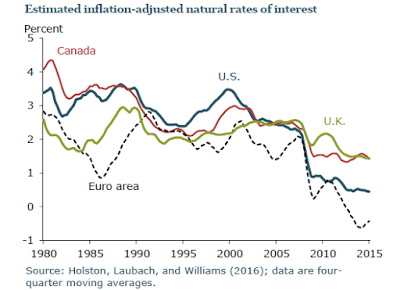

The natural rate is an old concept, well explained in Wicksell, that almost vanished (Keynes was explicitly against it, even though he partially failed to get rid of it), and has made a come back with the Neo-Wicksellian model that dominates macro today (misnamed New Keynesianism). Below the estimates published in the speech by John Williams. Note that what seems to drive the natural rate of interest is the basic rate determined by the central bank. Either the fall of the natural rate caused the crisis, or more plausibly, the crisis forced the central banks to reduce the basic rates, and the average of the fed funds rate (which is essentially how they get the natural rate) has subsequently fallen. The same goes for the twin concept of the natural rate of unemployment that keeps falling.Interesting thing is that for a while the very concept had lost some of its prominence. After the Keynesian Revolution, and particularly after the capital debates, mainstream economists were more cautious about bringing up the natural rate of interest. Friedman used a subterfuge to bring it back with the idea of the natural rate of unemployment.

Topics:

Matias Vernengo considers the following as important: Capital Controversy, Natural Rate, Wicksell

This could be interesting, too:

Matias Vernengo writes More on the possibility and risks of a recession

Matias Vernengo writes Two letters to The Economist about Donald Harris and what they reveal about ideology

Matias Vernengo writes Luigi Pasinetti (1930-2023)

Matias Vernengo writes Savings Glut, Secular Stagnation, Demographic Reversal, and Inequality: Beyond Conventional Explanations of Lower Interest Rates

Note that what seems to drive the natural rate of interest is the basic rate determined by the central bank. Either the fall of the natural rate caused the crisis, or more plausibly, the crisis forced the central banks to reduce the basic rates, and the average of the fed funds rate (which is essentially how they get the natural rate) has subsequently fallen. The same goes for the twin concept of the natural rate of unemployment that keeps falling.

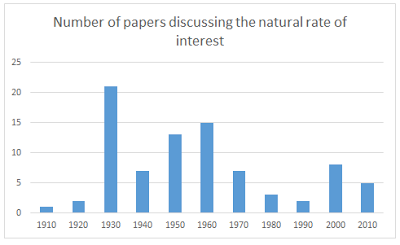

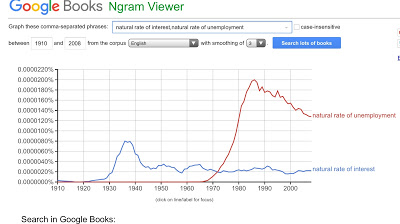

Interesting thing is that for a while the very concept had lost some of its prominence. After the Keynesian Revolution, and particularly after the capital debates, mainstream economists were more cautious about bringing up the natural rate of interest. Friedman used a subterfuge to bring it back with the idea of the natural rate of unemployment. In part because of that, as it can be seen below, the use of the term natural rate of interest in four of the central mainstream journals (American Economic Review, Economic Journal, Journal of Political Economy and Quarterly Journal of Economics) fell in the 1970s, 80s and 90s.

Since the 2000s, there seems to be an increase in the use of the term (in my JSTOR search; note we have a few more years left in the last decade), and if Ngram viewer is correct, a decline in the use of natural rate of unemployment (although the increase in natural rate of interest is not visible in Ngram; one was a limited search in academic journals and the other is a very broad search in books, which may explain the different results). I might be wrong, but my guess is that the natural rate of interest, now that the capital debates are long forgotten, is being rehabilitated.

PS: First paper in 1913 by Irving Fisher, in the JSTOR search. Roy Harrod is the one with the most papers using the term natural rate of interest, followed by Dennis Robertson. In recent times the one with more papers is Michael Woodford. I excluded papers that were about history of thought, rather than about theory (very few anyway).