarter, which means to me a very slow start for q3 unless further fiscal adjustments are made:

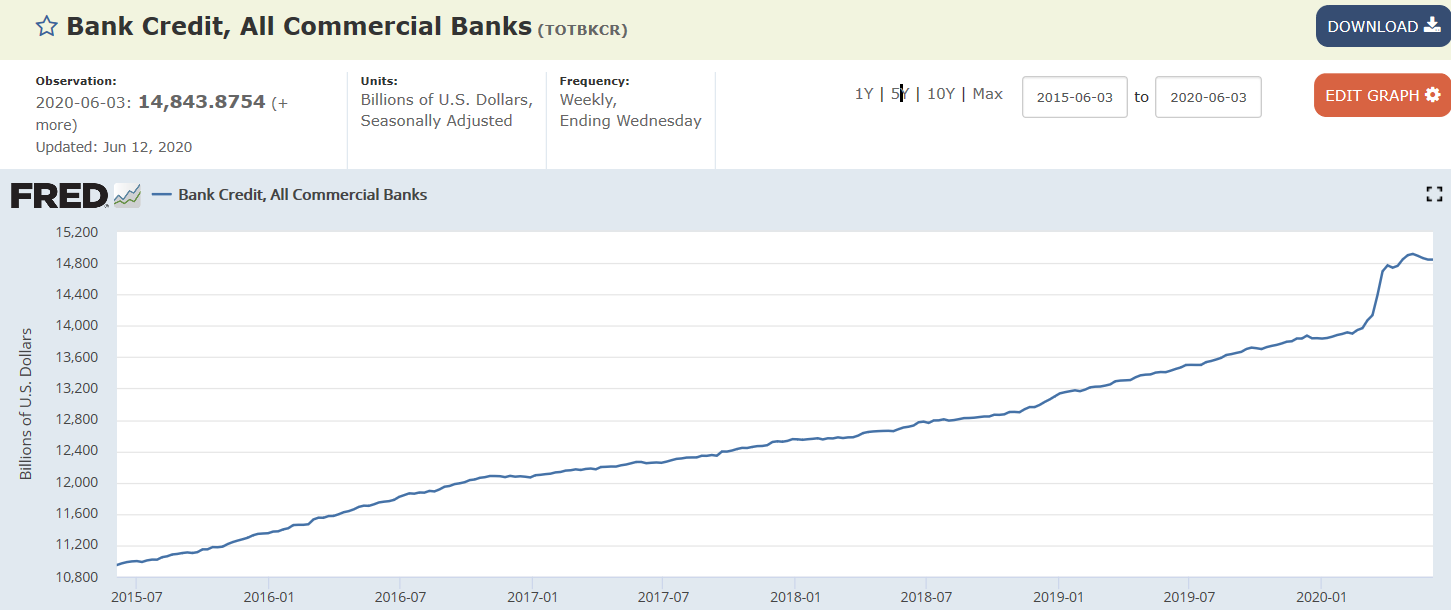

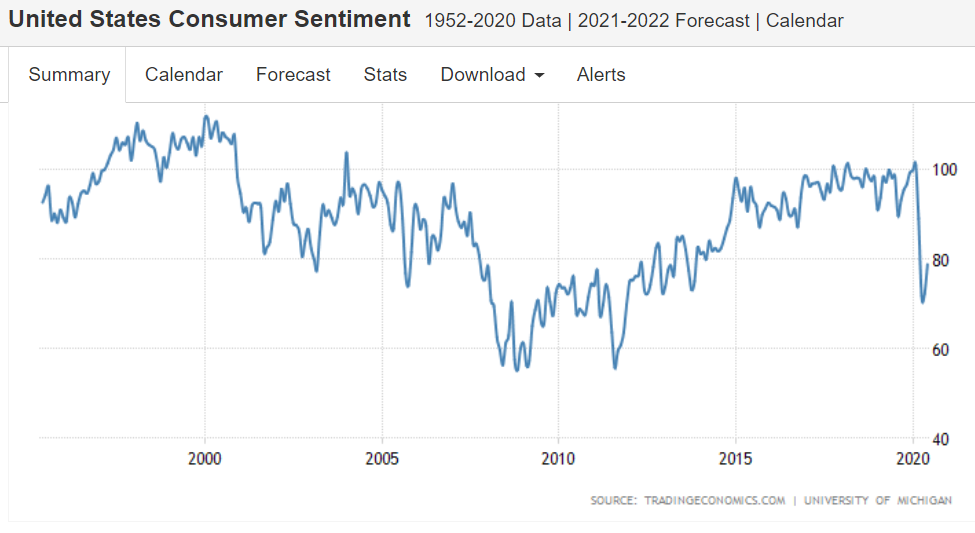

Not as low as the 2008 recession, as Federal transfers have been supporting consumer buying plans:

