The economic tailwind from falling commodity prices has likely ended – by New Deal democrat [Note: I’ll post on the August retail sales report later today.] Two days ago in my PPI and CPI overview, I wrote; “I am most interested in whether the producer price report tells us that the big decline in commodity prices is over. There have only been two increases in commodity prices in the past 12 months [ ] I suspect we’ll get #3 [on Thursday]. If producer prices have stopped declining, then the tailwind I have described above has ebbed, and maybe ended.” As anticipated, that is just what happened. Commodity prices (blue below) rose 1.5% in August. July was also revised slightly so that it rounds to unchanged rather than a decline. The

Topics:

NewDealdemocrat considers the following as important: Commodity Prices, Hot Topics, New Deal Democrat, September 2023, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

The economic tailwind from falling commodity prices has likely ended

– by New Deal democrat

[Note: I’ll post on the August retail sales report later today.]

Two days ago in my PPI and CPI overview, I wrote;

“I am most interested in whether the producer price report tells us that the big decline in commodity prices is over. There have only been two increases in commodity prices in the past 12 months [ ] I suspect we’ll get #3 [on Thursday]. If producer prices have stopped declining, then the tailwind I have described above has ebbed, and maybe ended.”

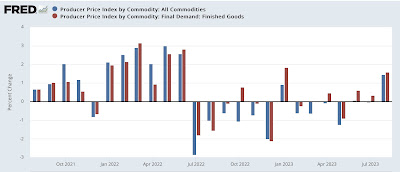

As anticipated, that is just what happened. Commodity prices (blue below) rose 1.5% in August. July was also revised slightly so that it rounds to unchanged rather than a decline. The PPI for finished goods (red) also rose 2.1%:

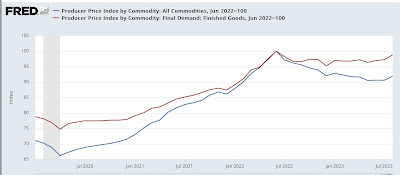

PPI for finished goods is now up YoY by 2.2%, and is only -1.2% below its June 2022 peak:

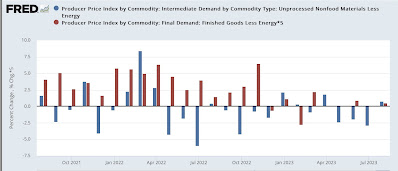

And it isn’t only energy which has contributed to the end of the decline. Excluding energy, both intermediate and final goods production costs rose slightly:

My strong suspicion has been that the tailwind of declining commodity prices, typified by the big decline in gas prices in late 2022 is what allowed the US economy to grow so well so far this year, blunting the effects of major Fed interest rate hikes. If this tailwind is indeed over, only the accumulating headwinds will remain going forward.

Fed rate hikes in the face of declining commodity prices: an analysis of 4 precedents, Angry Bear, New Deal democrat.