If you have been following NDd, you will note one of the biggest issues with the economy is supply chain. Most notably shortages of raw material, components, and finished products. Similar occurred in 2008 and my own belief is this is a recurrence of similar. I believe much of this could have been prevented. Beyongd that remark, I will let NDd tell you how falling costs impacts the economy. Real retail sales consistent with continued slow growth,...

Read More »Economic tailwind from falling commodity prices has likely ended

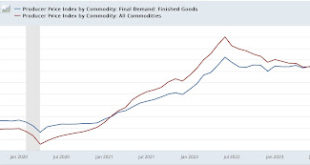

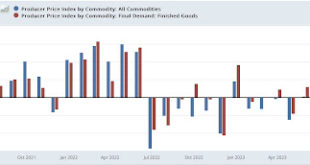

The economic tailwind from falling commodity prices has likely ended – by New Deal democrat [Note: I’ll post on the August retail sales report later today.] Two days ago in my PPI and CPI overview, I wrote; “I am most interested in whether the producer price report tells us that the big decline in commodity prices is over. There have only been two increases in commodity prices in the past 12 months [ ] I suspect we’ll get #3 [on...

Read More »Latin American Corner: Quantitative easing, commodities, corporate debt and the paradox of debt

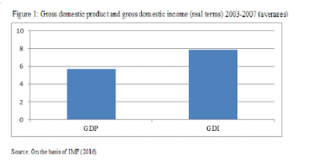

By Naked Keynes (Guest Blogger)The policy of quantitative easing (QE) pursued by the Federal Reserve following the fall of Lehman Brothers in September 2008 meant to lower long-term interest rates in the United States and boost expenditure had major effects on developing economies including in those of Latin America. As it is well know QE did not increase liquidity. The liquidity with which the Federal Reserve bought financial assets ended as excess reserves at the Federal Reserve balance...

Read More »Global depreciation since the collapse of oil prices

One figure is worth a thousand words (negative number imply depreciation). So, if you think China devalued a lot...Source here.

Read More » Heterodox

Heterodox