From Blair Fix It was a bet heard around the world. Okay, that’s an exaggeration. It was a bet heard mostly by academics and sustainability buffs. But still, it was a bet … and it was important. The year was 1980. The players were biologist Paul Ehrlich and business professor Julian Simon. The two had conflicting ideas about where humanity was headed. Ehrlich, the author of the 1968 book The Population Bomb, thought humanity was headed for a Malthusian catastrophe. Simon thought the opposite. Humanity, he argued, was itself The Ultimate Resource. Because humanity’s genius knew no bounds, Simon proclaimed that we could think our way out any problem. The debate between Ehrlich and Simon was fundamentally about resource scarcity. What’s interesting, though, is that their actual

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Blair Fix

It was a bet heard around the world. Okay, that’s an exaggeration. It was a bet heard mostly by academics and sustainability buffs. But still, it was a bet … and it was important.

The year was 1980. The players were biologist Paul Ehrlich and business professor Julian Simon. The two had conflicting ideas about where humanity was headed. Ehrlich, the author of the 1968 book The Population Bomb, thought humanity was headed for a Malthusian catastrophe. Simon thought the opposite. Humanity, he argued, was itself The Ultimate Resource. Because humanity’s genius knew no bounds, Simon proclaimed that we could think our way out any problem.

The debate between Ehrlich and Simon was fundamentally about resource scarcity. What’s interesting, though, is that their actual wager wasn’t about any physical measure of resource reserves. Their wager was about prices.

Simon challenged Ehrlich to bet on the price of raw materials. Pick any ‘non-government controlled’ resource, Simon said, and he’d bet that the price would decrease over time. Ehrlich chose five metals — copper, chromium, nickel, tin, and tungsten. If their inflation-adjusted prices went down by 1990, Ehrlich would lose. If metal prices went up, Ehrlich would win.

Ehrlich lost.

Actually, Ehrlich lost the bet the moment he entered it. Ehrlich’s was concerned with the physical exhaustion of resources. Had he bet Simon on any physical measure of resource reserves, Ehrlich would have won. (The Earth isn’t making more metal, so we’ve been exhausting our supply since day one.) Instead, Ehrlich fell for a bait and switch. He allowed Simon to frame scarcity in terms of prices. It was a fateful mistake.

The switch from physical scarcity to prices is one of economists’ favorite tricks for dispelling concerns about sustainability. In this post, I’ll show you how to avoid getting hoodwinked. The key is to realize that resources can get cheaper at the same time that they get less affordable. And when it comes to the price of oil, I think this is exactly what’s in store.

Hotelling’s ‘rule’

We can’t talk about the price of non-renewable resources without discussing Hotelling’s rule. Like all ‘rules’ in economics, it’s not an actual rule (i.e law of nature). It’s just a hypothesis. But it’s a hypothesis that dominates how economists think about the price of scarce resources. Hotelling’s ‘rule’ was outlined by Harold Hotelling in a 1931 paper called ‘The Economics of Exhaustible Resources’. In a nutshell, Hotelling argued that the price of a non-renewable resource should grow exponentially with time. Here’s his reasoning.

Imagine two people, Alice and Bob. Both own a stock of 100 barrels of oil. Alice sells her stock today for $50 per barrel, earning $5000. Like a good capitalist, Alice puts the money in the bank and lets it collect interest. Suppose she earns a hefty 10% annual return. After 10 years, her oil money has grown to about $13,000.

Back to Bob. Unlike Alice, Bob sat on his oil stock, waiting for the right time to sell. After 10 years, he’s finally ready. He calls Alice and finds out she’s got $13,000 in the bank from her 100 barrels of oil. Bob does some math and realizes that to match Alice’s earnings, he has to sell his oil for $130 per barrel (almost triple Alice’s price). Not wanting to lose money relative to Alice, that’s the price Bob asks. And damned if he doesn’t get it!

If everyone behaves like Alice and Bob (as rational money maximizers), the price of oil will grow exponentially at the rate of interest. That’s Hotelling’s ‘rule’ (hypothesis). More generally, Hotelling’s ‘rule’ predicts that the price of any non-renewable resource should grow exponentially with time.1

The bait and switch

When it comes to resource exhaustion, Hotelling’s ‘rule’ is the bait — an idea that is simple and plausible. The switch comes when we actually test Hotelling’s ‘rule’. Suppose we find that the price of a non-renewable resource does not grow exponentially. That would seem to falsify Hotelling’s ‘rule’. But that’s not how economists see it. Instead, they argue that since the price is not growing exponentially, the non-renewable resource is in fact not being exhausted.

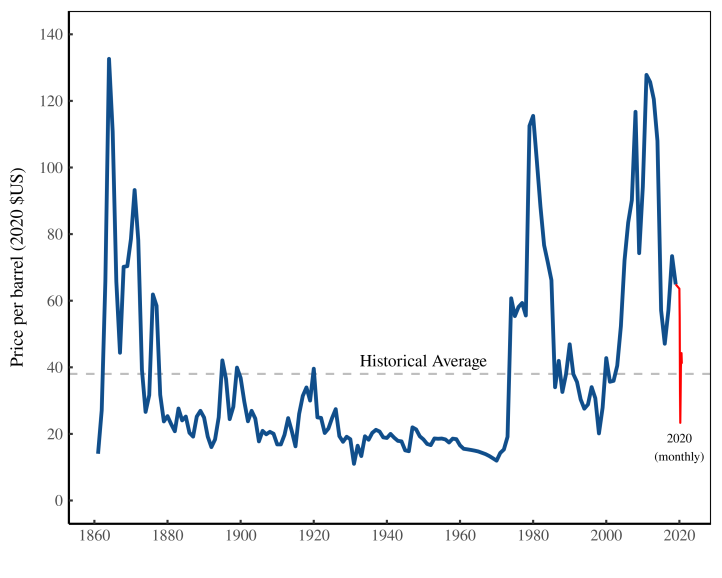

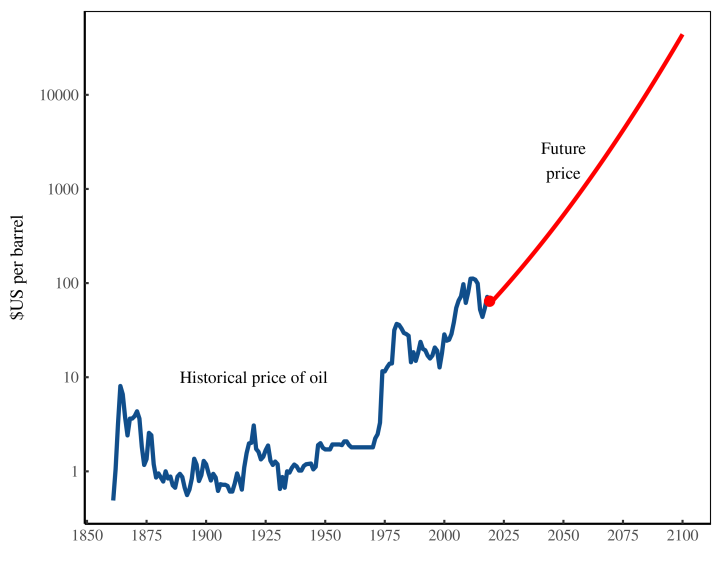

As Exhibit A for this logic, take the inflation-adjusted price of oil. Figure 1 shows the trend in this price over the last 160 years. Actually, ‘trend’ is the wrong word because … there isn’t one. Yes, oil prices have oscillated dramatically. But there is no sign of a long-term trend. Today, the price of oil is close to $40 — almost exactly its historical average (in ‘2020 $US’).2

Since the inflation-adjusted price of oil has not grown exponentially, it appears that Hotelling’s ‘rule’ is wrong. There’s no shame in that. When tested, most scientific hypotheses turn out to be wrong. But here’s the shameful part. Rather than admit that Hotelling’s ‘rule’ is wrong, some economists claim that this oil-price data shows something completely different. It indicates, they argue, that we’re not exhausting our oil reserves.

It’s a trick that fools many people. Even Paul Ehrlich was hoodwinked. True, Ehrlich wasn’t tricked into thinking that non-renewable resources are not being exhausted. But he was goaded into a bet where resource scarcity was measured using prices. Fortunately, we can learn from Ehrlich’s mistake. As we exhaust non-renewable resources, Hotelling’s ‘rule’ claims that their price should grow exponentially. It’s an idea that is simple, plausible, and false.

The power to consume

If Ehrlich had wagered on a physical measure of resource scarcity, he would have won his bet with Simon. But at least to me, this hindsight is little consolation. Simon and Ehrlich bet on prices for a good reason. Prices dominate our lives. So it’s natural to want to connect prices to resources scarcity.

Having chastised Ehrlich for betting on prices, I’ll now argue that prices do connect to how we harvest resources … just not the way Ehrlich thought. What was missing in the Simon-Ehrlich bet was income. When it comes to consuming a resource, what matters is not the price itself, but how much of the resource we can afford to buy.

Wait, you say. Aren’t ‘price’ and ‘affordability’ two sides of the same coin? If the price of oil drops, doesn’t oil also become more affordable? The answer is yes … in the short term. That’s because over a short period (a few months), your income will probably stay the same. So when the price of oil drops, you can afford to buy more oil.

Over the long term, however, your income changes. And that means prices are not the same thing as affordability. Prices can go up at the same time that resources become more affordable. And prices can go down at the same time that resources become less affordable. What matters is not prices themselves, but how they relate to income.

We can measure affordability by comparing your income to a commodity’s price. I’ll call this ratio ‘purchasing power’:

Purchasing power measures your ability to consume a commodity. The larger your purchasing power, the more of the commodity you can consume. What’s important is that purchasing power is affected by both the commodity price and your income. When your income changes, the commodity price on its own says little about affordability.

With purchasing power in hand, let’s return to the price of oil. As Figure 1 showed, there is no clear trend in the inflation-adjust oil price. But what about the affordability of oil?

To measure affordability, we need to compare the price of oil to someone’s income. Let’s use Americans as our guinea pigs. We’ll compare the price of oil to the average American income (measured by GDP per capita). I call the result ‘US oil purchasing power’. It measures the average American’s ability to purchase oil:

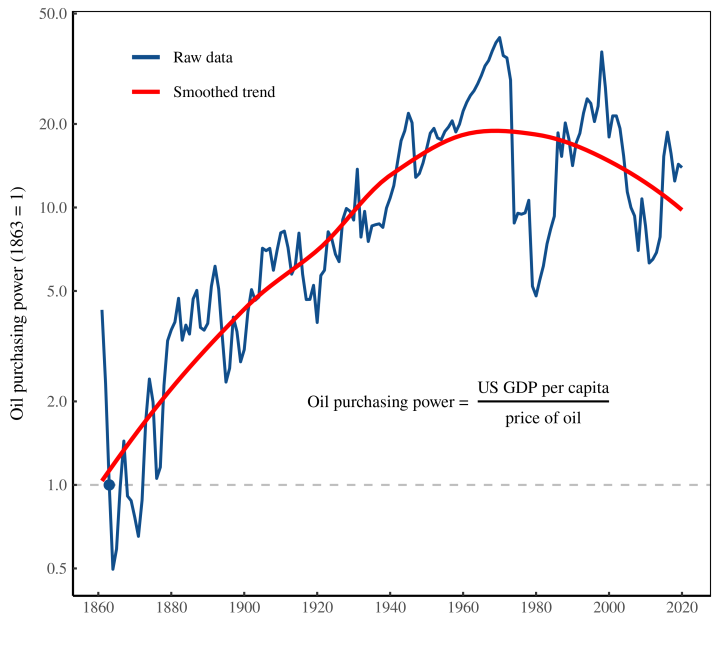

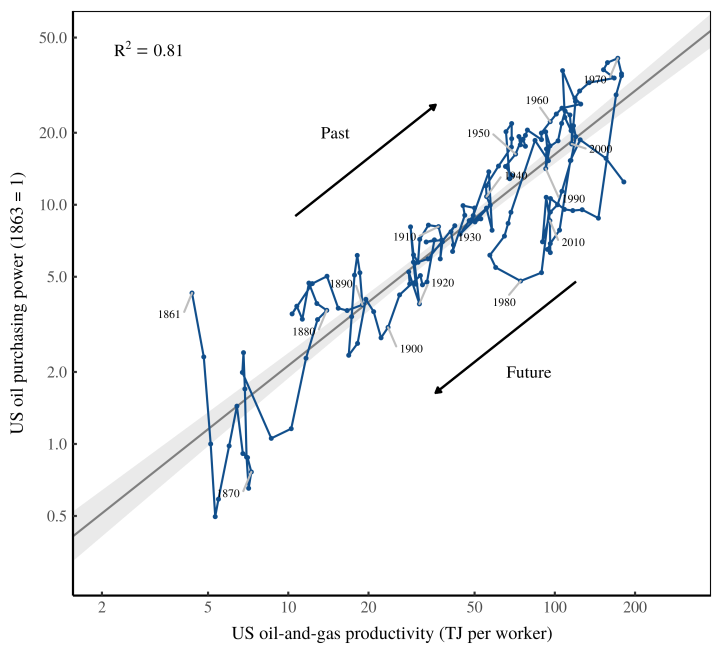

Figure 2 shows the history of US oil purchasing power. Unlike inflation-adjusted oil prices (which have no clear trend), oil purchasing power trended upwards. Actually, that’s an understatement. From the 1860s to the 1960s, US oil purchasing power grew by a factor of 40. (Note that in Figure 2, the vertical axis uses a log scale, so exponential growth appears as a straight line.)

What’s interesting, in Figure 2, is that the trend in purchasing power is visible only over long stretches of time. That’s because over the short term, oil prices fluctuate wildly, trumping changes in income. Even over a decade (the length of the Simon-Ehrlich wager), oil-price changes trump income changes. The long-term trend in purchasing power becomes visible only when you look at century-long time scales.

Speaking of century-long trends, let’s look at the big picture in Figure 2. It’s clear that something changed around 1970. In the century prior to 1970, US oil purchasing power grew steadily. But in the half century after 1970, oil purchasing power stagnated. And if the smoothed trend in Figure 2 is any indication, US oil purchasing power is now declining.

What explains this long-term trend in oil purchasing power? It turns out that the answer is simple. Oil purchasing power grows in lock step with oil-and-gas productivity.

Purchasing power and productivity

When oil purchasing power increases, we can afford to consume more oil. But how do we make this happen? How do we make oil more affordable?

To frame the question, think about it this way. When you buy crude oil, your money doesn’t go to the dead dinosaurs who made it. No, your money goes to the (living) humans who harvested the oil. This is a banal but important observation. It means that there are only two ways to make oil more affordable:

- Decrease the relative pay of the people who harvest oil

- Decrease the number of people needed to harvest the oil

While both options are important, there are limits to the first one. You can lower relative pay only so much before people revolt. Imagine, for instance, trying to halve the pay of every oil worker. I grew up in oil country (Alberta), and I can tell you that this policy wouldn’t fly.

Now imagine the second option — halving the number of people needed to extract a barrel of oil. At first, this seems just as brutal as halving pay. Won’t 50% of oil workers lose their jobs? The answer is yes … but only if oil consumption remains constant. The thing about consumption, however, is that it almost never remains constant in the face of rising productivity. Instead, when productivity grows, consumption also grows. So imagine that as we halve the number of workers needed to produce a barrel of oil, we also double our oil consumption. In this scenario, every oil worker would keep their job. It’s a win for oil workers and a win for society. (It’s a loss for the Earth’s climate… but we’ll ignore that.)

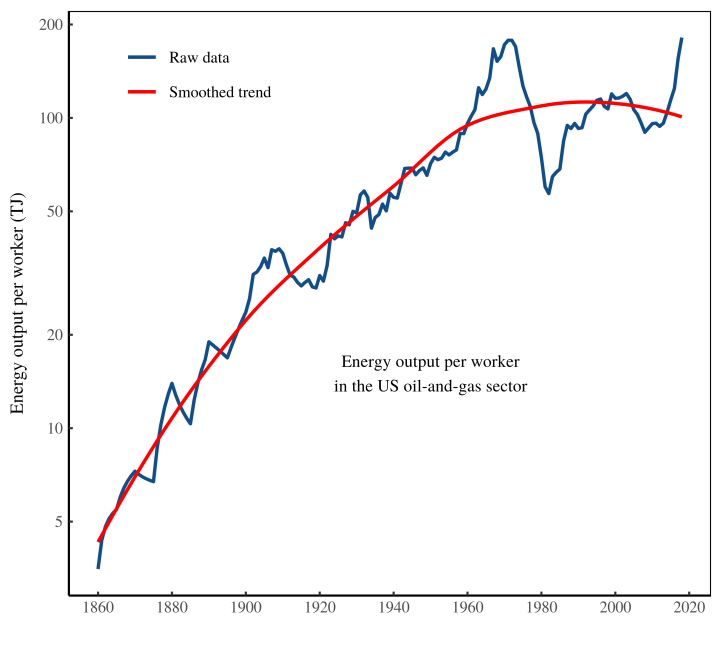

When it comes to making oil more affordable, increasing oil productivity is the path of least resistance. With this in mind, let’s have a look at US oil-and-gas productivity. Figure 3 shows how it’s changed over the last 160 years. I’ve plotted here the energy output per worker in the US oil-and-gas sector. From 1860 to 1970, this output grew by a factor of 50. In other words, 50 times fewer workers were needed to harvest the same amount of oil. That’s a spectacular change.

Now things are starting to make sense. Over the last century and a half, oil grew steadily more affordable for Americans (Figure 2). At the same time, US oil-and-gas productivity rose steadily (Figure 3). It doesn’t take a genius to connect the trends. It seems that productivity is the primary driver of affordability.

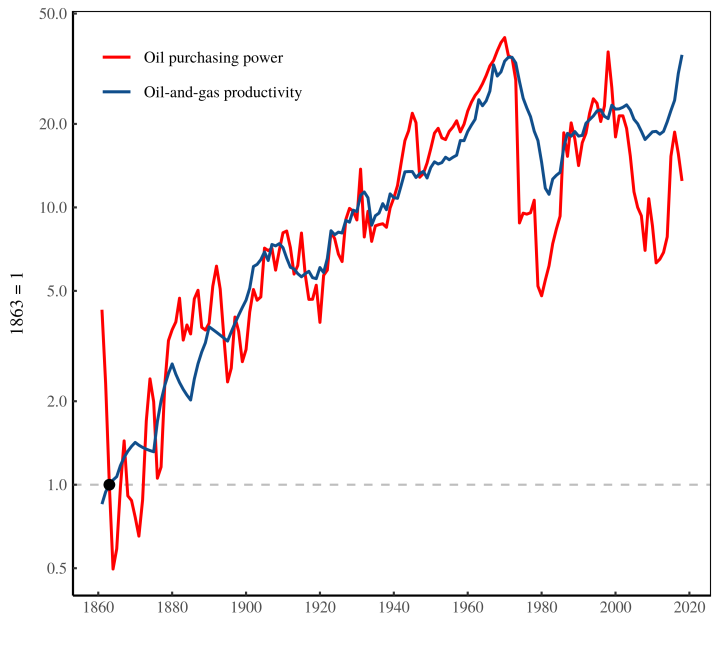

Figure 4 puts it all together. Here I compare the growth of US oil-and-gas productivity to the growth of US oil purchasing power. I’ve plotted both series on the same scale and indexed them to equal 1 in 1863. As oil-and-gas productivity grows, oil purchasing power increases in lock step. In fact, it’s roughly a one-to-one relation.

The connection between oil purchasing power and oil-and-gas productivity is easy to explain. Let’s break it down. (If you don’t like algebra, skip ahead.)

We’ll start with the price of oil. This price is the (gross) income that oil companies earn per barrel of oil:

We’ll assume that this income gets paid to oil-and-gas workers. (We’ll ignore profit.) So the price of oil equals the income per oil-and-gas worker times the number of workers employed per barrel of oil:

Now let’s assume that oil-and-gas workers earn roughly the same income as everyone else. We’ll assume they earn GDP per capita. Replacing income per worker with GDP per capta, we get:

Now we move GDP per capita to the left side of the equation to get:

We’re almost there. We take the inverse of both sides to give:

And there you have it. The left side of the above equation is oil purchasing power. The right side is oil productivity. Putting it all together, we have:

Now, this equation is not exact for a few reasons. First, oil and gas workers don’t earn exactly GDP per capita. Second, we haven’t accounted for profits that flow to oil company owners. And third, our empirical measure of productivity measures both oil and gas output. But we’ve compared this productivity to the price of oil only.3

Caveats aside, the growth of oil productivity explains most of the growth of oil purchasing power. And this fact brings us back to resource scarcity.

Enter resource scarcity

On the day we drilled the first well, we started to exhaust our supply of oil. A naive prediction would be that from this day forward, oil would become less affordable. That didn’t happen. Instead, oil got more affordable (until recently). Why?

As I’ve just shown (in Figure 4), oil got more affordable because oil productivity increased. And productivity increased despite the fact that we were exhausting our supply of oil. If we look at oil resources in isolation, this fact sounds counter intuitive. But what’s missing is that oil production depends jointly on oil resources and our technology. Better technology makes productivity grow, even as we deplete our energy reserves.

Figure 5 shows an example of this interplay. On the left is the Drake Well — the first productive US oil well. Drilled in 1859, it struck oil at a depth of 70 feet. Today, such a shallow strike is unheard of. Modern wells are often thousands of feet deep. But although the Drake oil was easy to get (by today’s standards), the technology of the day was crude. Most work was done by hand. So productivity was poor

Fast forward to the present. Today, we drill for oil in the most unlikely places — thousands of feet below ground that is itself thousands of feet under water. But while this oil is far more difficult to extract, operations like the Troll A platform (Figure 5, right) are orders of magnitude more productive than the Drake well. That’s because they use far better technology.

Looking at this growth of technology, Julian Simon claimed that it would trump resource scarcity. And in a certain sense, he was right. That’s how it’s worked in the past. But that’s not how it will work forever. The problem comes down to basic thermodynamics. Technology isn’t powered by human ingenuity (as Simon claimed). Technology is powered by energy. Think of technology as a tool for creating a positive feedback loop. It allows us to use energy to harvest energy. We harvest fossil fuels and then feed this fuel into technology that harvests still more fossil fuels. The result is that productivity grows exponentially.

Unfortunately, this feedback only works if we can perpetually feed our technology more energy. That means technology can’t save us from resource exhaustion. The endgame (for oil) happens when there’s no oil left to harvest. At that point, the fact that we have marvellous oil-extracting technology is moot. But the problem starts long before we run out of oil. As we exhaust the easy-to-get reserves, we move on to the harder ones. Yes, our technology improves. But at some point, the oil becomes so hard to find and extract that this difficulty trumps technology. (Think drilling in 2 km of water.) When this turning point happens, oil productivity stops growing and begins to decline.

Looking at Figure 3, we can see that this productivity peak has already happened. In the US, it came in 1970. Since then, US oil-and-gas productivity has plateaued. Of course, it’s possible that we’re just in the midst of lull, and that the exponentially growth of oil-and-gas productivity will soon continue. But I’m not betting on it.

The problem is simple — we’ve already passed the peak of conventional oil production. As we exhaust this high-quality oil and move on to poor-quality stuff, I think oil-and-gas productivity will decrease. In response, oil purchasing power will also decline.

Basically, I’m guessing that the correlation shown in Figure 6 will continue to hold. In the past, oil productivity and oil purchasing power grew together. In the future, I predict that they will decline together. How quickly this will happen, however, is anyone’s guess.

Back to prices

What’s interesting is that even if oil purchasing power does decline as I’ve predicted, this says nothing about prices. Oil prices could explode (as many peak-oil theorists expect). But oil prices could also collapse. It all depends on what income does. Let’s have a look at these opposite scenarios.

SCENARIO 1: OIL PRICES EXPLODE

In a future marked by oil scarcity, the price of oil explodes. It’s a future that many peak-oil theorists expect. It’s the future that Paul Ehrlich expected (for metals) when he bet Julian Simon. Here’s how it could happen.

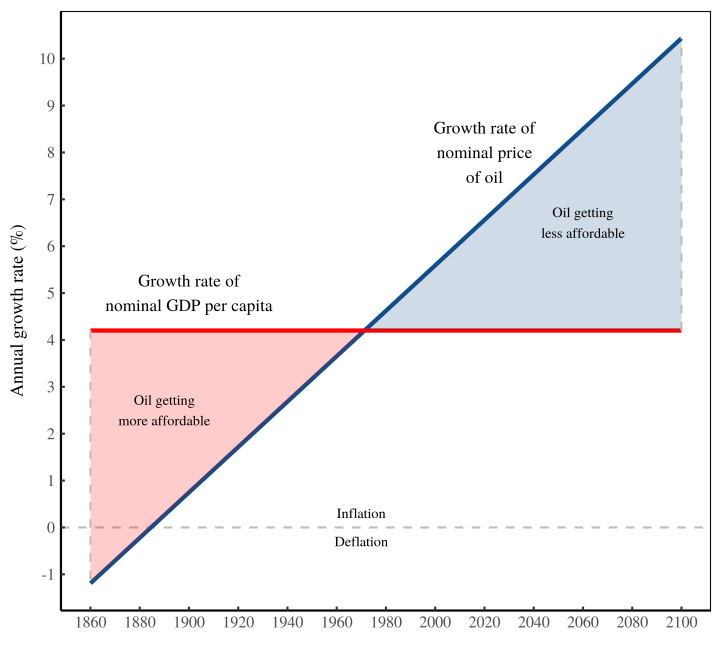

Figure 7 shows a model of oil purchasing power in which the price of oil explodes. It’s a bit abstract, so let’s talk through the elements. I’ve plotted hypothetical growth rates for the price of oil and US nominal GDP per capita. A horizontal line indicates constant exponential growth. A positively sloped line indicates that growth is accelerating. In our model, income (nominal GDP per capita) grows at a constant rate. The growth rate of the price of oil, however, accelerates over time.

What’s most important, in Figure 7, are the shaded regions. They tell us whether oil is get more affordable or less affordable. The red shaded region indicates that oil is getting more affordable. That’s because income (GDP per capita) is growing faster than the price of oil. So oil purchasing power increases. The blue shaded region, in contrast, indicates that oil is getting less affordable. That’s because income grows slower than the price of oil. So oil purchasing power decreases.

Although idealized, this model is based in part on real facts. Since 1860, US nominal GDP per capita has grown, on average, by about 4% per year. And I’ve chosen the oil-price dynamics to roughly reproduce the growth (and plateau) of US oil purchasing power shown in Figure 2. That said, this model is meant as a scenario for the future.

Let’s make this future concrete. In it, your income grows year by year. But although you have more money, oil becomes less affordable. That’s because the price of oil grows faster than your income. And so your oil purchasing power declines continuously.

Let’s turn now to the actual price of oil. Assuming our model holds, Figure 8 shows the projected oil price. It’s an explosion worthy of Hotelling’s ‘rule’. By 2100, a barrel of oil will cost more than $10,000.

I confess that this price explosion is what I expected when, in 2012, I bought oil futures. ‘We’re headed for an oil-scarce future,’ I thought. ‘The price of oil has nowhere to go but up. That’s a chance to make money!’

It was my Paul Ehrlich moment. Soon after I bought oil futures, the price of oil tanked. Luckily, I didn’t have much money in the game, so I had little to lose. Still, the principle irks me. Like Ehrlich, I thought that the price of a depleting resource would go up. I was wrong. And now I know why. If current trends are any indication, the price of oil will never explode (like in Figure 8). Instead, oil will get cheaper.

SCENARIO 2: OIL PRICES COLLAPSE

Scenario 1 imagines a Hotelling-like explosion of the price of oil. Assuming that oil production declines (as peak-oil theories predict), this price explosion is intuitive. That’s because almost everyone equates affordability with low prices. If a resource gets less affordable, we assume it’s because the price went up. Almost no one thinks of the alternative — that a resource could get less affordable because your income goes down.

We don’t think about this alternative because it involves something that few living people have experienced: the continuous contraction of income. Think about it this way. Most people are used to the annual ritual of asking for a raise. You may not get the raise, but no one (not you, not your boss) is surprised that you asked for one. That’s because for the last two centuries, growing incomes have been the norm. So asking for an annual raise has become a custom.

Now imagine an alternative reality. In it, asking for a raise is unthinkable. Instead, each year you beg your boss not to lower your income. Most years you’re unsuccessful. And so year after year, your income declines. The price of oil declines too, but not enough to offset your losses. And so oil gets cheaper, yet is increasingly unaffordable.

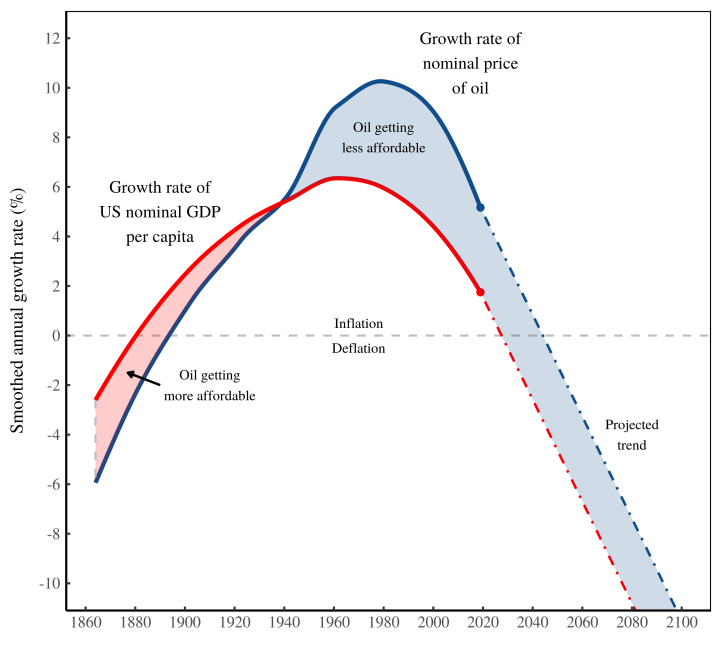

This alternative reality sounds like dystopian fiction. Yet if current trends are any indication, it’s the future we have in store. To see this fact, look at Figure 9. As with Figure 7, Figure 9 plots the growth rates of income (nominal GDP per capita) and the price of oil. The difference, though, is that Figure 9 shows real-world trends. I’ve plotted here the smoothed historical growth rates of US nominal GDP per capita and the price of oil. (Dashed lines extrapolate the recent trend into the future.)

Let’s look first at the growth of income (nominal GDP per capita). Other than a brief period in the 1860s, Americans’ average income rose consistently for the last 150 years. We know this because the growth rate of nominal GDP per capita was positive. Note, however, that this growth rate wasn’t constant. From 1860 to 1960, the growth rate of nominal GDP per capita accelerated. But starting in the 1970s, the trend reversed. Today, income growth rates are declining. If the trend continues, Americans are headed for a future in which incomes collapse. Every year, people will ask their boss not to lower their wage. Most years they’ll fail. And so incomes will decline.

With this dreary future in mind, let’s talk oil prices (again looking at Figure 9). Like income, the price of oil did not grow constantly. Instead, it’s growth tended to accelerate. But until the 1960s, incomes grew faster than the price of oil. So oil got more affordable. That changed during the oil crises of the 1970s. Oil prices exploded, while the growth of income slowed. As a result, oil got less affordable.

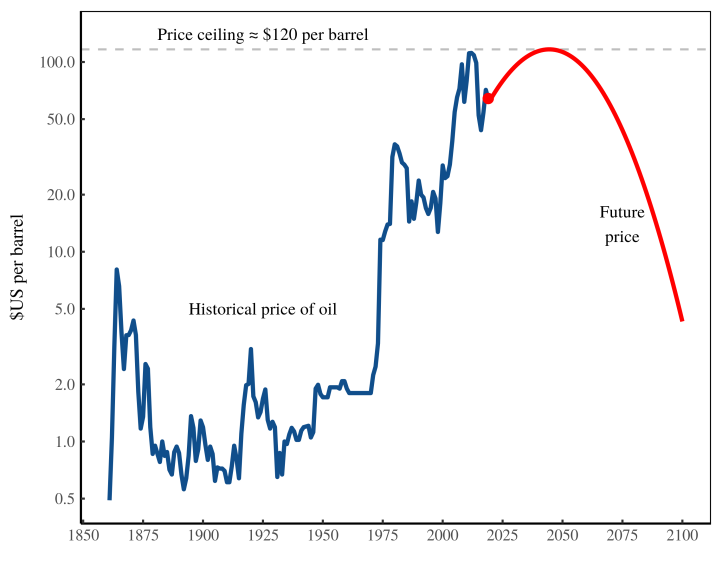

Today, the oil-price growth rate is headed south. If the trend continues, the price of oil isn’t going to explode, as many peak-oil theorists expect. It’s going to collapse. Figure 10 shows the prediction. In this future, the price of oil never gets above $120. And by 2100, oil won’t be $10,000 per barrel (as in Scenario 1). Instead, oil will be $5 a barrel.

At first glance, this future looks rosy. We’re headed for a world filled with cheap oil! (Never mind about climate change.) But in reality, Figure 10 paints a dystopian future. Yes, oil gets cheaper. But it also becomes less affordable. Why? Because incomes collapse faster than the price of oil. Every year, oil is cheaper. But every year you have less money. And so every year, you can afford less oil.

Ehrlich vs. Tverberg

I’ll close by returning to where I started: the Simon-Ehrlich wager. What’s important about this wager is that it conforms to our expectations about prices. Ehrlich bet money on the idea that resource scarcity will cause prices to rise. It’s an idea that most people find intuitive. Simon bet money on an equally intuitive idea — that resource abundance will cause prices to fall.

Looking at the bet, you can see that it’s really about two distinct hypotheses. The first hypothesis is that we’re exhausting our natural resources. The second hypothesis is that prices will rise in response. What’s interesting is that most of the discussion about the Simon-Ehrlich wager conflates the two hypotheses. Because Ehrlich lost the bet, people assume that resource scarcity is not a problem. But that’s faulty logic. What’s also possible (and what all the evidence points towards), is that the price hypothesis is wrong. As we exhaust natural resources, their price does not explode. Instead, it collapses.

Even though Ehrlich lost his bet, his thinking remains widespread. Just look at peak-oil theory. Many peak-oil theorists think that as oil production declines, the price of oil will explode. But not everyone is convinced. The notable exception is the analyst Gail Tverberg. For years, Tverberg has been arguing that we’re headed for lower oil prices. (Here’s a thread of her writing on deflation.) But she doesn’t think prices will fall because of resource abundance. She’s a Malthusian much like Paul Ehrlich. Instead, Tverberg thinks we’re headed for a world where oil is scarce yet cheap.

To many people, such a future makes little sense. But that’s because we can’t imagine a world in which incomes collapse. But Tverberg can. And so I propose a hypothetical bet for the future: Ehrlich vs. Tverberg. Both scientists assume that oil will get more scarce. But in the Ehrlich scenario, oil prices explode. In the Tverberg scenario, oil prices collapse.

I once thought that the Ehrlich scenario was all but guaranteed. But today, my money’s on Tverberg. In the future, oil will be scarce and unaffordable. But I think it will also be cheap.