What do you do when your economy is in the doldrums and you need to kickstart growth?Why, you put more people to work, that's what you do.This has been the Tories’ strategy since 2010. The sustained attack on welfare benefits has all been focused on “making work pay” - encouraging, and at the margin forcing, people with illnesses, disabilities and caring responsibilities into paid work. But there is another way of putting more people to work, and that is to import them. In a new report, the...

Read More »What do Canadian corporations do with their profits?

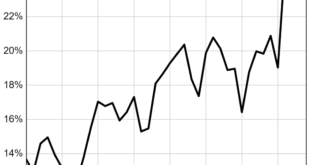

Corporate profits have received much more scrutiny in recent years. High inflation provoked on-going debates about the role of profit margins with terms like “greedflation” and “price gouging” levelled at corporations. People recognized that, at minimum, corporations are profiting from inflation. Analysis of 4,550 publicly-listed corporations found that 33% had record operating profits in 2021 or 2022.[1] Further, corporations with pricing power were found to be actively worsening...

Read More »To Loot or Not to Loot? How Public-Private Partnerships Harmed Turkey

This article first appeared in the Indian journal Economic and Political Weekly on 18 July 2022. A Murder in Konya Konya is a province in Turkey. On 6 July 2022, about an hour before I started writing this article, a murder news hit the Turkish pages of the internet: “In Konya City Hospital, a patient shot and killed a cardiologist and his secretary today.” Whether the assassin committed suicide or the private security killed him is unknown, although there are both rumours. City hospitals,...

Read More »To Loot or Not to Loot? How Public-Private Partnerships Harmed Turkey

This article first appeared in the Indian journal Economic and Political Weekly on 18 July 2022.A Murder in KonyaKonya is a province in Turkey. On 6 July 2022, about an hour before I started writing this article, a murder news hit the Turkish pages of the internet: “In Konya City Hospital, a patient shot and killed a cardiologist and his secretary today.” Whether the assassin committed suicide or the private security killed him is unknown, although there are both rumours.City hospitals, the...

Read More »To Loot or Not to Loot? How Public-Private Partnerships Harmed Turkey

This article first appeared in the Indian journal Economic and Political Weekly on 18 July 2022.A Murder in KonyaKonya is a province in Turkey. On 6 July 2022, about an hour before I started writing this article, a murder news hit the Turkish pages of the internet: “In Konya City Hospital, a patient shot and killed a cardiologist and his secretary today.” Whether the assassin committed suicide or the private security killed him is unknown, although there are both rumours.City hospitals, the...

Read More »Rentier capitalism is profoundly risk-averse

The following article is based on my speech notes for a presentation to University College London’s Global Business School for Health on 22nd February 2022. The webinar was titled: Health Innovation through Capital and Private Equity Markets webinar. The question panellists were asked to address was this: “….whether capital and private equity markets are actually driving forward better and sustainable health innovation?” I argued that private capital and private equity markets – far from...

Read More »Rentier capitalism is profoundly risk-averse

The following article is based on my speech notes for a presentation to University College London’s Global Business School for Health on 22nd February 2022. The webinar was titled: Health Innovation through Capital and Private Equity Markets webinar.The question panellists were asked to address was this: “….whether capital and private equity markets are actually driving forward better and sustainable health innovation?”I argued that private capital and private equity markets – far from...

Read More »Rentier capitalism is profoundly risk-averse

The following article is based on my speech notes for a presentation to University College London’s Global Business School for Health on 22nd February 2022. The webinar was titled: Health Innovation through Capital and Private Equity Markets webinar.The question panellists were asked to address was this: “….whether capital and private equity markets are actually driving forward better and sustainable health innovation?”I argued that private capital and private equity markets – far from...

Read More »The dismal decade

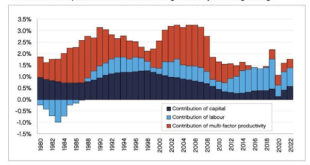

Earlier today, the Governor of the Bank of England, Andrew Bailey, gave a speech at the Resolution Foundation outlining the nature of the Covid-19 crisis and the challenge that it poses for monetary policy. But as his speech progressed, it became clear that the Bank faces a much larger challenge. Covid-19 hit the UK economy at the end of a dismal decade. Returning to "where we were" before the pandemic won't be good enough. Just how dismal the 2010s were is evident in this chart from Andrew...

Read More »We can’t afford a capitalism that doesn’t work for the next generation

As we look ahead, young people believe there is no regard for future generations who will suffer from the decisions taken today in the name of “economic growth”.In a recent interview the 18-year-old climate activist Xiye Bastida beautifully summarised why the next generation is angry: “Companies say their role is to help the economy. They say, they don’t have the need to be socially responsible or care about biodiversity. We create jobs.”Xiye and young climate activists around the world argue...

Read More » Heterodox

Heterodox