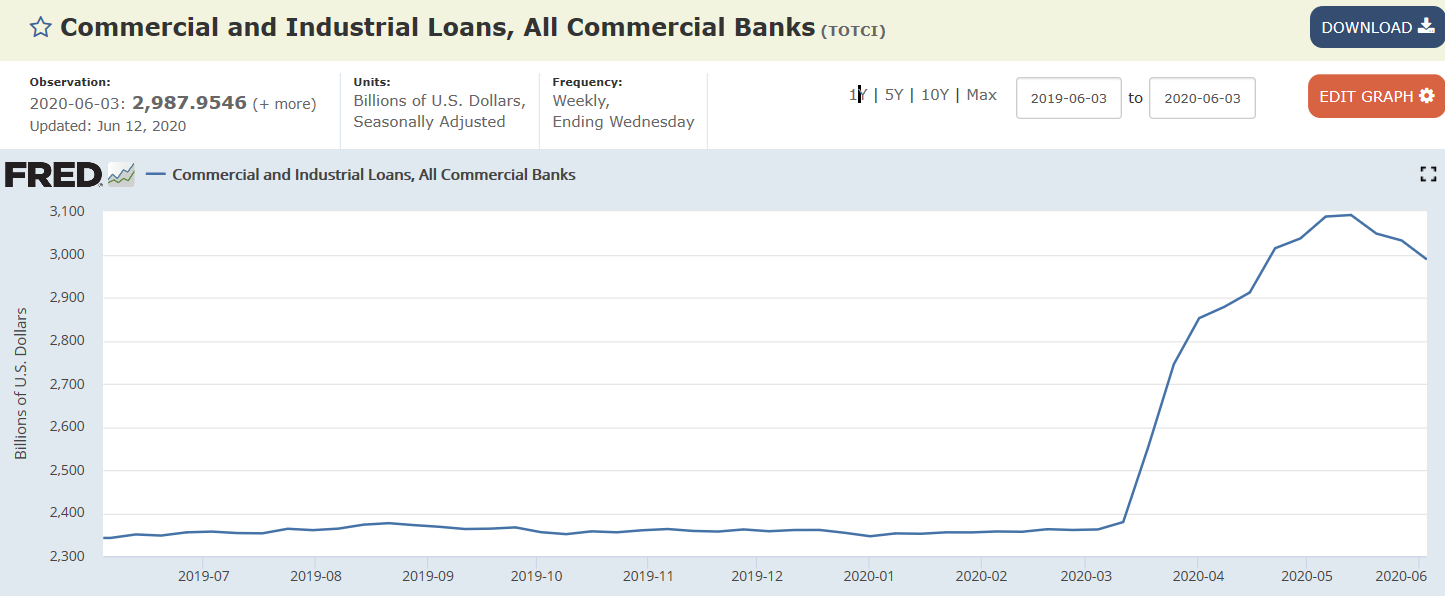

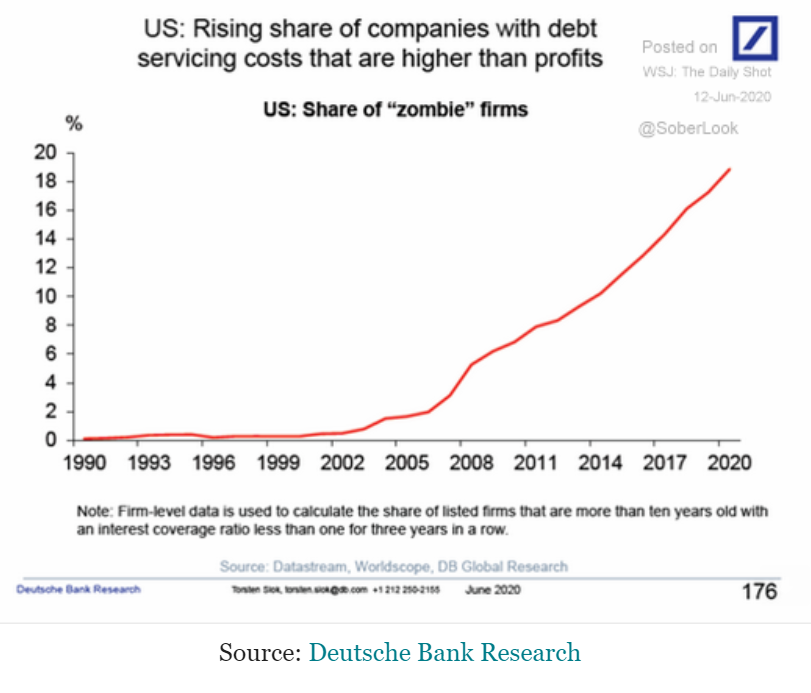

This does not include the private equity deals financed via debt