So both the (inverted) yield curve and the Sahm rule indicate a recession. This together with two months of slower employment creation, and the slightly higher unemployment rate, has many wondering whether the economy will crash soon. I discussed before -- a while ago, before the pandemic recession, that had nothing to do with the yield curve -- why an inverted yield curve doesn't necessarily mean a forthcoming recession. The Sahm rule, like the inverted yield curve has an impressive track...

Read More »Friedman vs. Wicksell

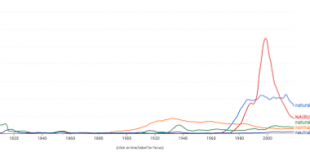

Slowly, but steadily the Wicksellian concept of a natural, normal or neutral rate of interest is making a come back and becoming more relevant and cited than Friedman's natural rate of unemployment and its awkward twin the Non Accelerating Inflation Rate of Unemployment (NAIRU).Note that up to Friedman's infamous presidential address the normal rate dominated the field. But in all fairness, even thought it has lost space it seems that Friedman's natural rate of unemployment has a lot of...

Read More »La macroeconomia dopo la moneta endogena (Wonkish)

Appena pubblicato sui Working papers di Siena Bofinger and Ries versus Borio and Disyatat: macroeconomics after endogenous money. A brief note. Sergio Cesaratto Abstract A paper by Peter Bofinger and Mathias Ries (2017a/b) strays from the recent rethinking in monetary analysis to criticise Summers’ “saving glut” explanation of the prevalence of low real interest rates. A similar critical perspective is held by Borio and Disyatat (e.g. 2011a/b, 2015), who are criticised, however, by...

Read More »The Economist and the natural rate of unemployment

The Economist new series on 'big ideas' tackled in a recent issue the concept of the natural rate unemployment (subscription required; other ideas included Say's Law and Human Capital, just to give you the broad picture of what they think it's big). I will only comment very briefly on two issues, one related to the history of ideas and the other to the concept itself.The Economist suggests that the natural rate of unemployment can somehow be connected to the ideas of Keynes. In their...

Read More »The “Natural” Interest Rate and Secular Stagnation: Loanable Funds Macro Models Don’t Fit Today’s Institutions or Data

By Lance TaylorCan America recover ideal rates of growth through interest-rate policies? This important analysis suggests that most economists misunderstand the issue. Updating Keynes, the analysis suggests that fiscal stimulus, labor union bargaining power, and more progressive income taxes are needed to support growth. (The article includes some algebra, which some readers may choose to skip.)The main points of this paper are that loanable-funds macroeconomic models with their “natural”...

Read More »Lance Taylor on Loanable Funds and the Natural Rate

New paper on INET. Here is from Lance's conclusion: ... writing in the General Theory after leaving his Wicksellian phase, Keynes said that “... I had not then understood that, in certain conditions, the system could be in equilibrium with less than full employment….I am now no longer of the opinion that the concept of a ‘natural’ rate of interest, which previously seemed to me a most promising idea, has anything very useful or significant to contribute to our analysis (pp. 242-43).”...

Read More »On the return of the natural rate of interest

The natural rate is an old concept, well explained in Wicksell, that almost vanished (Keynes was explicitly against it, even though he partially failed to get rid of it), and has made a come back with the Neo-Wicksellian model that dominates macro today (misnamed New Keynesianism). Below the estimates published in the speech by John Williams. Note that what seems to drive the natural rate of interest is the basic rate determined by the central bank. Either the fall of the natural rate...

Read More » Heterodox

Heterodox

-310x165.png)