Summary:

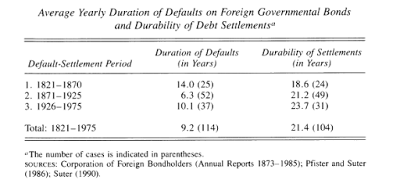

If Argentina finalizes an agreement with the holdouts, the so-called Vultures, it will close a long process that started with default in 2002, and was followed by renegotiations with about 93% of bondholders in 2005 and 2010. How fast has this process been when compared to other debt rescheduling processes? Figure below by Christian Suter (subscription required) looks at the average duration of defaults on foreign bonds in three different periods. Even though it misses the debt crisis of the 1980s, since that one was related to bank loans rather than bonds, the numbers might be pretty good for the whole period. The average for the whole period is about 9 years, which makes the Argentine situation rather long, and comparable to the 1821 to 1870 period. The table also shows what he refers to as the durability of debt settlements, or time period between the conclusion of the debt settlement and the outbreak of the next debt default or rescheduling. Let's hope Argentina does better on this one, but given Macri's policies I wouldn't be too confident.PS: Table 1 in Borensztein and Panizza also show the average periods of defaults, and they tend to be longer in the early periods too.

Topics:

Matias Vernengo considers the following as important: Argentina, Debt restructuring, Suter

This could be interesting, too:

If Argentina finalizes an agreement with the holdouts, the so-called Vultures, it will close a long process that started with default in 2002, and was followed by renegotiations with about 93% of bondholders in 2005 and 2010. How fast has this process been when compared to other debt rescheduling processes? Figure below by Christian Suter (subscription required) looks at the average duration of defaults on foreign bonds in three different periods. Even though it misses the debt crisis of the 1980s, since that one was related to bank loans rather than bonds, the numbers might be pretty good for the whole period. The average for the whole period is about 9 years, which makes the Argentine situation rather long, and comparable to the 1821 to 1870 period. The table also shows what he refers to as the durability of debt settlements, or time period between the conclusion of the debt settlement and the outbreak of the next debt default or rescheduling. Let's hope Argentina does better on this one, but given Macri's policies I wouldn't be too confident.PS: Table 1 in Borensztein and Panizza also show the average periods of defaults, and they tend to be longer in the early periods too.

Topics:

Matias Vernengo considers the following as important: Argentina, Debt restructuring, Suter

This could be interesting, too:

Matias Vernengo writes Milei and real wages in Argentina

Joel Eissenberg writes Javier Milei: Argentina’s Trump?

Merijn T. Knibbe writes Superinflation in Milei´s Argentina

Matias Vernengo writes Podcast with about the never ending crisis in Argentina

If Argentina finalizes an agreement with the holdouts, the so-called Vultures, it will close a long process that started with default in 2002, and was followed by renegotiations with about 93% of bondholders in 2005 and 2010. How fast has this process been when compared to other debt rescheduling processes? Figure below by Christian Suter (subscription required) looks at the average duration of defaults on foreign bonds in three different periods. Even though it misses the debt crisis of the 1980s, since that one was related to bank loans rather than bonds, the numbers might be pretty good for the whole period.

The average for the whole period is about 9 years, which makes the Argentine situation rather long, and comparable to the 1821 to 1870 period. The table also shows what he refers to as the durability of debt settlements, or time period between the conclusion of the debt settlement and the outbreak of the next debt default or rescheduling. Let's hope Argentina does better on this one, but given Macri's policies I wouldn't be too confident.

The average for the whole period is about 9 years, which makes the Argentine situation rather long, and comparable to the 1821 to 1870 period. The table also shows what he refers to as the durability of debt settlements, or time period between the conclusion of the debt settlement and the outbreak of the next debt default or rescheduling. Let's hope Argentina does better on this one, but given Macri's policies I wouldn't be too confident.

PS: Table 1 in Borensztein and Panizza also show the average periods of defaults, and they tend to be longer in the early periods too.