Summary:

First GDP numbers of the Great Shutdown were out yesterday. As it can be seen in the graph, GDP shrunk by about 4.8%. The data reflects only the first weeks of the stay at home lockdown of the economy in March, as the BEA report points out. Numbers will get considerably worse. You must add to this the increase in unemployment insurance claims, which since the crisis started has gone up by more than 26 million, as reported by the Labor Department. Note that the unemployment rate is still at 4.4% and that it would take a while for numbers to reflect the collapse in jobs. Also, the series are measured in different ways, so many that lost their jobs, and filed for benefits (and might not even have received them) will not look for jobs (what would be the point), and, as a result would not

Topics:

Matias Vernengo considers the following as important: austerity, coronavirus, fiscal pact, Godley, recession

This could be interesting, too:

First GDP numbers of the Great Shutdown were out yesterday. As it can be seen in the graph, GDP shrunk by about 4.8%. The data reflects only the first weeks of the stay at home lockdown of the economy in March, as the BEA report points out. Numbers will get considerably worse. You must add to this the increase in unemployment insurance claims, which since the crisis started has gone up by more than 26 million, as reported by the Labor Department. Note that the unemployment rate is still at 4.4% and that it would take a while for numbers to reflect the collapse in jobs. Also, the series are measured in different ways, so many that lost their jobs, and filed for benefits (and might not even have received them) will not look for jobs (what would be the point), and, as a result would not

Topics:

Matias Vernengo considers the following as important: austerity, coronavirus, fiscal pact, Godley, recession

This could be interesting, too:

Matias Vernengo writes Elon Musk (& Vivek Ramaswamy) on hardship, because he knows so much about it

NewDealdemocrat writes What to look for if housing construction does forecast a recession

Matias Vernengo writes More on the possibility and risks of a recession

Nick Falvo writes Report finds insufficient daytime options for people experiencing homelessness

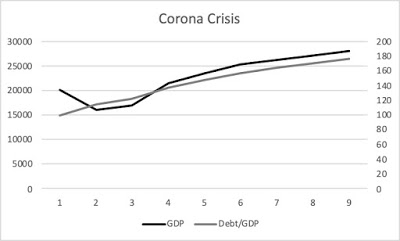

First GDP numbers of the Great Shutdown were out yesterday. As it can be seen in the graph, GDP shrunk by about 4.8%. The data reflects only the first weeks of the stay at home lockdown of the economy in March, as the BEA report points out. Numbers will get considerably worse.

You must add to this the increase in unemployment insurance claims, which since the crisis started has gone up by more than 26 million, as reported by the Labor Department. Note that the unemployment rate is still at 4.4% and that it would take a while for numbers to reflect the collapse in jobs. Also, the series are measured in different ways, so many that lost their jobs, and filed for benefits (and might not even have received them) will not look for jobs (what would be the point), and, as a result would not count as unemployed. Expect the participation rate to fall. At any rate, the true unemployment rate as we speak, 26 plus another 5 million or so unemployed before the crisis, would be closer to about 19%. This is a crisis of biblical proportions.

But that is not my main concern. There are many ways in which fiscal and monetary policy could mitigate the worst effects of the crisis. The problem for me is that almost nobody is talking about the size of the effort that would be required for the economy to get out of this deep hole. Imagine that unemployment does get to something like almost a third of the labor force, as suggested by some Fed officials.

I've been playing around with some scenarios. This is not forecasting, which I don't consider a particular useful approach. This scenario is based on very simple assumptions using a simple Keynesian (yes, as in Keynesian cross) model, and some simple stock-flow accounting definitions, even though I don't have a fully consistent accounting model (on that and Godley and stock-flow models see this old post). I also assume certain parameters and sizes of shocks (even though I played with different numbers; on Godley and his view of the role of parameter estimation and model architecture see this other old post). Other than the simple multiplier (in this scenario of 1.2) and Okun's Law (3:1 ratio in this case), there are only assumptions about autonomous spending (government in this case, with some assumptions for this year at least informed by current events), and my concerns are essentially about what those mean in terms of the political economy of fiscal policy.

So, in my scenario output falls by about 8% next year, and recovery starts immediately, but GDP only surpasses the previous level in 2022/23, in the third year of the crisis. That's with a lot of fiscal stimulus, by the way. And in part the result of that is that the debt-to-GDP ratio goes to, in this scenario, about 180%, after 9 years (I had others with considerably more). Japanese levels of debt. I see no problem, but not everybody agrees, and, of course, that's the problem. Since the social forces that push for austerity are still around.

The scenario also implies that unemployment spikes (less than the number I gave above; so I guess a lot of discouraged workers and disguised unemployment), and it takes almost a decade to come down to reasonable numbers.

As with Godley, my interest in this is NOT to make predictions. I have no clue if this is going to happen or not (most likely not). My point is that in all my scenarios, huge fiscal stimulus was followed by moderate stimulus (not austerity*), and yet in all the debt-to-GDP ratio would go considerably up. It shouldn't be a surprise. In a crisis with a collapse in demand, that destroys jobs and income, and that workers and corporations are heavily indebted, it is unavoidable that the federal government would be required to pick up the tab, run higher deficits, and accumulate debt.

But are we prepared for that scenario? Republicans already called for less government, less taxes, and reduction in all types of spending (particular social spending, which is frankly nuts in the context of a pandemic). More surprisingly, Mitch McConnell seems to want States and municipalities to go bankrupt, that is, not do the normal thing in federations, which is to make the only entity with ability to borrow in its own currency to borrow (at zero rates really) and transfer resources. He basically wants the US to look more like Europe, and not the more social spending part, but the absence of a federal fiscal pact part. That's dangerous. And a Biden presidency (oh man, this hurts!), if it happens (consider the alternative; is it too early for a beer?), would have to deal with that and discussions about the debt ceiling (am I glad a grabbed a beer?). Oh well.

* In my scenarios, austerity makes things worse, making the recovery slower, and tax revenue growth too, btw.

PS: The other post on Godley's approach to macro modeling here.