Claims continue to drift lower but are still about double what they were pre covid: Continued claims are also about double pre covid levels: Fell back some and still below pre covid highs.This chart is not adjusted for inflation: Same pattern of recent weakness: Pending home sales in the US surged 51.7 percent year-on-year in April of 2021, the biggest increase ever amid a low base effect from last year when sales sank at a record pace because of the pandemic. All four US regions recorded year-over-year increases. On a monthly basis however, pending home sales dropped 4.4 percent, compared to forecasts of a 0.8 percent rise, with only the Midwest witnessing month-over-month gains. “Contract signings are approaching pre-pandemic levels after the big surge due to the lack of

Topics:

WARREN MOSLER considers the following as important: Economic Releases, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

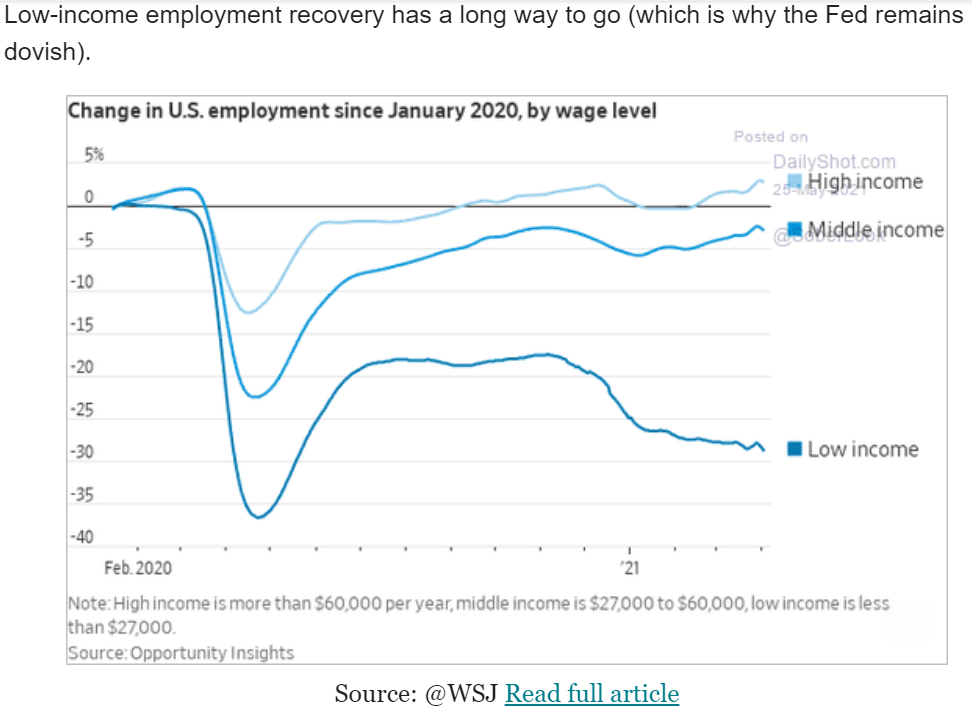

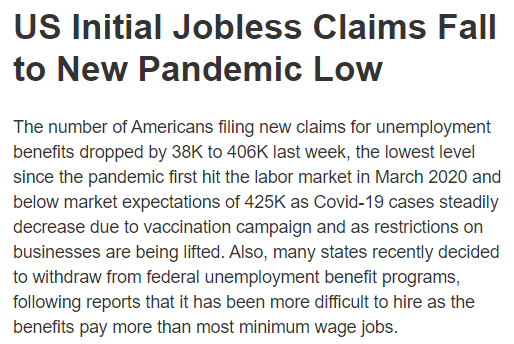

Claims continue to drift lower but are still about double what they were pre covid:

