Summary:

Where the Digital Things Are I have suggested for a while here (this entry from May 2011) that deindustrialization in the US has not meant a decline in technological hegemony. Consider big tech digital firms in that respect. From the new Trade and Development Report: The widening gaps across firms have been particularly marked in the digital world. Of the top 25 big tech firms (in terms of market capitalization) 14 are based in the United States, 3 in the European Union, 3 in China, 4 in other Asian countries and 1 in Africa. The top three big tech firms in the United States have an average market capitalization of more than 0 billion, compared with an average of 0 billion in the top big tech firms in China, 3 billion in Asia, billion in Europe and billion in Africa.

Topics:

Matias Vernengo considers the following as important: American Hegemony, Deindustrialization, Technological change

This could be interesting, too:

Where the Digital Things Are I have suggested for a while here (this entry from May 2011) that deindustrialization in the US has not meant a decline in technological hegemony. Consider big tech digital firms in that respect. From the new Trade and Development Report: The widening gaps across firms have been particularly marked in the digital world. Of the top 25 big tech firms (in terms of market capitalization) 14 are based in the United States, 3 in the European Union, 3 in China, 4 in other Asian countries and 1 in Africa. The top three big tech firms in the United States have an average market capitalization of more than 0 billion, compared with an average of 0 billion in the top big tech firms in China, 3 billion in Asia, billion in Europe and billion in Africa.

Topics:

Matias Vernengo considers the following as important: American Hegemony, Deindustrialization, Technological change

This could be interesting, too:

Joel Eissenberg writes The end of the “American Century”

Matias Vernengo writes On the New Argentine Pendulum

Matias Vernengo writes Some brief thoughts on Bidenomics

Matias Vernengo writes On Re-Industrialization: Brief Comment on Krugman’s column

Where the Digital Things Are

I have suggested for a while here (this entry from May 2011) that deindustrialization in the US has not meant a decline in technological hegemony. Consider big tech digital firms in that respect. From the new Trade and Development Report:

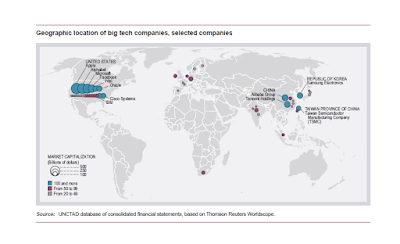

The widening gaps across firms have been particularly marked in the digital world. Of the top 25 big tech firms (in terms of market capitalization) 14 are based in the United States, 3 in the European Union, 3 in China, 4 in other Asian countries and 1 in Africa. The top three big tech firms in the United States have an average market capitalization of more than $400 billion, compared with an average of $200 billion in the top big tech firms in China, $123 billion in Asia, $69 billion in Europe and $66 billion in Africa. What has been significant is the pace at which the benefits of market dominance have accrued in this sector: Amazon’s profits-to-sales ratio increased from 10 per cent in 2005 to 23 per cent in 2015, while that for Alibaba increased from 10 per cent in 2011 to 32 per cent in 2015.For a country in decline, the US corporations are doing surprisingly well. Again, the problem of deindustrialization is one of the consequences for working class people, and inequality. American corporations, capitalism if you prefer, is doing fine. Workers not so much (and hence Trump).