Ever since the secured overnight repo rate (SOFR) spiked to 10% in September, there have been dire warnings that these exceptional movements show the financial system is fundamentally broken. The story goes that the post-crisis financial system is so dysfunctional that it is unable to operate without continual injections of money from central banks. The Fed's attempt to reduce the $4.2tn of reserves it added to the financial system in three rounds of QE has dangerously destabilised the...

Read More »The blind Federal Reserve

Ever since the secured overnight repo rate (SOFR) spiked to 10% in September, there have been dire warnings that these exceptional movements show the financial system is fundamentally broken. The story goes that the post-crisis financial system is so dysfunctional that it is unable to operate without continual injections of money from central banks. The Fed's attempt to reduce the $4.2tn of reserves it added to the financial system in three rounds of QE has dangerously destabilised the...

Read More »What, if anything, does Kevin Warsh understand?

I came across this article by Kevin Warsh that appeared in the Wall Street Journal last August, 2016. The article was re-posted by GATA.ORG.As you may know, Warsh is the currently the favorite to take over as Fed Chair when Janet Yellen's term expires next February.If you read the article you will find that Warsh sort of understands that Fed policy is confused and focused on either the wrong things or, things which the Fed has no set of tools to accomplish. On the other hand he seems to lack...

Read More »Everything’s under control, China edition

Daiwa Securities has forecast Armageddon. They say that over-investment in China in recent years has created a debt bubble so great that Chinese authorities would not able to manage its collapse, resulting in a debt deflationary spiral which would make 2008 look like a walk in the park. Such a meltdown would, in their words, "send the global economy into a tailspin".But they also outline another scenario, in which China's economy undergoes a nasty, possibly prolonged recession, from which...

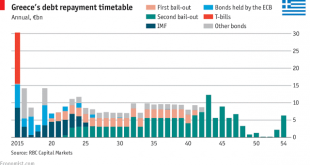

Read More »The Great Greek Bank Drama, Act I: Schaeuble’s Sin Bin

Greece's banks have been closed since 29th June. The closure followed the ECB's decision not to increase ELA funding after talks broke down between the Greek government and the Eurogroup.The closure is doing immense economic damage. The cash withdrawal limit of 60 euros per bank card per day is restricting spending in the Greek economy to a trickle. Media generally focus more on the hardship that the cash limit causes for households: but far worse is the inability of businesses to...

Read More » Heterodox

Heterodox