Ever since the secured overnight repo rate (SOFR) spiked to 10% in September, there have been dire warnings that these exceptional movements show the financial system is fundamentally broken. The story goes that the post-crisis financial system is so dysfunctional that it is unable to operate without continual injections of money from central banks. The Fed's attempt to reduce the .2tn of reserves it added to the financial system in three rounds of QE has dangerously destabilised the financial system, so it has now had to re-start asset purchases to restore the lost reserves and refloat tottering banks.It's fair to say that much has changed since the financial crisis. Prior to 2008, banks maintained far lower levels of reserves than they do now, typically at or just above their

Topics:

Frances Coppola considers the following as important: banks, cash, central bank, Federal Reserve, lending, repo

This could be interesting, too:

Merijn T. Knibbe writes More ´Natural rate of unemployment´ busting, bad measurement edition.

Robert Waldmann writes The 0.5% Reduction of the Federal Funds Rate

Robert Waldmann writes The 0.5% Reduction of the Federal Funds Rate

Angry Bear writes Inflation Data Gives a ‘Bright Green Light’ for a Fed Rate Cut

Ever since the secured overnight repo rate (SOFR) spiked to 10% in September, there have been dire warnings that these exceptional movements show the financial system is fundamentally broken. The story goes that the post-crisis financial system is so dysfunctional that it is unable to operate without continual injections of money from central banks. The Fed's attempt to reduce the $4.2tn of reserves it added to the financial system in three rounds of QE has dangerously destabilised the financial system, so it has now had to re-start asset purchases to restore the lost reserves and refloat tottering banks.

It's fair to say that much has changed since the financial crisis. Prior to 2008, banks maintained far lower levels of reserves than they do now, typically at or just above their reserve requirement. They borrowed reserves from each other in the unsecured interbank market to settle customer deposit withdrawals and securities transactions. The Federal Reserve intervened in the interbank market to maintain the average rate banks would charge for lending reserves (the Fed Funds rate) at the target level set by the FOMC. (This is of course a much summarised version of the pre-crisis architecture.)

But after the crisis, all that changed. QE disconnected Fed reserve creation from banks' need for reserves for settlement. Since banks collectively are obliged to hold all the reserves created by the Fed, they became (collectively) awash with reserves. However, reserve distribution is uneven: some banks still needed to borrow reserves, while other banks were parking excess reserves at the Fed. To create a "floor" for the Fed Funds rate, the Fed started paying interest on those excess reserves. Had it not done so, the Fed Funds rate would have fallen to zero, regardless of the FOMC's decision. But even with the Fed paying interest on excess reserves, the interbank market has become a shadow of its former self. Banks, their trust in each other permanently damaged by the crisis, now want other banks to post collateral against borrowed reserves. Most of the action has therefore moved to the repo market.

The repo market isn't solely, or even mainly, an interbank market. It intermediates funds across the entire panoply of financial institutions, including broker-dealers, insurance companies, pension funds, hedge funds, mutual funds (MMFs) and real-estate investment trusts (REITs), and some non-financial institutions such as large corporations and municipalities. Most of the funds that move around the repo market aren't lent directly by banks. But all cash transactions in the repo market are intermediated by banks, without exception. Although the majority of players in the repo market aren't banks, the cash that they lend each other simply moves from one bank to another. Mainly, it moves between four large banks - JP Morgan, Bank of America, Citigroup and Wells Fargo.

Thus, when an MMF lends cash to, say, an insurance company, the money simply moves from a demand deposit account at say Citigroup to a demand deposit at another bank, perhaps JPM. If Citigroup is short of reserves to settle this movement, it must borrow them from another bank or, as a last resort, from the Fed's discount window. In the post-crisis world when big banks had more reserves than they knew what to do with, Citigroup wouldn't have had to borrow anything. But now that reserves are scarcer, and liquidity requirements for big banks are much tougher (including intraday liquidity, which is a whole new subject in itself), it's quite possible that Citigroup might have to borrow cash in the repo market to replenish reserves lost due to its MMF customers lending cash in the repo market. Meanwhile, JPM ends up with more reserves than it wants, so it lends cash in the repo market, thus transferring reserves to another bank, perhaps Citigroup. I totally understand that this is confusing, but this is what happens when the interbank market becomes absorbed into a general collateralised market made up largely of non-banks. It helps to remember that regardless of who owns them, electronic dollars never leave the banking system. Follow the money, not its owners.

And so to our SOFR spike. If a market interest rate spikes, it means market participants don't want to lend. That can be because they have stopped trusting each other, as when Reserve Primary MMF broke the buck in 2008. But it doesn't have to mean that. It might signify that they have other uses for the money or the associated collateral, for example if they need to hold more of them because of tighter regulatory requirements. Or it might simply mean there is a market shortage of cash or collateral, so they prefer to hang on to what they have rather than lend it to others and risk paying much higher funding costs themselves.

Much ink has now been spilled trying to discern which of these caused the SOFR spike. Most people blame banks. For example, according to the FOMC's Randal Quarles, the SOFR spike was because banks suddenly stopped lending to protect their reserve levels:

Randal Quarles, the vice-chair of the Fed, said on Wednesday that banks’ own internal stress testing may have led them to hoard cash rather than lending it in the overnight repurchase — or repo — market.Banks' own internal stress tests made them suddenly pull back lending enough for the Fed Funds and SOFR rates to spike into double digits? Really?

