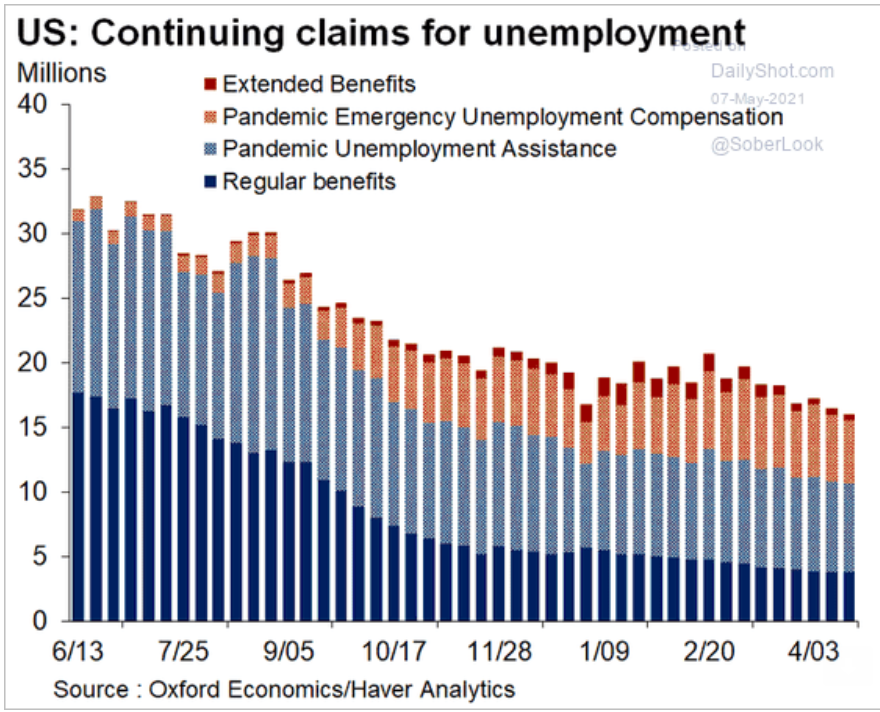

Coming down, but still a lot of people collecting benefits:( Counter to what the Fed believes, the 0 rate policy has a damping effect on growthand inflation due to the income interest paid by the Treasury to the economy, andalso due to forward pricing effects. So far, the increase in gov deficit spending has about offset the decrease in private sectordeficit spending. Nor do I see much more in the way of Federal deficit spending asthe infrastructure bill seems to be both watered down and bogged down, and there’s a substantialbelief in the narrative that Federal benefits are keeping people from working.We’ll see what happens with covid fears fading, but it may already be priced into the financial markets.

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Coming down, but still a lot of people collecting benefits

:(

Counter to what the Fed believes, the 0 rate policy has a damping effect on growth

and inflation due to the income interest paid by the Treasury to the economy, and

also due to forward pricing effects.

So far, the increase in gov deficit spending has about offset the decrease in private sector

deficit spending. Nor do I see much more in the way of Federal deficit spending as

the infrastructure bill seems to be both watered down and bogged down, and there’s a substantial

belief in the narrative that Federal benefits are keeping people from working.

We’ll see what happens with covid fears fading, but it may already be priced into the financial markets.