Summary:

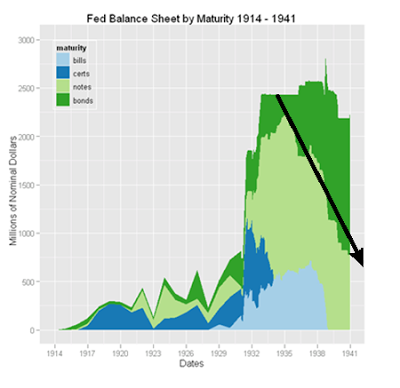

So last weekend I was at the Eastern Economic Association meetings, and I presented with Steve Bannister (on and off contributor to NK) a paper on Quantitative Easing in the 1930s. It's been a while since we looked at this work, which started long ago (4 years at least). One point worth noticing is that while most accounts of Eccles performance at the Fed suggest that he didn't do much (see Meltzer in his A History of the Federal Reserve), we suggest that he was crucial in pushing qualitative easing, that is a shift in the composition of the Fed's balance sheet. The figure shows that when Eccles assumed at the Fed, in 1934, QE, the increase of the balance sheet had already started, but the shift from short term government bills (blue ones) to long term bonds (green) had not. The dark line shows Eccles' policy, which had the objective of keeping long term interest rates at 2.5 percent, in order to allow for fiscal stimulus and sustainable expansion of public debt.

Topics:

Matias Vernengo considers the following as important: Eccles, Great Depression, Meltzer, Monetary Policy

This could be interesting, too:

So last weekend I was at the Eastern Economic Association meetings, and I presented with Steve Bannister (on and off contributor to NK) a paper on Quantitative Easing in the 1930s. It's been a while since we looked at this work, which started long ago (4 years at least). One point worth noticing is that while most accounts of Eccles performance at the Fed suggest that he didn't do much (see Meltzer in his A History of the Federal Reserve), we suggest that he was crucial in pushing qualitative easing, that is a shift in the composition of the Fed's balance sheet. The figure shows that when Eccles assumed at the Fed, in 1934, QE, the increase of the balance sheet had already started, but the shift from short term government bills (blue ones) to long term bonds (green) had not. The dark line shows Eccles' policy, which had the objective of keeping long term interest rates at 2.5 percent, in order to allow for fiscal stimulus and sustainable expansion of public debt.

Topics:

Matias Vernengo considers the following as important: Eccles, Great Depression, Meltzer, Monetary Policy

This could be interesting, too:

Matias Vernengo writes Very brief note on the Brazilian real and the fiscal package

Angry Bear writes Open Thread January 4 2024 overly “restrictive” monetary policy

Hasan Cömert & T. Sabri Öncü writes Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment – III

Hasan Cömert & T. Sabri Öncü writes Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment – III

So last weekend I was at the Eastern Economic Association meetings, and I presented with Steve Bannister (on and off contributor to NK) a paper on Quantitative Easing in the 1930s. It's been a while since we looked at this work, which started long ago (4 years at least). One point worth noticing is that while most accounts of Eccles performance at the Fed suggest that he didn't do much (see Meltzer in his A History of the Federal Reserve), we suggest that he was crucial in pushing qualitative easing, that is a shift in the composition of the Fed's balance sheet.

The figure shows that when Eccles assumed at the Fed, in 1934, QE, the increase of the balance sheet had already started, but the shift from short term government bills (blue ones) to long term bonds (green) had not. The dark line shows Eccles' policy, which had the objective of keeping long term interest rates at 2.5 percent, in order to allow for fiscal stimulus and sustainable expansion of public debt.

The figure shows that when Eccles assumed at the Fed, in 1934, QE, the increase of the balance sheet had already started, but the shift from short term government bills (blue ones) to long term bonds (green) had not. The dark line shows Eccles' policy, which had the objective of keeping long term interest rates at 2.5 percent, in order to allow for fiscal stimulus and sustainable expansion of public debt.