I noted (here on the blog and also here) that I didn't think predictions about inflation acceleration and a recession as a result of a a second Trump presidency seemed probable. Yes, he would cut social spending, but would likely expand defense spending, and the tariffs would have a level effect on prices, but not a persistent one on the rate of change (inflation). This was before the rant by Elon Musk on spending cuts and the need for real hardship. Elon suggested cuts of 2 trillion dollars...

Read More »What to look for if housing construction does forecast a recession

[unable to retrieve full-text content] – by New Deal democrat No data today, but since it is mainly a housing week, let me pick up on a topic I discussed at the end of yesterday’s post; namely, if housing does indeed forecast an oncoming recession, what should we expect next in that sector? To cut to the chase, ultimately we […] The post What to look for if housing construction does forecast a recession appeared first on Angry Bear.

Read More »More on the possibility and risks of a recession

So both the (inverted) yield curve and the Sahm rule indicate a recession. This together with two months of slower employment creation, and the slightly higher unemployment rate, has many wondering whether the economy will crash soon. I discussed before -- a while ago, before the pandemic recession, that had nothing to do with the yield curve -- why an inverted yield curve doesn't necessarily mean a forthcoming recession. The Sahm rule, like the inverted yield curve has an impressive track...

Read More »Bidenomics and other ugly ducklings

The media and a good chunk of the policy wonks are surprised that Biden does not get the deserved recognition for the relatively good state of the US economy, and that as a result he is suffering in the polls. There are two separate, but interrelated, causes for that. The most obvious can be defined in one word, inflation. The second, is related to the fact that, even though the recovery from the pandemic was fast, the economic situation for most working class people has not been great for a...

Read More »On the possibility of a recession at the Rick Smith Show

[embedded content]My brief interview at the Rick Smith Show on the likelihood of a recession this year, and the unfounded fears about public debt in the United States.

Read More »US recession fears ease: surprisingly strong data on housing, consumer confidence, labor market

Fed Chair Jerome Powell already warned he “may” have two more planned Fed rate increases in the making. Even a Fed comment is enough to stymie a housing market increase. US recession fears ease: surprisingly strong data on housing, consumer confidence, labor market, Financial Review, Vince Golle and Reade Pickert President Joe Biden told donors he thinks the US will avoid a potential recession that economists and banks have long been...

Read More »Industrial production continues to falter in May

Industrial production continues to falter in May – by New Deal democrat My final update this morning is for industrial production, the King of Coincident Indicators, which has most frequently corresponded with peaks and troughs in economic activity as determined by the NBER. The news for total production was not good, as it declined -0.2% in May, and March and April were revised -0.2% lower each. It remains -0.5% below its recent peak last...

Read More »Soft landing or recession

This is a very short note, prompted by the increasing fears of the default and its consequences, which I think it's greatly exaggerated, and the relatively optimistic views about the effects of monetary tightening. Sure enough, as I noted recently, an adjustment, and lower spending, associated either with an agreement with Congress Republicans (very unlikely) or as contingency plans (14th Amendment of other solutions) are implemented, could certainly through the economy into a recession. But...

Read More »March jobs report: leading sectors turn down, pre-recessionary report still quite positive

March jobs report: leading sectors turn down in a pre-recessionary, but still quite positive, report – by New Deal democrat Unsurprisingly, my focus on this report, like the last few reports, was on whether residential construction jobs turned negative or not, whether manufacturing and temporary jobs continued on their downward trajectory, and whether the deceleration in job growth would be apparent. Some of the deceleration or decline...

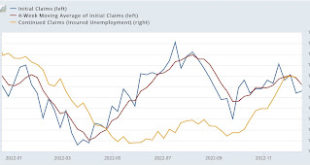

Read More »They will give us a lead on when the Sahm rule for recessions may be triggered

Initial claims continue in range; why they will give us a lead on when the Sahm rule for recessions may be triggered Initial claims ticked up 2,000 last week to 216,000. The 4 week moving average declined 6,250 to 221,750. Continued claims, with a one week delay, declined 6,000 to 1.670 million: To state the obvious continued good news, it remains the case that almost nobody is getting laid off. Also continued good news is that claims, and...

Read More » Heterodox

Heterodox

-310x165.png)

-310x165.png)

-310x165.png)