that assumed earnings would more than cover debt service:

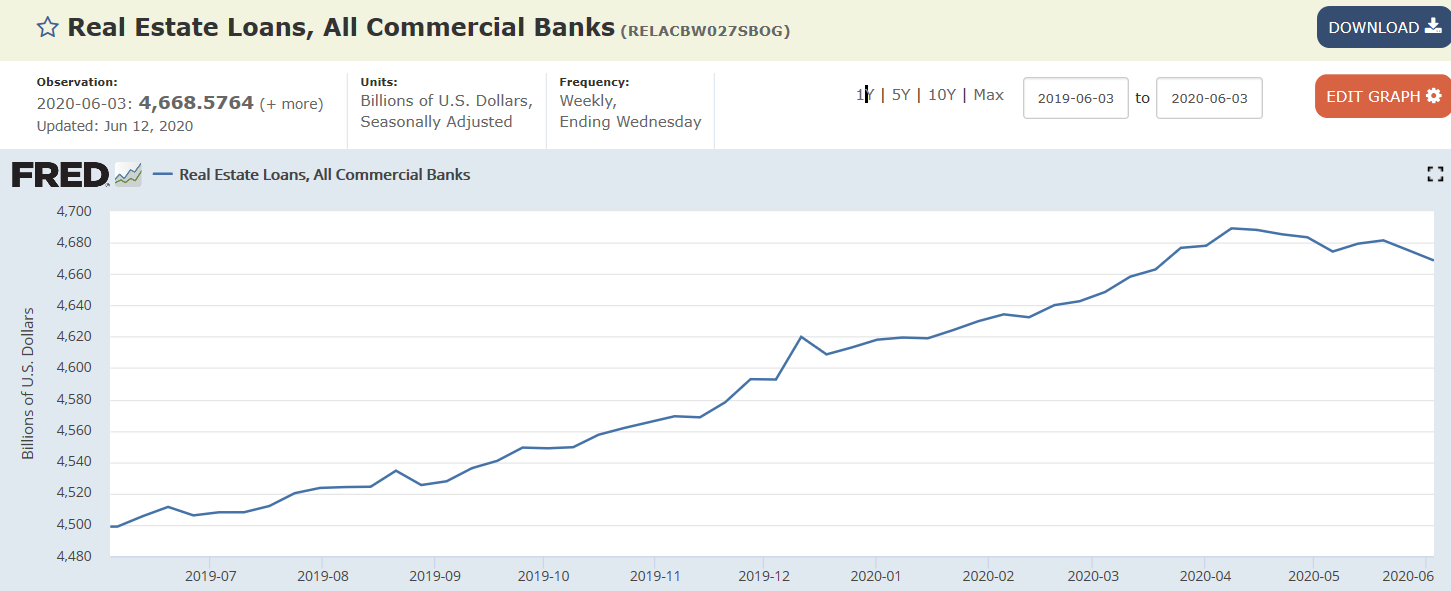

Seems it’s all downhill from here for a while: