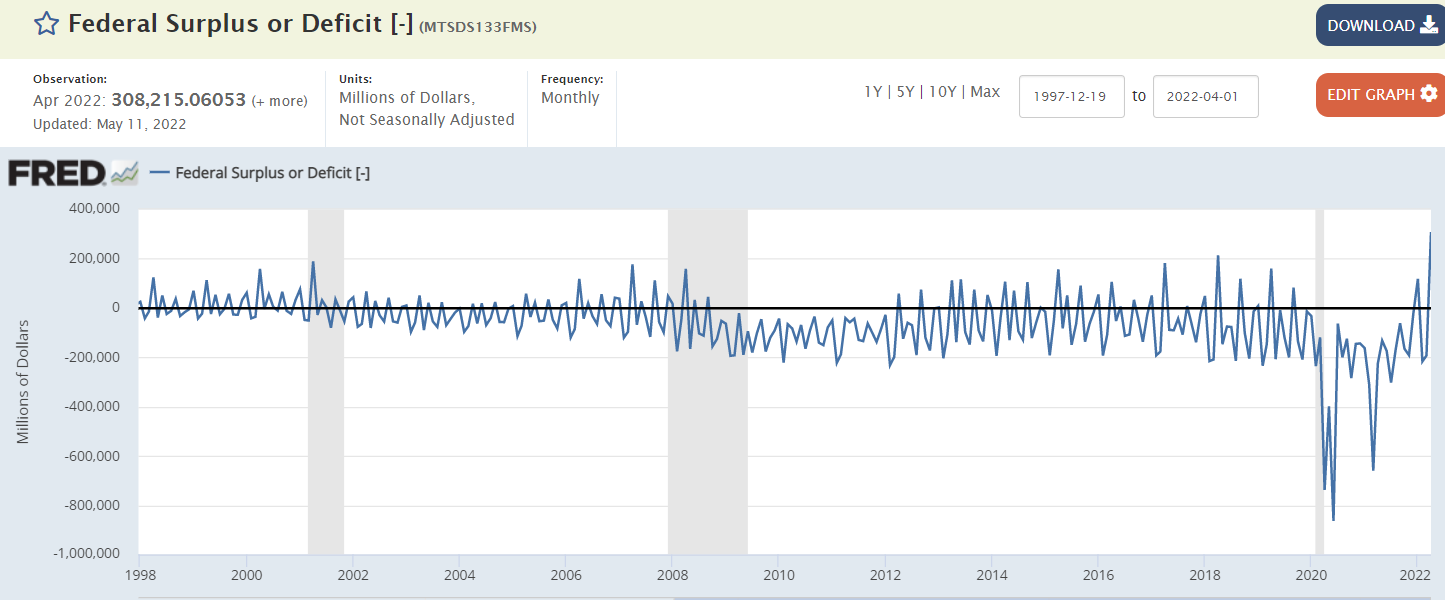

This is the automatic fiscal stabilizers doing their thing to slow things down during a recovery, and they keep increasing the pressure until growth goes negative. Additionally, with some trillion of public debt, an 8% increase in prices means the value of the public debt- the net money supply in the economy- has contracted by about .4 trillion. This is a direct ‘removal of savings’ and functions the same as a tax on savings, thereby slowing the economy. It is reflected in the debt/GDP ratio which is falling rapidly. This is how a typical post war slump develops- high wartime deficit spending followed by a reduction in deficit spending. The US posted a budget surplus of USD 308 billion in April of 2022, the highest on record, switching from a USD 226

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The US posted a budget surplus of USD 308 billion in April of 2022, the highest on record, switching from a USD 226 billion gap in the same period last year and above market expectations of a USD 226 billion surplus. April has traditionally been a budget surplus month due to the traditional April 15 tax filing deadline, except in 2009, 2010 and 2011 after a financial crisis, and in 2020 and 2021 due to the Covid-19 pandemic. Receipts jumped 97 percent to an all-time high of USD 864 billion, underpinned by tax receipts on the back of a strong economic recovery. At the same time, outlays slumped 16 percent to USD 555 billion, reflecting lower spending for COVID-19 relief. For the first seven months of the 2022 fiscal year, the US federal deficit was at USD 360 billion, a 81 percent decline from the same period of fiscal 2021. source: Financial Management Service, US Treasury Monthly Treasury Statement