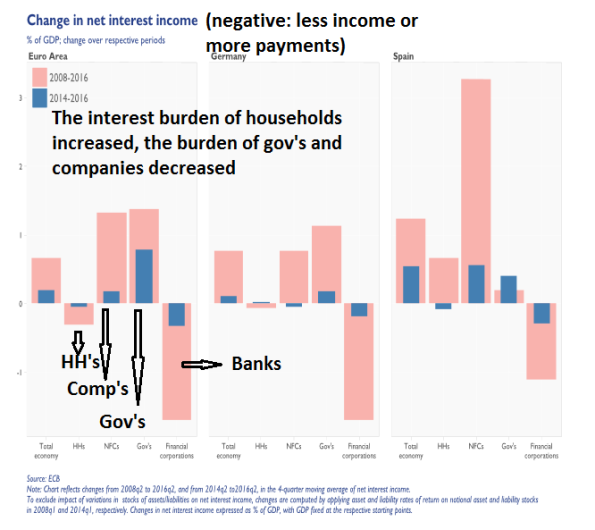

As far as I’m concerned, the ECB does not yet have to increase interest rates – as households still have to be able to refinance many billions high rate loans. As mister Draghi has shown, using sectoral balances, households have, unlike companies and governments not yet profited from low rates and QE! Individual EU countries have to reign in the housing market, though. Below, I’ll share some thoughts about this (as I’m a member of the ECB shadow council who gives advice on this, and I am reconsidering my point of view). Graph 1: Net interest ‘income’ of banks, the government, non-financial companies and households. Source: ECB Borrowing is not just about the interest rate. It’s also about collateral, changing rules and habits and different markets – the market for national mortgage credit is not the same as the market for international commercial credit. But being indebted is very much about interest rates. In dire times, low rates enable people to refinance their debts, which eases the burden on households and therewith the economy. Refinancing however takes time. And as can be seen in graph 2, EU household and company rates have only been low for quite a short period! Graph 2.

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

As far as I’m concerned, the ECB does not yet have to increase interest rates – as households still have to be able to refinance many billions high rate loans. As mister Draghi has shown, using sectoral balances, households have, unlike companies and governments not yet profited from low rates and QE! Individual EU countries have to reign in the housing market, though. Below, I’ll share some thoughts about this (as I’m a member of the ECB shadow council who gives advice on this, and I am reconsidering my point of view).

Graph 1: Net interest ‘income’ of banks, the government, non-financial companies and households.

Source: ECB

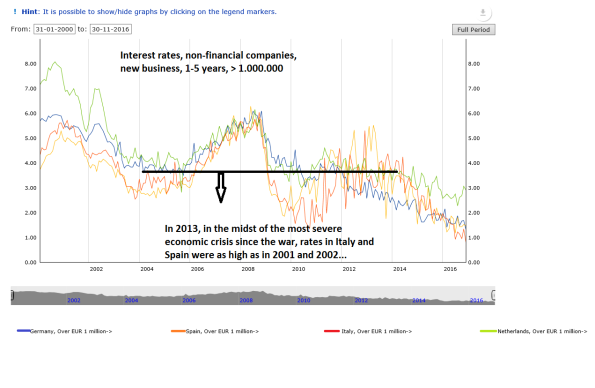

Borrowing is not just about the interest rate. It’s also about collateral, changing rules and habits and different markets – the market for national mortgage credit is not the same as the market for international commercial credit. But being indebted is very much about interest rates. In dire times, low rates enable people to refinance their debts, which eases the burden on households and therewith the economy. Refinancing however takes time. And as can be seen in graph 2, EU household and company rates have only been low for quite a short period!

Graph 2. Interest rates in different countries in the EU

Source: ECB

An important background to this: over the twentieth century mortgage credit changed from an important asset on the balance sheet of banks to by far the most important asset backing credit creation by banks – houses (and land underlying houses) became the most important kind of collateral backing money creation! The other side of this is that households took up an ever mounting burden of mortgage debt. This burden has to diminish. At this moment, house prices are increasing again, which, as mortgage debt is the most important kind of debt, seems to alleviate the situation. Houses are, as everybody with even a passing knowledge of bricks knows, not too ‘liquid’. Fortunately, sales of houses are also increasing, which means that quite some people are able to sell their house and in the mean time refinance the debt. Housing markets are, however, getting bubbly again – though this time the ever faster price increases do not only seem to be fired by bank credit in combination with securitization but also by an inflow from money from ‘somewhere’ (Rich parents? Rich Russians and Chinese? Rich lawyers and doctors?). Which means that the total amount of mortgage credit is not rising anywhere as fast as house prices. Still, considering the overriding importance of the housing (and therewith the land-) market, countries have to take measures (introducing a land tax, a higher loan to value ratio, less mortgage interest deductions) to limit house price increases, also because busts (which will come) do not only affect prices but also the volume of sales which, in conjunction with low prices, will, again, lead to serious problems for households and banks alike. This is, however, a responsibility of the individual countries and not of the ECB.

Aside of this, low ECB interest rates have also, in conjunction with QE, enabled a convergence of Eurozone interest rates for households and companies, which is a good thing in its own right. While it also enables government to borrow as well as refinance against low rates. High rates will totally cripple the Italian and Irish governments which (I’m not a sheltered USA radical like Steve Bannon or a even more sheltered mainstream German economist) I do not like to see happen. Crashing governments will ultimately lead to Mexican style drug companies with company armies who do not obey but set the law. Their law. Compare what Trump is doing to the USA – low rates do have their advantages!

And oh, the pension fund problem? Let them invest in solar cells. At short notice still need a few billion (say, four per inhabitant) of these in the EU and the ROI on them is a magnitude higher than bond yields.