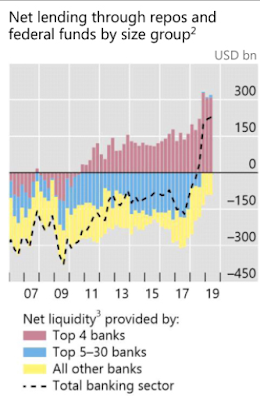

Unlikely though this sounds, Quarles could be on to something. This chart in a recent paper from the BIS shows a remarkable structural change in the composition of the interbank market:

Since mid-18, the entire market has become dependent on funding from just four big banks. If those banks reduce lending to the market even slightly, the market suffers a heart attack. As the BIS explains:

The big four banks appear to have turned into the marginal lender, possibly as other banks do not have the scale and non-bank cash suppliers such as money market funds (MMFs) hit exposure limits (see below).This, I think, is what Quarles is getting at. The four banks collectively are acting as lender-of-last-resort to the market. They are effectively doing the job of a central bank. But they are not a central bank, they are commercial banks driven by their own profit motives - and those motives can be in conflict with the needs of the market. Furthermore, they are ultimately dependent on the Fed for cash liquidity. And the Fed has been blindly pursuing a monetary policy that diminishes the cash available to banks.

The total quantity of reserves in the system has been falling since 2015 due to the Fed running off its balance sheet: from mid-2018 onwards, reserves have been draining even faster due to higher debt issuance by the US Treasury, which the Fed has done nothing to offset. The BIS says that as reserves have become scarcer, and Treasuries more abundant, the big banks have reduced their reserve holdings in favour of Treasuries. But this means that they have less cash to lend. The repo market depends on them for cash, but they are becoming increasingly reluctant to lend it.

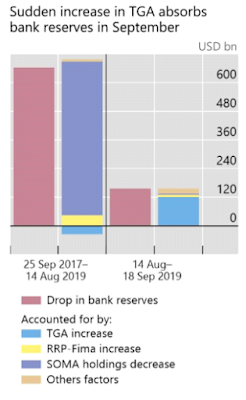

The final straw appears to have been a sudden increase in the US Treasury's General Account balance when the debt ceiling was lifted and quarterly tax payments arrived. This rapidly drained a very large quantity of reserves:

It is hardly surprising that, faced with a sudden liquidity shortfall of $120bn, banks stopped lending, causing the SOFR and Fed Funds rates to spike.

The BIS's analysis raises many questions. Firstly, should such a crucial market really be entirely dependent for liquidity on four big banks? The answer is surely "no". But what other market participants could now provide such liquidity?

Secondly, why does the market have such a need for cash? BIS suggests that part of the reason might be leveraged money market arbitrage trades by hedge funds, indirectly funded by MMFs, who are able to lend to these high-risk counterparties because the trades are executed through a central counterparty with banks taking the credit risk:

Market commentary suggests that, in preceding quarters, leveraged players (eg hedge funds) were increasing their demand for Treasury repos to fund arbitrage trades between cash bonds and derivatives. Since 2017, MMFs have been lending to a broader range of repo counterparties, including hedge funds, potentially obtaining higher returns.These transactions are cleared by the Fixed Income Clearing Corporation (FICC), with a dealer sponsor (usually a bank or broker-dealer) taking on the credit risk. The resulting remarkable rise in FICC-cleared repos indirectly connected these players.BIS says that during September, MMFs became reluctant to participate in these "sponsored repos" (my emphasis):

During September, however, quantities dropped and rates rose, suggesting a reluctance, also on the part of MMFs, to lend into these markets (Graph A.2, right-hand panel). Market intelligence suggests MMFs were concerned by potential large redemptions given strong prior inflows. Counterparty exposure limits may have contributed to the drop in quantities, as these repos now account for almost 20% of the total provided by MMFs.It seems that MMFs fear runs on their scarce cash. The whole picture is one of taps running dry as the Fed and the US Treasury between them drain the reservoir.

Now, the Fed has started replenishing the reservoir, though it is decidedly stingy about it, which is remarkable considering that it seems to have had little idea of the consequences of its previous actions. It is painfully evident that the Fed no longer knows how the plumbing works, if indeed it ever did. At least Randal Quarles is trying to find out.

But to my mind simply replenishing the lost reserves is not good enough. We need to start asking hard questions about what the role of the repo market, and the big banks upon which it has become dependent, should really be. As the interbank market slowly dies, and reserves return to being scarce rather than abundant, the repo market is becoming the principal market through which monetary policy is transmitted. But it is poorly understood and extremely concentrated. Do we really want the transmission of monetary policy to depend entirely upon four large banks?

The Fed has also mooted SOFR to replace Libor as the principal benchmark rate for variable rate loans and derivatives. But SOFR is prone to wild swings, which is not good in a benchmark rate. The Fed seems to want the four banks that provide repo market liquidity to lend countercyclically, thus smoothing out spikes in SOFR. Should the stability of the principal market benchmark rate really depend entirely on the liquidity preference of four banks?

Finally, the Fed is replenishing reserves in order to support a market that is populated by non-banks as well as banks. The BIS says that the rate rise was partly because MMFs pulled back from lending cash for sponsored repos. Rate rises caused by lenders becoming nervous help to limit leverage and prevent markets becoming overheated. Yet the Fed is intervening in the repo market to dampen rate rises. Why are we once again allowing the Fed to provide an implicit backstop for risky non-banks, thus enabling them to misprice risk and gorge on leveraged trades without fear of market penalty? Have we learned nothing from the past?

The Fed's actions critically affect the way banks and financial markets behave, and this in turn impacts on the real economy. Yet it does not appear to understand the financial system that is emerging as a result of regulatory and market changes since the crisis. It is flying blind.

Image: "Blind Man's Buff", by Charles Baugniet, courtesy of Wikipedia.

Related reading:

How the financial markets' plumbing got blocked - FT

The BIS Misses an Opportunity to Get Consistent with the Facts - Alhambra Capital

White Paper on the Repo Market Affecting U.S. Treasury and Agency MBS - IDTA (pdf)