Summary:

2008 type of collapse: Lowest ever: Saudi OSPs are still at premiums to fair market value, and the price trend is still up. If it keeps going all heck breaks loose: The President threw the strategic petroleum reserve at it, and lots of other nations did the same, to no avail. And the calendar spreads in the futures market is indicating absolute spot shortages:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

2008 type of collapse: Lowest ever: Saudi OSPs are still at premiums to fair market value, and the price trend is still up. If it keeps going all heck breaks loose: The President threw the strategic petroleum reserve at it, and lots of other nations did the same, to no avail. And the calendar spreads in the futures market is indicating absolute spot shortages:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

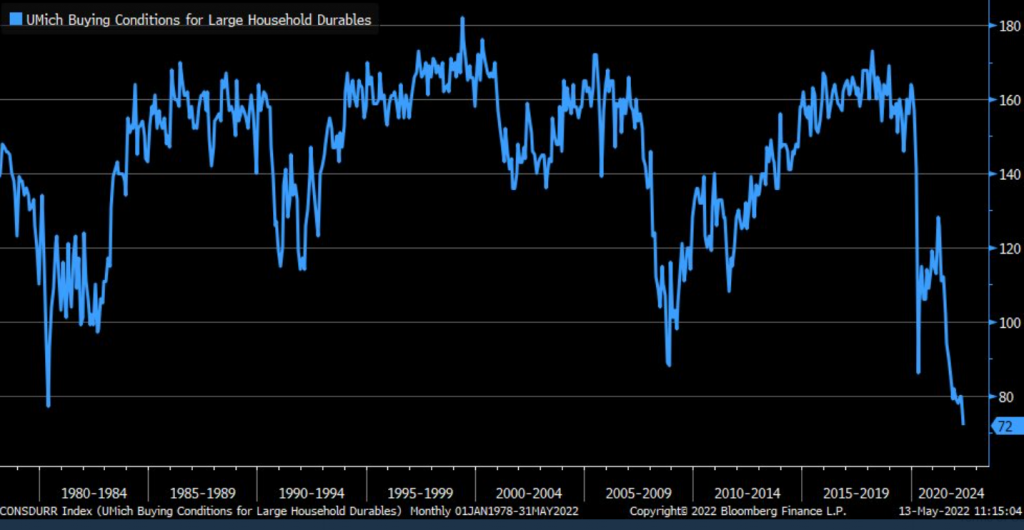

2008 type of collapse:

