By Naked Keynes (Guest Blogger)The policy of quantitative easing (QE) pursued by the Federal Reserve following the fall of Lehman Brothers in September 2008 meant to lower long-term interest rates in the United States and boost expenditure had major effects on developing economies including in those of Latin America. As it is well know QE did not increase liquidity. The liquidity with which the Federal Reserve bought financial assets ended as excess reserves at the Federal Reserve balance sheet and the money multiplier became, actually a divisor (the money multiplier dropped below 1 after the start of QE).However, quantitative easing had an important portfolio rebalancing effect, which altered the relative profitabilities of different assets and made commodities an attractive investment and speculative alternative. Investing in commodities as a way to hedge risk was also championed by mainstream economists. Gorton and Rouwenhorst (2004) (here) argued that commodities and stocks yield similar returns over time so that they are adequate investment substitutes. Moreover they claimed that commodities and stocks are, in terms of levels and volatilities, either not correlated or negatively correlated over time so that investing a part of the portfolio in commodities lowers its total risk.

Topics:

Matias Vernengo considers the following as important: Commodity Prices, Latin America, QE

This could be interesting, too:

NewDealdemocrat writes Real retail sales consistent with continued slow growth, aided by a continuing decline in commodity prices

NewDealdemocrat writes Economic tailwind from falling commodity prices has likely ended

Matias Vernengo writes Is dependency over?

Matias Vernengo writes New book on the crisis of economics and teaching in Latin America

The policy of quantitative easing (QE) pursued by the Federal Reserve following the fall of Lehman Brothers in September 2008 meant to lower long-term interest rates in the United States and boost expenditure had major effects on developing economies including in those of Latin America. As it is well know QE did not increase liquidity. The liquidity with which the Federal Reserve bought financial assets ended as excess reserves at the Federal Reserve balance sheet and the money multiplier became, actually a divisor (the money multiplier dropped below 1 after the start of QE).

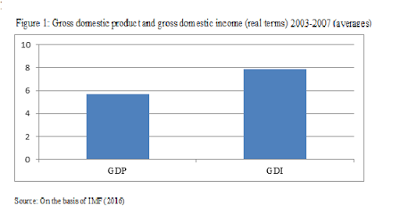

However, quantitative easing had an important portfolio rebalancing effect, which altered the relative profitabilities of different assets and made commodities an attractive investment and speculative alternative. Investing in commodities as a way to hedge risk was also championed by mainstream economists. Gorton and Rouwenhorst (2004) (here) argued that commodities and stocks yield similar returns over time so that they are adequate investment substitutes. Moreover they claimed that commodities and stocks are, in terms of levels and volatilities, either not correlated or negatively correlated over time so that investing a part of the portfolio in commodities lowers its total risk. The effect of the boom in commodities during the 2000s in Latin America is reflected in the difference between GDP and gross domestic income (GDI) (the latter is equal to GDP plus the effects of the term-of-trade which were clearly favorable in many Latin American economies. See figure 1 below for a comparison of GDP and GDI for major Latin American commodity exporters.

This gave a false sense of prosperity that even endured after GDP growth in most economies of the region began to decline in 2011: domestic income follows GDP but with a lag).

Moreover, the increase in commodities and terms-of-trade was accompanied by nominal and real exchange rate appreciation in the great majority of Latin American countries. The appreciation in the exchange rate was detrimental to export diversification but, nonetheless, welcome by policy makers as it permitted to control inflation.

Low external interest rates, high commodity prices and income, and exchange rate appreciation set the stage for the large rise observed in the corporate debt following the Global Financial Crisis (2008-2009) in the larger economies of the region. The issuance of corporate debt involved some of the major firms in the region and major commodity producing firms as well the financial sector.

According to recent estimates (here) corporate bond issuance in foreign currency increased from US$ 170 to 383 billion dollars between 2010 and 2015 (compare with FDI figures which are of the order of US$ 150-160 billion per year). But these corporate debt estimates are flows. The corporate debt stocks are much higher. Available non-official figures for Brazil point to a corporate debt stock of US$ 300 billion dollars. The corporate debt issue not only affects Latin America but in general the developing world. According to a research note published by the Institute of International Finance (IIF, June 1 2015), the stock of corporate debt outstanding was above US$ 6.8 trillion in 2014.

The decline in commodity prices which began in 2011 and turned into an outright crash in 2015 was accompanied by exchange rate depreciation and lower growth. The decline in commodity prices reduced the income flows of tradable sector firms giving rise to a wedge between income flows and debt flows. In the case of the non-tradable sectors, the decline commodity prices plus exchange rate depreciation had both income flows and balance sheet effects. Firms have reacted by reducing the debt issuance and slash capital expenditure which affects negatively investment and growth.

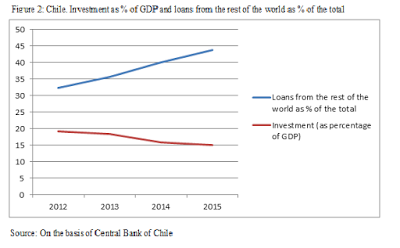

As argued by Fitch “the refinancing risk is high and default risk in climbing” (Fitch Latin American Corporate Bond maturities, February 8, 2016). Moreover, as firms have tried to cut investment, this has affected profits so that the corporate sector has increased its debt instead of deleveraging. This paradox of debt, prevalent in part of the Post Keynesian literature (See, M. Lavoie, New Foundations of Post Keynesian Economics, 2014) can be illustrated in figure 2 above with the case of Chile and may be a major stumbling block to overcome the current slowdown of some of the major Latin American economies.