Daiwa Securities has forecast Armageddon. They say that over-investment in China in recent years has created a debt bubble so great that Chinese authorities would not able to manage its collapse, resulting in a debt deflationary spiral which would make 2008 look like a walk in the park. Such a meltdown would, in their words, "send the global economy into a tailspin".But they also outline another scenario, in which China's economy undergoes a nasty, possibly prolonged recession, from which it will emerge with lower growth.Which of these scenarios will play out? Well, as I discuss in my latest Forbes post, it really depends what Chinese authorities do. They insist that "everything is under control". But are they actually in the wrong trousers?Read my analysis and conclusions here.

Topics:

Frances Coppola considers the following as important: central bank, China, Debt, Deflation, GDP, government

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

Dean Baker writes Donald Trump is badly nonfused # 67,218: The story of supply and demand

Merijn T. Knibbe writes Peak babies has been. Young men are not expendable, anymore.

Robert Skidelsky writes In Memory of David P. Calleo – Bologna Conference

Daiwa Securities has forecast Armageddon. They say that over-investment in China in recent years has created a debt bubble so great that Chinese authorities would not able to manage its collapse, resulting in a debt deflationary spiral which would make 2008 look like a walk in the park. Such a meltdown would, in their words, "send the global economy into a tailspin".

But they also outline another scenario, in which China's economy undergoes a nasty, possibly prolonged recession, from which it will emerge with lower growth.

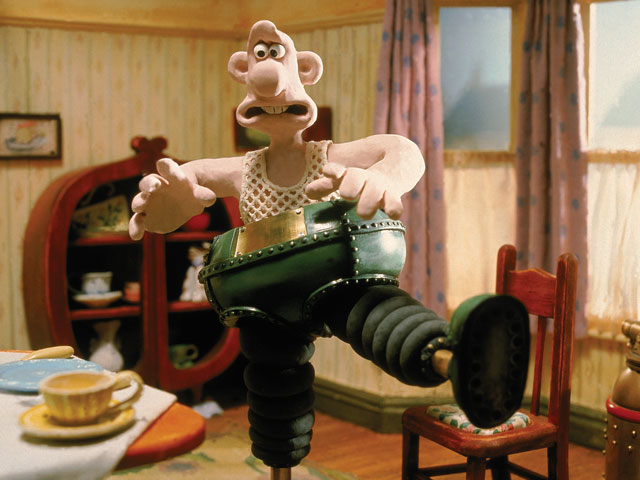

Which of these scenarios will play out? Well, as I discuss in my latest Forbes post, it really depends what Chinese authorities do. They insist that "everything is under control". But are they actually in the wrong trousers?

Read my analysis and conclusions here.

Related reading:

Never mind Greece, look at China

Lessons for China from Japan

China's economy: no collapse, but it's serious and so are the politics - George Magnus

If we don't understand both sides of China's balance sheet we understand neither - Michael Pettis

Other Forbes posts on China:

Quantitative tightening is a myth (but that doesn't mean there isn't a problem)

China's interest rate cuts will not solve its real problem

China's Black Monday signals the end of its growth cycle

China joins the global devaluation party