Signs of stabilizing: So the ECB threatened more negative rates and QE, both placebos at best, analogous to spraying the crowd with a barrage of blanks, which nonetheless dispersed the crowd. However, with the record and growing euro area 31 billion trade surplus last month and a growing US trade deficit augmented by increased petro imports as domestic production falls, I expect those fundamentals to dominate: Interesting how growth that supported GDP in 2014 peaked as oil price broke down:This new indicator now shows 2 weeks flattening, but not enough history to make a call based on it:This, too, changed slope after oil supported growth reversed:The growth rate remains historically very low (particularly given the ultra low rates?). Some of the increase is due to the drop in ‘all cash’ purchases, some due to the higher sales prices, etc.

Topics:

WARREN MOSLER considers the following as important: CBs, Credit, currencies

This could be interesting, too:

NewDealdemocrat writes Two long leading indicators – real money supply and credit conditions – worsen

WARREN MOSLER writes Europe’s debtors must pawn their gold for Eurobond Redemption

Stavros Mavroudeas writes Comment on Miguel Ramirez’s paper, ‘Credit, Indebtedness and Speculation in Marx’s Political Economy’ – ECONOMIC THOUGHT

Mike Norman writes Vladimir Asriyan, Luc Laeven, Alberto Martin — Credit booms and information depletion

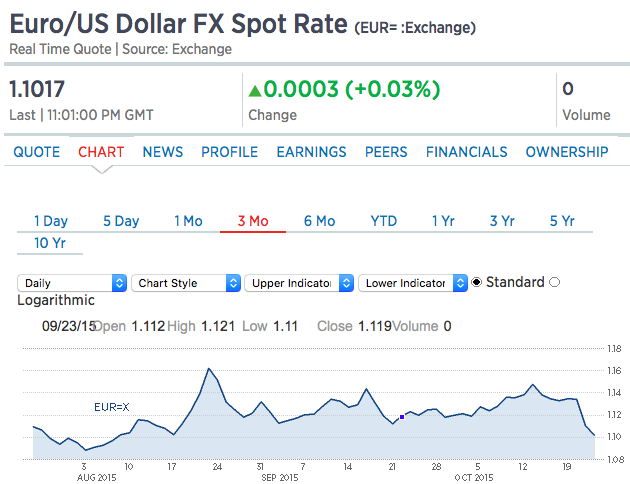

So the ECB threatened more negative rates and QE, both placebos at best, analogous to spraying the crowd with a barrage of blanks, which nonetheless dispersed the crowd. However, with the record and growing euro area 31 billion trade surplus last month and a growing US trade deficit augmented by increased petro imports as domestic production falls, I expect those fundamentals to dominate:

