I'm not a forecaster. I do macro, and worked for Wynne Godley at the Levy, but I feel that there are too many dangers in forecasting. Wynne was also, btw, more concerned with what he called medium term scenarios, than pinpointing when a recession would take place. The obvious joke applies here. Economists have predicted 10 of the last 9 recessions. Having said that let me do the exact opposite and throw caution to the wind.So I'm going out on a limb here. Everybody thinks the recession is around the corner. I'm more skeptical. Let me start by looking at what Martin Wolf has said in his last column, since he seems to be close to what consensus views would argue. He resuscitates old views about confidence cycles. For him: "Bull markets, it is said, climb a wall of worry... so much

Topics:

Matias Vernengo considers the following as important: Financial Times, Godley, IMF, Martin Wolf, recession, shadow banking, US economy

This could be interesting, too:

Matias Vernengo writes Milei’s Psycho Shock Therapy

Matias Vernengo writes Elon Musk (& Vivek Ramaswamy) on hardship, because he knows so much about it

NewDealdemocrat writes What to look for if housing construction does forecast a recession

Matias Vernengo writes More on the possibility and risks of a recession

I'm not a forecaster. I do macro, and worked for Wynne Godley at the Levy, but I feel that there are too many dangers in forecasting. Wynne was also, btw, more concerned with what he called medium term scenarios, than pinpointing when a recession would take place. The obvious joke applies here. Economists have predicted 10 of the last 9 recessions. Having said that let me do the exact opposite and throw caution to the wind.

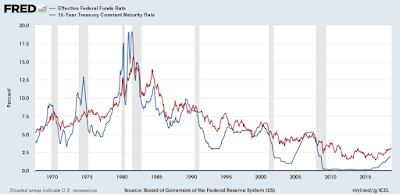

So I'm going out on a limb here. Everybody thinks the recession is around the corner. I'm more skeptical. Let me start by looking at what Martin Wolf has said in his last column, since he seems to be close to what consensus views would argue. He resuscitates old views about confidence cycles. For him: "Bull markets, it is said, climb a wall of worry... so much optimism was already in the prices of financial assets — in the US, above all — that once worry returned they had nowhere to go but down." He suggests that a "jump in risk aversion" might trigger the recession.

"The biggest shift of all is in the US. Last week, President Donald Trump broke a longstanding taboo by condemning recent tightening by the Federal Reserve. Under him, the US has also embarked on an assault on the World Trade Organization’s dispute settlement system and an open-ended trade war with China."

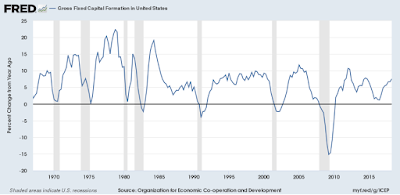

Note that there are other indicators that suggest that even though the recovery is not great, it may continue for a while. For example, if one looks at Gross Fixed Capital Formation, it is clear that an initial downturn seems to have subsided (like in the mid-1980s), and that the system got a second wind.

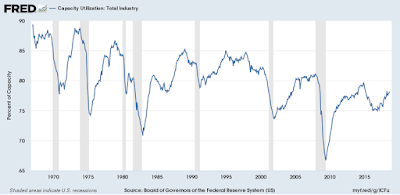

Capacity Utilization in Industry shows a similar picture. Note that this does not mean that the recovery is strong by any means. But last week the news, in spite of the unstable financial markets, were if anything indicating that the economy may continue on this path. I'm referring to fiscal news.

The budget deficit increased. That in and off itself says nothing, since the deficit is endogenous. In part the deficit went up as a result of tax cuts (a lot going to corporations and the wealthy). But also higher spending, quite a bit on defense. So there is a lot to complain about how money is being spent and how taxes are being collected. But that provides a modicum of stimulus. Trump, one should note, actually was more accurate on this than Wolf. He said that there is no fiscal danger, and that the US runs no risk of default (so why would financial markets be concerned with that), since the US can print money. Note that printing money might have consequences, but these are not the ones orthodox economists often suggest (see more here).

Contrary to Wolf I don't think that the trade wars would affect significantly the US economy. It might affect China, and certainly will have effects on the supply chains of US corporations. It might lead to higher prices, but it's implausible that it would bring the economy to a halt. The American economy depends on domestic demand. Nothing much will be affected by the trade war on that front. Also, while I think that student debt (and car loans too) are out of control, and will have implications, it's not clear that these, by themselves would cause a recession, in the way that mortgage loans did last time. They might not affect domestic demand to the same extent, at least not in the short run.

If there is a risk (besides monetary policy) is the persistence of financial speculation and the shadow financial sector, as represented by for example Collateralized Loan Obligations (CLOs), which have been going to high risk non-financial corporate firms (like Sears). But that does not mean that a recession is around the corner, and this weak recovery can (arguably) prolong itself for a few more quarters. Hey, conceivably it might go on until the 2020 election, giving Trump a serious shot at reelection (and that's not a happy thought).