Summary:

This index is settling in to about a 3.5% annual rate of growth.No recession indication here: No recession here either: No sign of recession here: Markets are being driven by the understanding that the Fed will continue to raise rates until there is a recession, not realizing that rate increases, with debt/GDP as high as it is,result in a sufficiently large increase in government deficit spending on those interest payments to support both the growth of private sector total spending on goods and services as well as to support prices. So what happens each cycle is the Fed raises rates and supports growth until something else causes a recession. Recent history has seen the automatic stabilizers (tax receipts rising and transfer payments falling with growth) bring down gov

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

This index is settling in to about a 3.5% annual rate of growth.No recession indication here: No recession here either: No sign of recession here: Markets are being driven by the understanding that the Fed will continue to raise rates until there is a recession, not realizing that rate increases, with debt/GDP as high as it is,result in a sufficiently large increase in government deficit spending on those interest payments to support both the growth of private sector total spending on goods and services as well as to support prices. So what happens each cycle is the Fed raises rates and supports growth until something else causes a recession. Recent history has seen the automatic stabilizers (tax receipts rising and transfer payments falling with growth) bring down gov

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

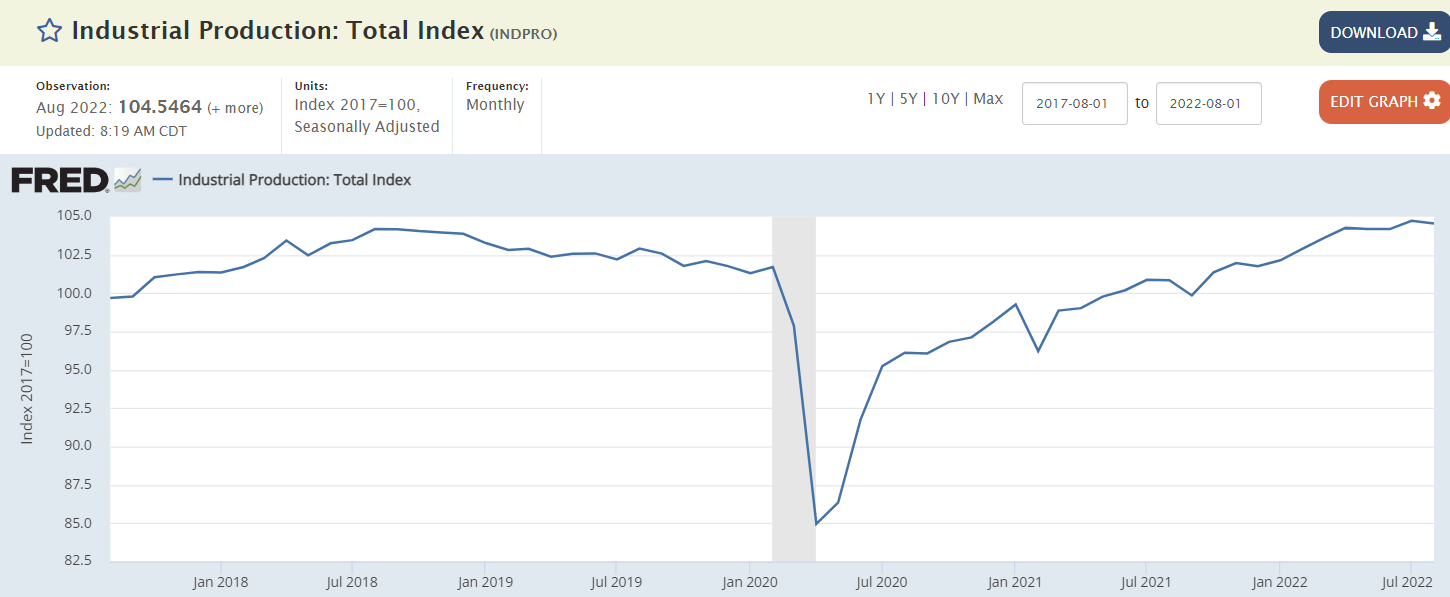

This index is settling in to about a 3.5% annual rate of growth.

No recession indication here:

No recession indication here:

No recession here either:

No sign of recession here:

Markets are being driven by the understanding that the Fed will continue to raise rates until there is a recession, not realizing that rate increases, with debt/GDP as high as it is,

result in a sufficiently large increase in government deficit spending on those interest payments to support both the growth of private sector total spending on goods and services as well as to support prices.

result in a sufficiently large increase in government deficit spending on those interest payments to support both the growth of private sector total spending on goods and services as well as to support prices.

So what happens each cycle is the Fed raises rates and supports growth until something else causes a recession. Recent history has seen the automatic stabilizers (tax receipts rising and transfer payments falling with growth) bring down gov deficit spending sufficiently to end the cycle, while at the same time the Saudis have raised oil prices until the economy and demand collapses.