Summary:

So far so good for Q3 that ended Sep 30- about in line with pre-Covid growth rates: Much like the US, much of the rest of the world is hiking rates with high debt/GDP and supporting their economies that had slowed from fiscal contraction with massive government interest payments- universal basic income for those who already have money: Looks like the pro forecasters see accelerating earrings ahead- yet more evidence the rate hikes aren’t working in the intended direction:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

So far so good for Q3 that ended Sep 30- about in line with pre-Covid growth rates: Much like the US, much of the rest of the world is hiking rates with high debt/GDP and supporting their economies that had slowed from fiscal contraction with massive government interest payments- universal basic income for those who already have money: Looks like the pro forecasters see accelerating earrings ahead- yet more evidence the rate hikes aren’t working in the intended direction:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

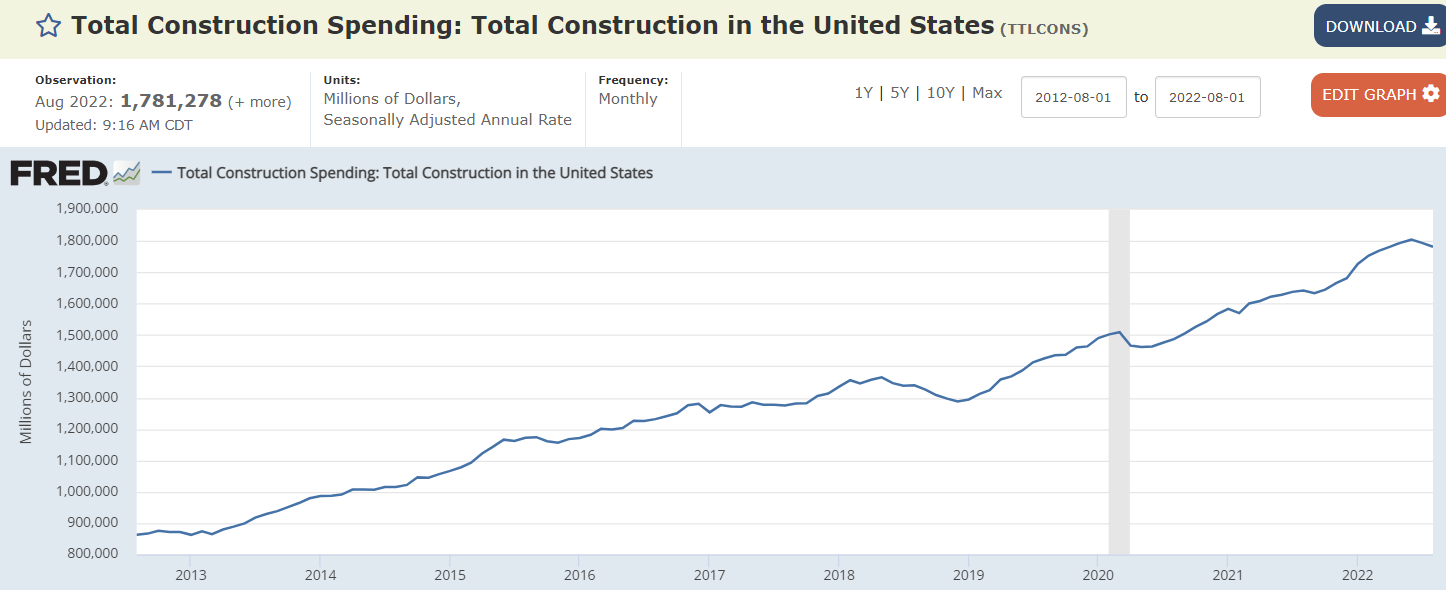

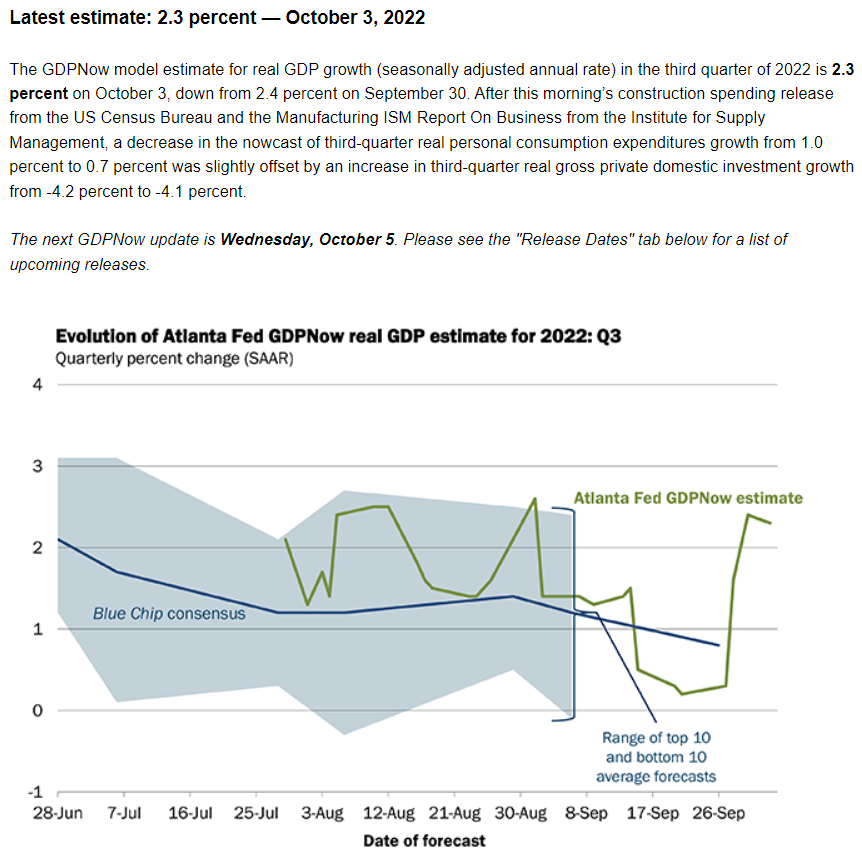

So far so good for Q3 that ended Sep 30- about in line with pre-Covid growth rates:

