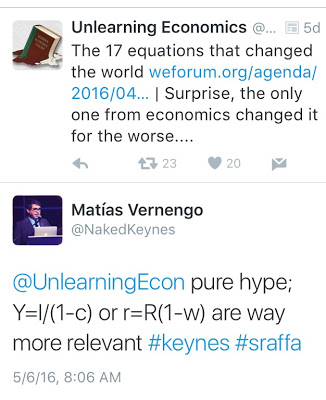

A few days ago, Unlearning Economics twitted a link to an article on "The 17 equations that changed the world." Only one was an economic equation, The Black-Scholes one, and in all fairness it did not change the world, and is not even a central one in economics. First of all, Nassim Taleb has argued convincingly (for example, here) that Black, Scholes and Merton did not invent the formula, and what they really did was to provide a theoretical justification that was compatible with Arrow-Debreu general equilibrium (GE) views. Haug and Taleb say it clearly: Indeed what Black, Scholes and Merton did was “marketing”, finding a way to make a well-known formula palatable to the economics establishment of the time, little else, and in fact distorting its essence. So market participants already had formulas to price options, and the idea that their version of the formula "helped create the now multi-trillion dollar derivatives market," as suggested by Andy Kiersz, is clearly incorrect. Unregulated financial markets didn't need the Black-Scholes formula, economists did. And we know how well that ended. Deregulation and the nature of competition in financial markets would have led to the expansion of derivative markets anyway. But GE would not look like it could provide practical answers to real economic problems. Which turns out it couldn't.

Topics:

Matias Vernengo considers the following as important: Arrow–Debreu, Black-Scholes, Kalecki, Keynes, Nassim Taleb, Sraffa

This could be interesting, too:

Lars Pålsson Syll writes The Road Not Taken

Matias Vernengo writes Paul Davidson (1930-2024)

Matias Vernengo writes Keynes’ denial of conflict: a reply to Professor Heise’s critique

Matias Vernengo writes Was Keynes a Liberal or a Socialist?

So market participants already had formulas to price options, and the idea that their version of the formula "helped create the now multi-trillion dollar derivatives market," as suggested by Andy Kiersz, is clearly incorrect. Unregulated financial markets didn't need the Black-Scholes formula, economists did. And we know how well that ended. Deregulation and the nature of competition in financial markets would have led to the expansion of derivative markets anyway. But GE would not look like it could provide practical answers to real economic problems. Which turns out it couldn't. Besides, as discussed here before, the Arrow-Debreu general equilibrium model is not devoid of problems.Indeed what Black, Scholes and Merton did was “marketing”, finding a way to make a well-known formula palatable to the economics establishment of the time, little else, and in fact distorting its essence.

So what are, if any, the great economic equations, you ask. If I had to say one it would be either Keynes' multiplier formula, Y = I/(1 – c), or Sraffa's demonstration of the inverse relation between wages and profits, r = R(1 – w).* The first clearly shows that spending determines the level of activity and provides formal justification for counter-cyclical policies, which have indeed reduced the effects of recessions on the economy, even if, as Kalecki had noted it would happen, austerity is often imposed for political reasons. The second resolved an issue first clearly posed by Ricardo, is part of the clear understanding of what determines long-term prices, and shows the conflictive nature of the capitalist system. Both are central to understanding the way capitalist economies work.

* Where all variables have the standard meaning, Y is output, I investment, c the propensity to consume, r is the rate of profit, R is the maximum rate of profit, and w the wage share.