Still slowly working its way back to the pre covid trend: New rigs continue to come online, but it won’t interfere with Saudi/Russian price setting until sufficient production comes online to reduce Saudi sales. And right now sales are going up, indicating that demand for oil at the Saudi’s prices is increasing, as the Saudis set price and let their refiners buy all they want at their posted prices: As previously discussed, Saudi OSP’s (official selling price spreads vs benchmarks) are now set above ‘fair value’ imparting a continuous upward pressure on prices. If this policy continues prices will continue to rise and seriously disrupt markets as happened in 2008:

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

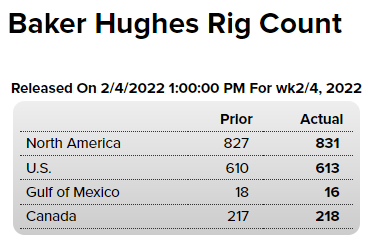

Still slowly working its way back to the pre covid trend:

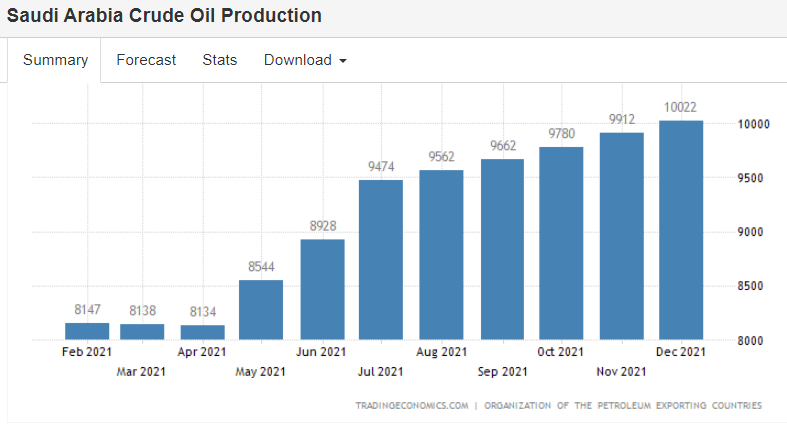

New rigs continue to come online, but it won’t interfere with Saudi/Russian price setting until sufficient production comes online to reduce Saudi sales. And right now sales are going up, indicating that demand for oil at the Saudi’s prices is increasing, as the Saudis set price and let their refiners buy all they want at their posted prices:

As previously discussed, Saudi OSP’s (official selling price spreads vs benchmarks) are now set above ‘fair value’ imparting a continuous upward pressure on prices. If this policy continues prices will continue to rise and seriously disrupt markets as happened in 2008: