Summary:

Low rates are here to stay The head of the Minneapolis Fed agrees with something that I discussed several times here (or here for the use of alternative unemployment measures like U6) in the blog, that the unemployment level (U3) is not a good measure of the slack in the labor market. Neel Kashkari says: No one knows how many more Americans want to work. But if the job market continues to improve with only modest wage growth and below-target inflation, it can be safely assumed that maximum employment isn’t here yet and there is no present need to raise interest rates. So we're NOT at full employment (neutral or natural rate in their parlance) even with 3.6%. Note that a few years back they thought it was closer to 6%. Reality has an heterodox bias.

Topics:

Matias Vernengo considers the following as important: FED, Natural Rate

This could be interesting, too:

Low rates are here to stay The head of the Minneapolis Fed agrees with something that I discussed several times here (or here for the use of alternative unemployment measures like U6) in the blog, that the unemployment level (U3) is not a good measure of the slack in the labor market. Neel Kashkari says: No one knows how many more Americans want to work. But if the job market continues to improve with only modest wage growth and below-target inflation, it can be safely assumed that maximum employment isn’t here yet and there is no present need to raise interest rates. So we're NOT at full employment (neutral or natural rate in their parlance) even with 3.6%. Note that a few years back they thought it was closer to 6%. Reality has an heterodox bias.

Topics:

Matias Vernengo considers the following as important: FED, Natural Rate

This could be interesting, too:

NewDealdemocrat writes Inflation is decelerating substantially towards the Fed target ADDENDUM: the huge impact of shelter

Matias Vernengo writes Savings Glut, Secular Stagnation, Demographic Reversal, and Inequality: Beyond Conventional Explanations of Lower Interest Rates

NewDealdemocrat writes Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace

Matias Vernengo writes Rational expectations, New Classicals, and Real Business Cycles Schools

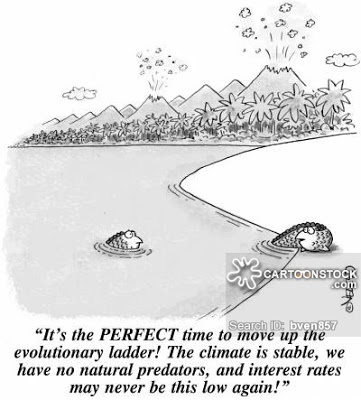

Low rates are here to stay

The head of the Minneapolis Fed agrees with something that I discussed several times here (or here for the use of alternative unemployment measures like U6) in the blog, that the unemployment level (U3) is not a good measure of the slack in the labor market. Neel Kashkari says:

No one knows how many more Americans want to work. But if the job market continues to improve with only modest wage growth and below-target inflation, it can be safely assumed that maximum employment isn’t here yet and there is no present need to raise interest rates.So we're NOT at full employment (neutral or natural rate in their parlance) even with 3.6%. Note that a few years back they thought it was closer to 6%. Reality has an heterodox bias.