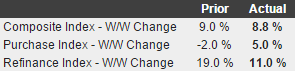

Inching up a bit but still seriously depressed: MBA Mortgage ApplicationsHighlightsWeekly mortgage applications have been very volatile so far this year but mostly to the upside. Purchase applications jumped 5.0 percent in the January 22 week with refinancing applications up 11.0 percent. Low mortgage rates are driving the activity, down 4 basis points in the week to an average 4.02 percent for 30-year conforming loans ($417,000 or less). Looks like Wards is forecasting no improvement in...

Read More »Consumer Credit, Oil comment

Looks like the last blip up just got reversed so it continues to go nowhere and it’s at levels higher than before the last recession: Consumer CreditHighlightsRevolving credit barely made it into the plus column in October, up $0.2 billion for what is, however, an eighth straight gain. Non-revolving credit, which in contrast to revolving credit hasn’t posted a decline since April 2010, rose an intrend $15.8 billion, once again boosted by vehicle financing and also by student loans which are...

Read More »Rail traffic, Credit check, Employment flows, State and local taxes and expenditures

Rail Week Ending 28 November 2015: Contraction Growing Faster. Rail Traffic in November Down 10.4%. Week 47 of 2015 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic contracted year-over-year, which accounts for approximately half of movements and weekly railcar counts continued in contraction. The 52 week rolling average contraction is continuing to grow. Rail counts for the...

Read More »Credit check

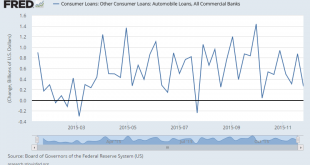

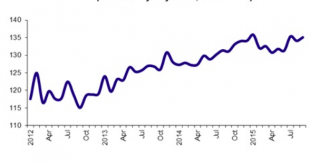

Nothing of consequence here. Growth still below prior cycles and not accelerating as it was beginning to do before oil capex collapsed: While growth of real estate lending is still far below the prior cycle, it has been increasing, probably due to fewer ‘all cash’ purchases, and the modest recovery in prices and sales:Consumer credit growth remains modest and, if If anything, is softening most recently: Looks to me like car loan growth is slowing a bit:

Read More »Consumer Credit, Credit Check, Rail Traffic, Employment Charts

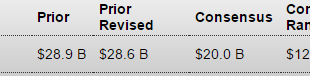

Consumer Credit HighlightsIn a record report, consumer credit data are strongly confirming the strength of the consumer. Credit outstanding surged $28.9 billion in September for the largest gain in the history of the series which goes back to 1941. Nonrevolving credit, in part reflecting vehicle financing and also student loans, rose $22.2 billion. Revolving credit, reflecting a rise in credit-card debt, jumped $6.7 billion to extend an emerging run of strength that suggests consumers are...

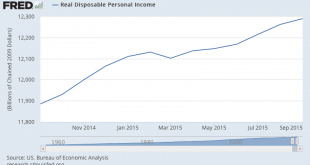

Read More »Rail traffic, Personal Income, Credit Check

Rail Week Ending 24 October 2015: A Worse Week Among Bad Weeks Week 42 of 2015 shows same week total rail traffic (from same week one year ago) and monthly total rail traffic (from same month one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic contracted year-over-year, which accounts for approximately half of movements. and weekly railcar counts continued in contraction. See how the growth rate slowed down just before year...

Read More »Truck tonnage, Philly Fed Coincident Index, ECB policy, Credit Check

Signs of stabilizing: So the ECB threatened more negative rates and QE, both placebos at best, analogous to spraying the crowd with a barrage of blanks, which nonetheless dispersed the crowd. However, with the record and growing euro area 31 billion trade surplus last month and a growing US trade deficit augmented by increased petro imports as domestic production falls, I expect those fundamentals to dominate: Interesting how growth that supported GDP in 2014 peaked as oil price broke...

Read More »Credit check, ECRI WLI Growth Index, Rail Week

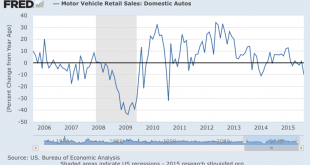

Still no sign of acceleration:Though still how historically, the growth rate in real estate secured lending has picked up some, probably reflecting fewer cash buyers and the modest increases in sales:This is up some as well. Note that it went up gradually into the last recession, probably because when things go bad people borrow for a while before cutting back:This is a new series. The latest leveling off might be an indication that the mini surge in car sales is over? ECRI’s WLI Growth...

Read More »Consumer Credit

Now looking like this peaked as oil prices collapsed: Consumer Credit Highlights Revolving credit continues to show life, up a solid $4.0 billion in August for a sixth straight gain. Gains in this reading, which have been scarce this recovery, perhaps suggest that consumers are growing less reluctant to run up their credit cards, which would be good news for retailers going into the holidays. Non-revolving credit, driven by both vehicle financing and student financing which is tracked in...

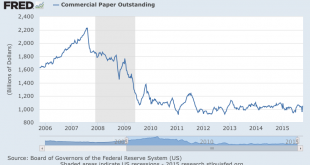

Read More »Saudi Price Cut, Domestic Car Sales, Commercial Paper

This is how they would start a downward price spiral if that’s what they wanted: Saudi Aramco Cuts Crude to Asia, U.S. Amid Weak Demand By Anthony Dipaola Oct 4 (Bloomberg) —Saudi Arabia cut pricing for November oil sales to Asia and the U.S. as the world’s largest crude exporter seeks to keep its barrels competitive with rival suppliers amid sluggish demand. Saudi Arabian Oil Co. reduced its official selling price for Medium grade crude to Asia next month to a discount of $3.20...

Read More » Heterodox

Heterodox