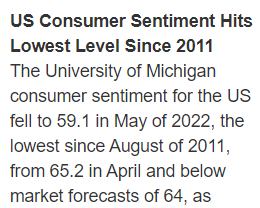

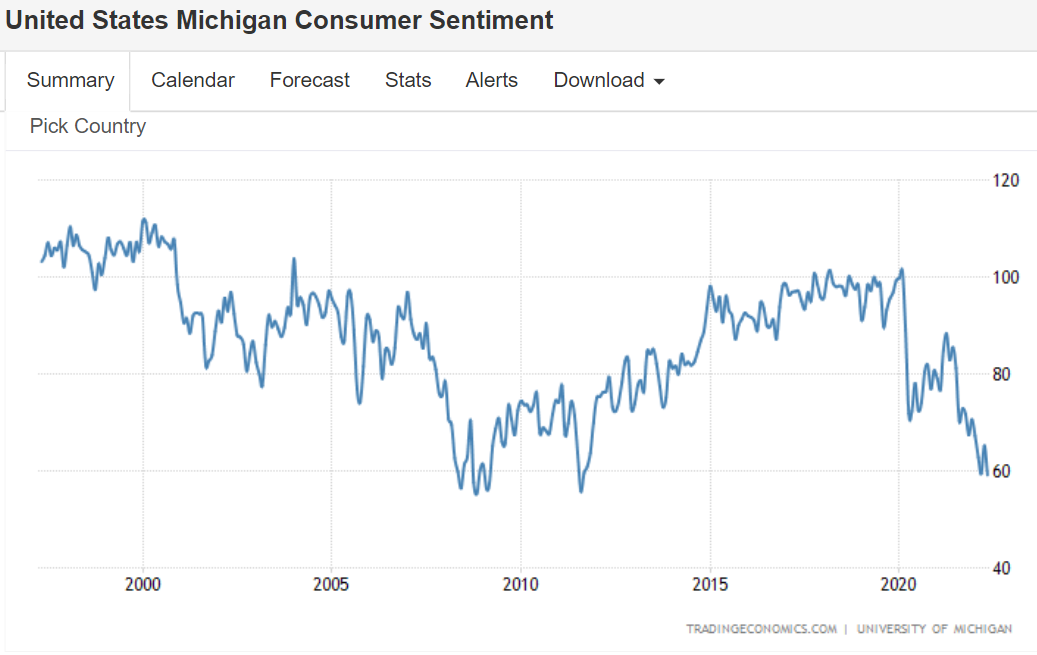

Lowest ever:

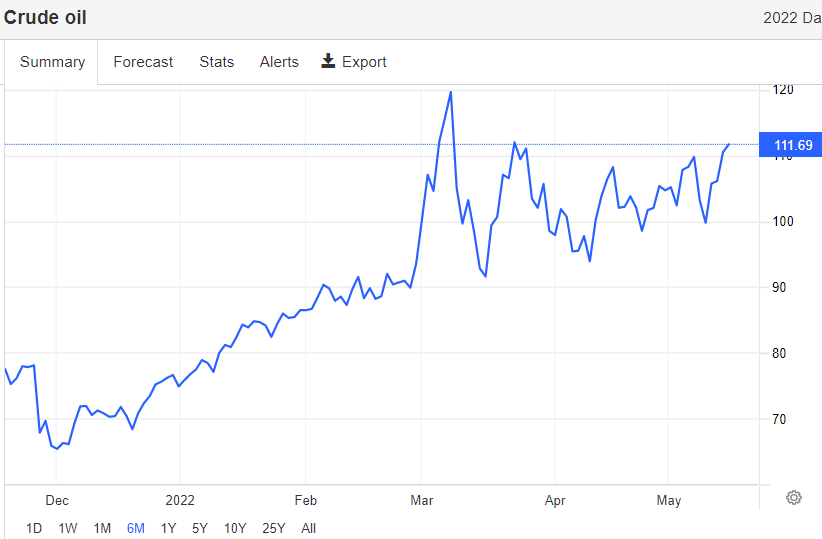

Saudi OSPs are still at premiums to fair market value, and the price trend is still up. If it keeps going all heck breaks loose:

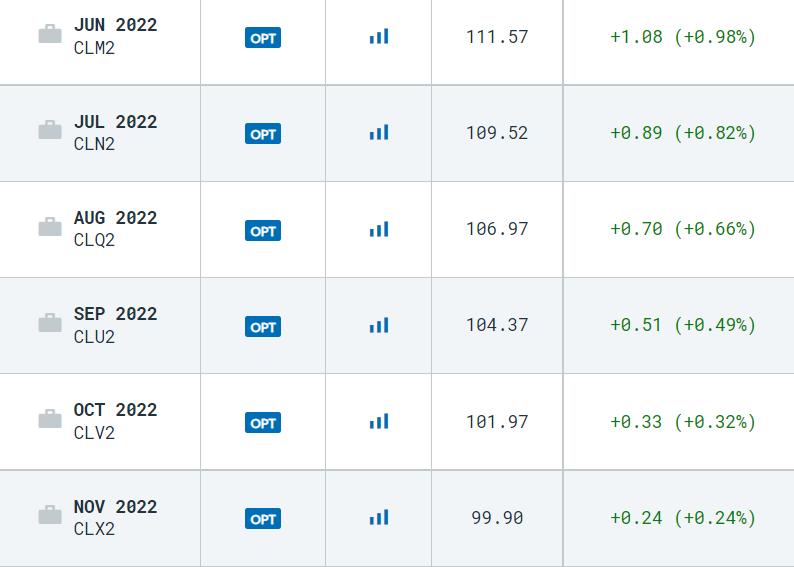

The President threw the strategic petroleum reserve at it, and lots of other nations did the same, to no avail. And the calendar spreads in the futures market is indicating absolute spot shortages: