Central bank "independence." Say again?Oh, right. Central bank independence means political indolence of technocrats from influence or intrusion on the part of elected representatives. It has nothing to do with influence by financial industry cronies.Real-World Economics Review BlogThe curious silence of the British media regarding Mark Carney and the secretive G30 Norbert HäringAlsoJean-Claude Trichet cannot be chairman of the ECB’s ethics committee any longer

Read More »Tom Rees — Bank of England hikes interest rates for first time in a decade

Bank of England increases interest rates for the first time in a decade in order curb high inflation squeezing UK households Base rate lifted from 0.25pc to 0.5pc; Mark Carney will give a press conference at 12.45pm to explain the central bank's decision Bank of England last hiked interest rates in July 2007; interest rates fell to historic lows to help the UK economy recover from the financial crisis Pound plunges on currency markets on dovish commentary from the central bank The...

Read More »Bill Mitchell — A former UK Chancellor attempts to save face and just becomes confused

On May 6, 1997, just 4 days after coming to office in what was to become Tony Blair’s retrogressive regime, the then British Labour Chancellor Gordon Brown announced that Labour would legislate the so-called independence of the Bank of England. The BBC claimed this was the “most radical shake-up in the bank’s 300-year history”, which gave “the bank freedom to control monetary policy”. Gordon Brown’s legacy to the British people, of course, is in his famous ‘light touch’ regulation, which he...

Read More »The Libor witch hunt

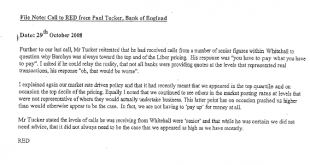

Since I wrote my post about the Bank of England's alleged manipulation of Libor before and during the financial crisis, something of a witch hunt seems to have developed. Certain people with axes to grind have jumped on the bandwagon set in motion by the BBC's Andy Verity and are aggressively promoting their view that the Bank of England's behaviour was fraudulent. Their argument is that the Bank of England has no business attempting to influence market rates, that those at the Bank who...

Read More »Money for Nothing…

April 18th, 2017 The production of money is ultimately the struggle for control over resources, wealth, people and our environment. But there is a surprising level of ignorance around how banks create money out of thin air and the benefits which flow from it. So on this programme we shine a much-needed light on who should get the privilege of creating our money. Host Ross Ashcroft is joined by the economist and author of the recent book The Production of Money, Ann Pettifor and founder...

Read More »Libor and the Bank

Nearly five years ago, the former CEO of Barclays Bank, Bob Diamond, defended himself against accusations that on his watch, Barclays had deliberately falsified Libor submissions. To no avail: after widespread adverse press coverage, Diamond resigned.Was this at the instigation of the Governor of the Bank of England and the head of the FSA? We will probably never know. But events yesterday make not only Diamond's resignation, but also the prosecution and jailing of traders and Libor...

Read More »History of Central Banks Tutorial – Before Central Banks II

As promised, one more installment on the history of central banks, and why the early Italian (and Spanish and Dutch) public banks were not seen as central banks. We must start with Italian banking. Even though the Medici Bank is probably the most well-known of the Italian banks of the Renaissance period the two key cities to understand the development of modern banking, and the precursors of central banks, are Genoa and Venice. And as noted before, central to the story is the emergence of...

Read More »The dangerous scheming of stupid politicians

There is growing speculation that the Governor of the Bank of England, Mark Carney, will not extend his term. Carney originally agreed to a five-year term, which would end in 2018, but it had been thought he might extend to the more usual eight years for a Bank of England governor. This is now looking increasingly unlikely.Carney has come under fire from pro-Brexit politicians for warning that Brexit is likely to increase inflation and unemployment and reduce economic growth. They...

Read More »Can the Bank of England’s New ‘Ring-fencing’ Rules Work?

NEP’s Bill Black and Wharton professor of legal studies and business ethics Peter Conti-Brown discuss the Bank of England’s move to re-regulate the banking industry in Britain and protect depositors and taxpayers. You can view the article and listen to the podcast here. [Translate]

Read More »Monetary Snake Oil

Guest post by Paddy Carter. Jeremy Corbyn’s People’s QE offers the alluring prospect of spending more without borrowing more. Which is just the ticket, if you want to replace austerity with largesse, and cut the deficit to boot. Sadly, this appealing miracle cure is pure snake oil (although there is, perhaps, a version of the idea which might be helpful, if substantially less miraculous). The basic idea behind People’s QE is to finance public spending by printing money. This is actually...

Read More » Heterodox

Heterodox