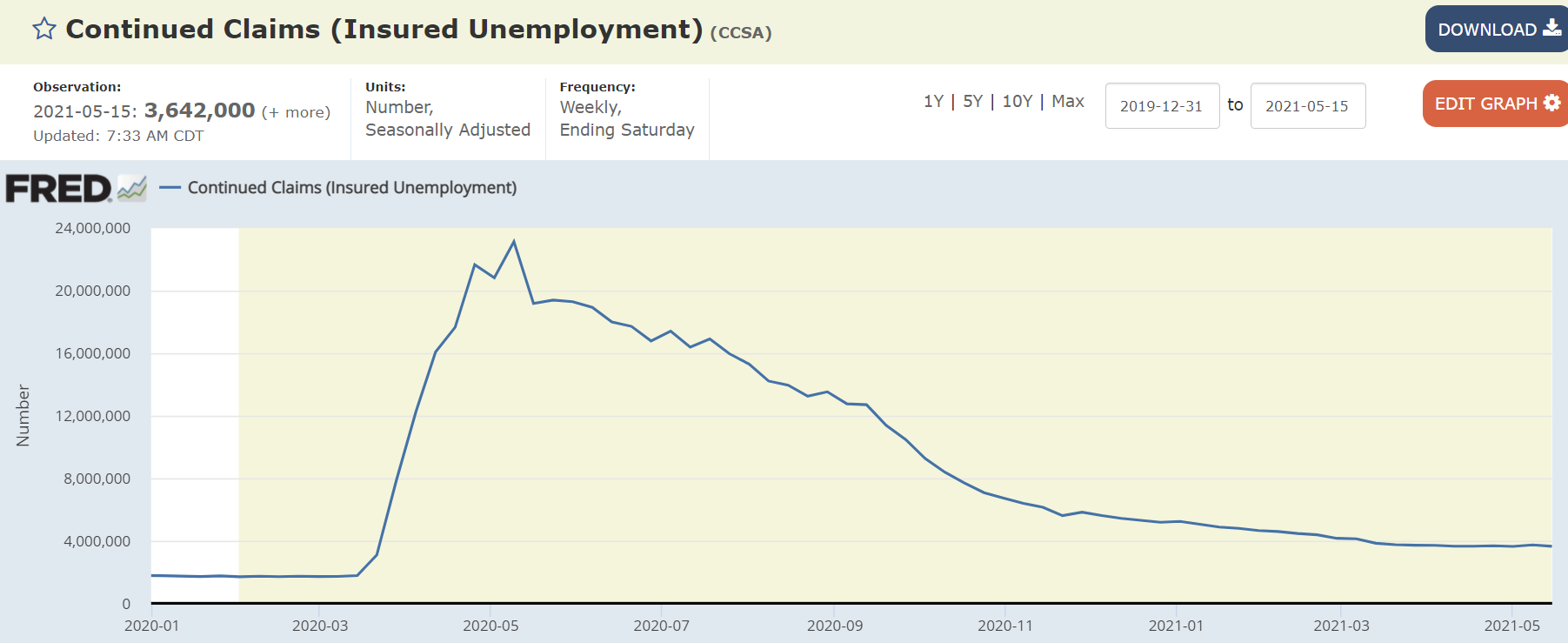

Continued claims are also about double pre covid levels:

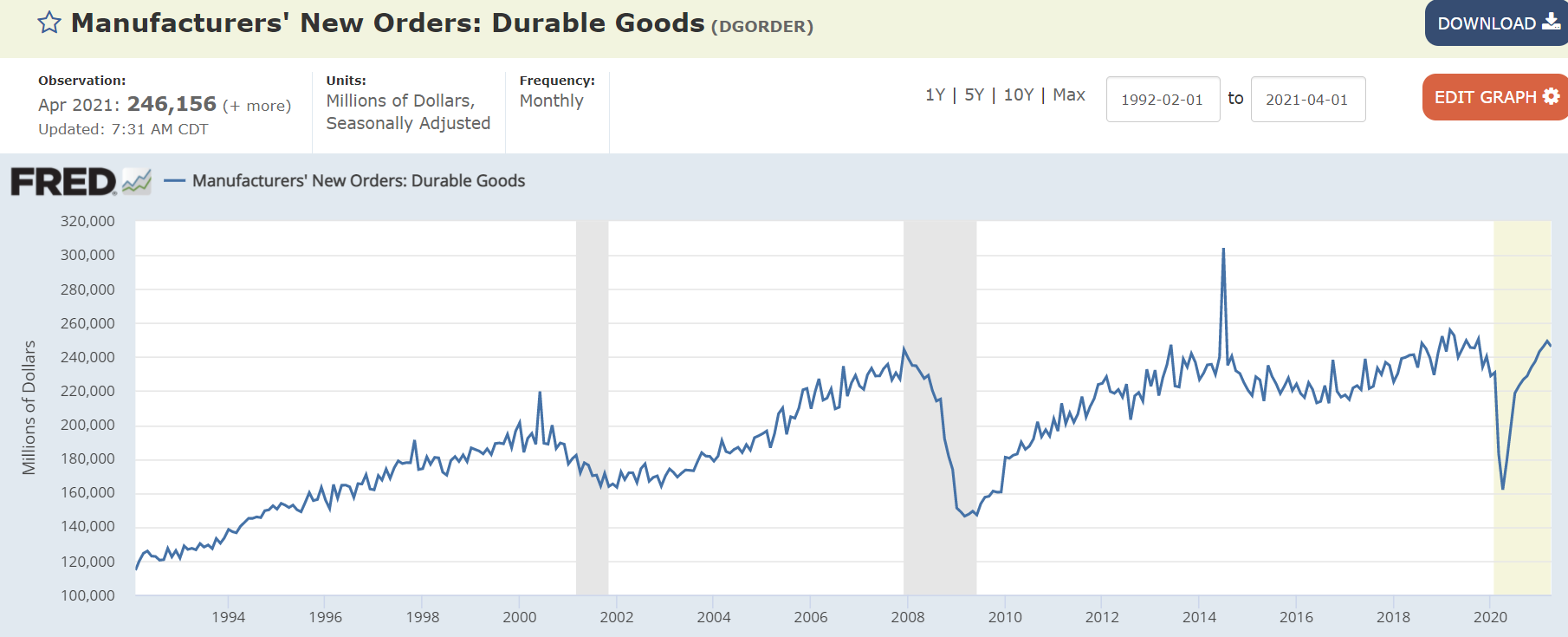

Fell back some and still below pre covid highs.

This chart is not adjusted for inflation:

Same pattern of recent weakness:

Pending home sales in the US surged 51.7 percent year-on-year in April of 2021, the biggest increase ever amid a low base effect from last year when sales sank at a record pace because of the pandemic. All four US regions recorded year-over-year increases. On a monthly basis however, pending home sales dropped 4.4 percent, compared to forecasts of a 0.8 percent rise, with only the Midwest witnessing month-over-month gains. “Contract signings are approaching pre-pandemic levels after the big surge due to the lack of sufficient supply of affordable homes,” said Lawrence Yun, NAR’s chief economist. “The upper-end market is still moving sharply as inventory is more plentiful there”. Yun anticipates housing supply to improve as a whole as soon as autumn. He points to an increase in the comfortability of those listing, as well as a rise in sellers after the conclusion of the eviction moratorium or as they exit forbearance. source: National Association of Realtors