Summary:

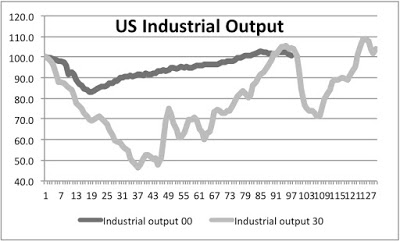

So I teach a course on the two (old syllabus here). One of the initial classes looks at Eichengreen and O'Rourke's comparison of the two events, and how, even though at the beginning the shock seemed similar, the recovery has been faster the second time. O'Rourke had noticed in his blog last year that the current recovery started way before, but has been so slow that now the 1930s look better when industrial output (rather than GDP) is used as a measure. Below the same data for the US economy (he uses world industrial output). Note that I added more of the 1930s recovery, and one can see the effects of the Roosevelt recession in 1937-38 (the indexes are monthly and start in October 1929 and December 2007 as 100 respectively). Industrial output growth has slowed down in the last year, by the way. I don't think we are on the verge of a recession in the US. My guess is that sluggish growth will continue. But it is an additional reason to be cautious about hiking interest rates, and presuming that the economy is all fine.

Topics:

Matias Vernengo considers the following as important: Eichengreen, Great Depression, Great Recession

This could be interesting, too:

So I teach a course on the two (old syllabus here). One of the initial classes looks at Eichengreen and O'Rourke's comparison of the two events, and how, even though at the beginning the shock seemed similar, the recovery has been faster the second time. O'Rourke had noticed in his blog last year that the current recovery started way before, but has been so slow that now the 1930s look better when industrial output (rather than GDP) is used as a measure. Below the same data for the US economy (he uses world industrial output). Note that I added more of the 1930s recovery, and one can see the effects of the Roosevelt recession in 1937-38 (the indexes are monthly and start in October 1929 and December 2007 as 100 respectively). Industrial output growth has slowed down in the last year, by the way. I don't think we are on the verge of a recession in the US. My guess is that sluggish growth will continue. But it is an additional reason to be cautious about hiking interest rates, and presuming that the economy is all fine.

Topics:

Matias Vernengo considers the following as important: Eichengreen, Great Depression, Great Recession

This could be interesting, too:

Matias Vernengo writes The 1920-21 recession

Matias Vernengo writes The End of Bretton Woods

Matias Vernengo writes Nixon ends dollar convertibility

Matias Vernengo writes The Demise of Bretton Woods

So I teach a course on the two (old syllabus here). One of the initial classes looks at Eichengreen and O'Rourke's comparison of the two events, and how, even though at the beginning the shock seemed similar, the recovery has been faster the second time. O'Rourke had noticed in his blog last year that the current recovery started way before, but has been so slow that now the 1930s look better when industrial output (rather than GDP) is used as a measure. Below the same data for the US economy (he uses world industrial output).

Note that I added more of the 1930s recovery, and one can see the effects of the Roosevelt recession in 1937-38 (the indexes are monthly and start in October 1929 and December 2007 as 100 respectively). Industrial output growth has slowed down in the last year, by the way. I don't think we are on the verge of a recession in the US. My guess is that sluggish growth will continue. But it is an additional reason to be cautious about hiking interest rates, and presuming that the economy is all fine.

Note that I added more of the 1930s recovery, and one can see the effects of the Roosevelt recession in 1937-38 (the indexes are monthly and start in October 1929 and December 2007 as 100 respectively). Industrial output growth has slowed down in the last year, by the way. I don't think we are on the verge of a recession in the US. My guess is that sluggish growth will continue. But it is an additional reason to be cautious about hiking interest rates, and presuming that the economy is all fine.