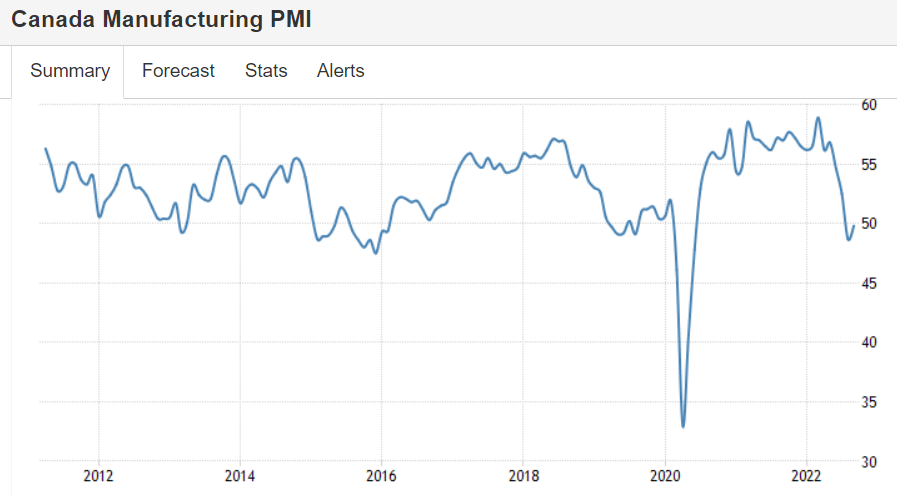

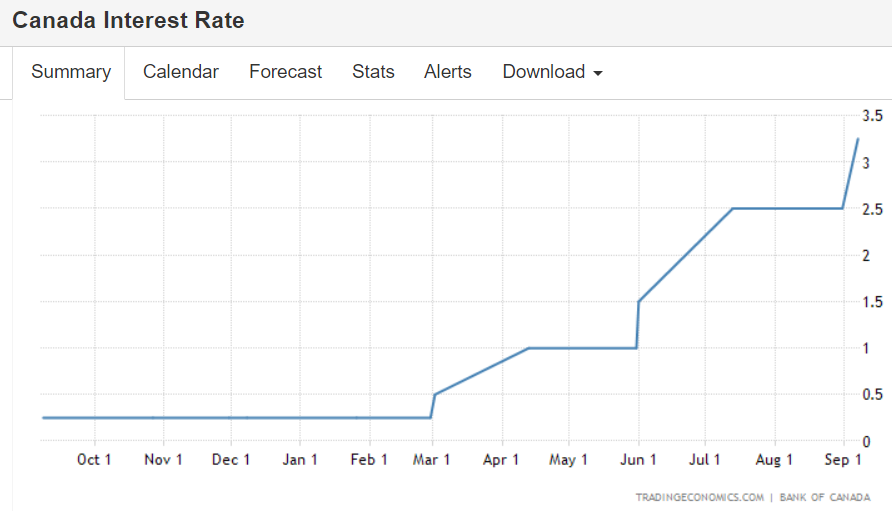

Much like the US, much of the rest of the world is hiking rates with high debt/GDP and supporting their economies that had slowed from fiscal contraction with massive government interest payments- universal basic income for those who already have money:

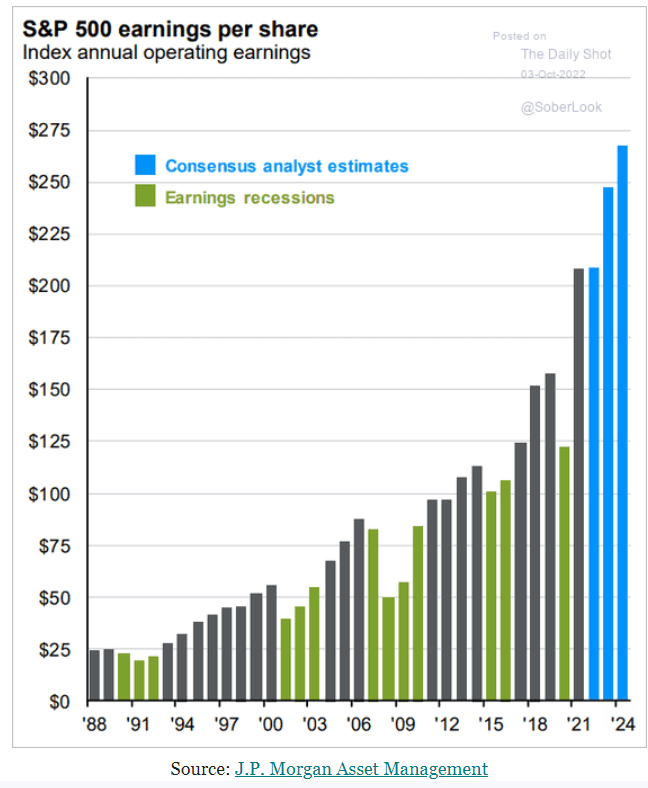

Looks like the pro forecasters see accelerating earrings ahead- yet more evidence the rate hikes aren’t working in the intended direction: