Summary:

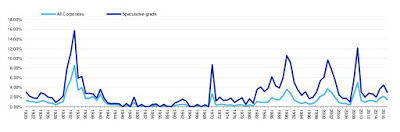

In the Eatwell and Taylor book, Global Finance at Risk, they had, I think, a graph with the percentage of corporate bonds in default in the US (I don't have the book here, it's my office). I think this is a close one, with data that is more recent (from this Moody's report). The graph shows corporate bond default rates (and also the speculative-grade bond defaults). Note that defaults fall significantly during the Bretton Woods era of capital controls and low interest rates.

Topics:

Matias Vernengo considers the following as important: Corporate default, Golden Age

This could be interesting, too:

In the Eatwell and Taylor book, Global Finance at Risk, they had, I think, a graph with the percentage of corporate bonds in default in the US (I don't have the book here, it's my office). I think this is a close one, with data that is more recent (from this Moody's report).In the Eatwell and Taylor book, Global Finance at Risk, they had, I think, a graph with the percentage of corporate bonds in default in the US (I don't have the book here, it's my office). I think this is a close one, with data that is more recent (from this Moody's report). The graph shows corporate bond default rates (and also the speculative-grade bond defaults). Note that defaults fall significantly during the Bretton Woods era of capital controls and low interest rates.

Topics:

Matias Vernengo considers the following as important: Corporate default, Golden Age

This could be interesting, too:

Matias Vernengo writes Three Globalizations, Not Two: Rethinking the History and Economics of Trade and Globalization

Matias Vernengo writes Brothers on the line

The graph shows corporate bond default rates (and also the speculative-grade bond defaults). Note that defaults fall significantly during the Bretton Woods era of capital controls and low interest rates.