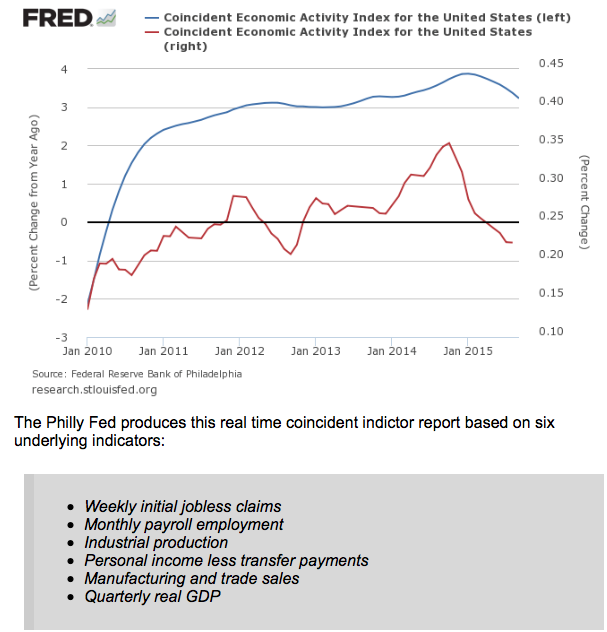

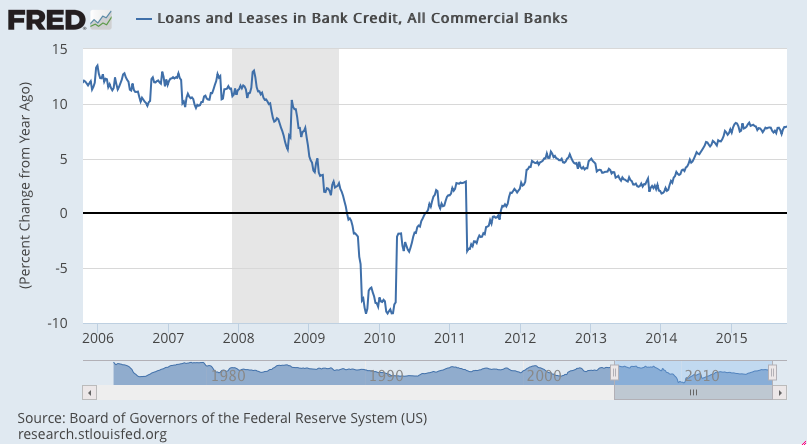

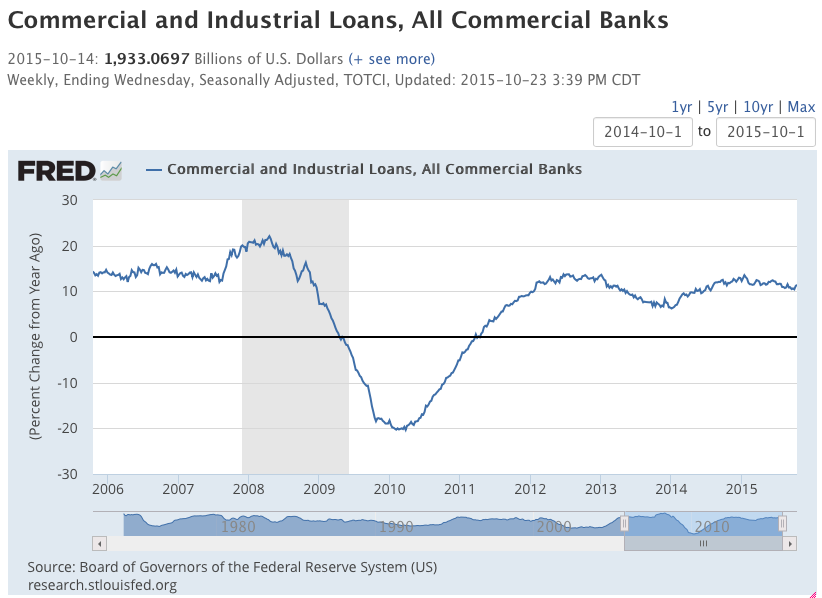

Interesting how growth that supported GDP in 2014 peaked as oil price broke down:

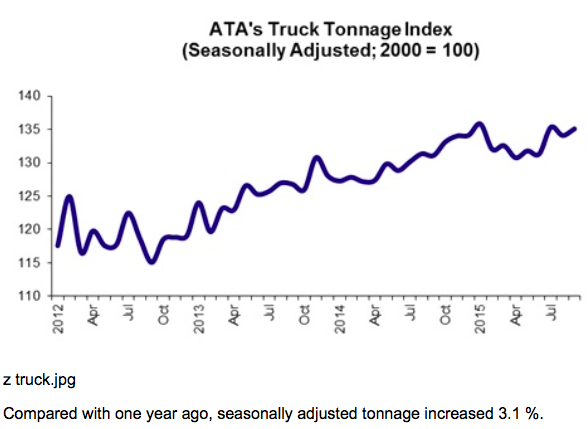

This new indicator now shows 2 weeks flattening, but not enough history to make a call based on it:

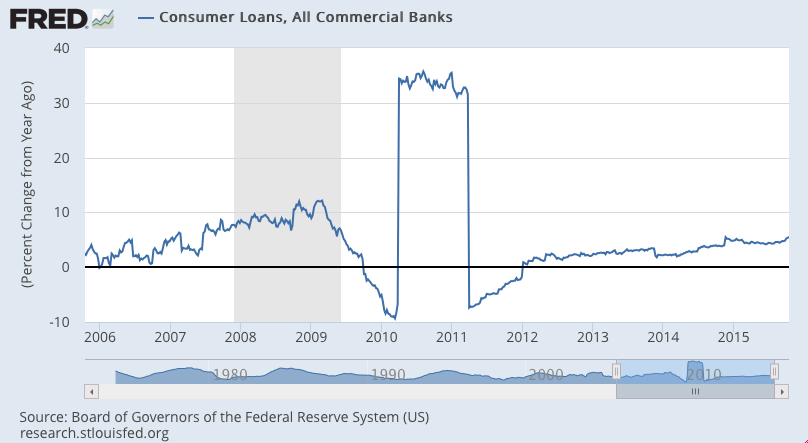

This, too, changed slope after oil supported growth reversed:

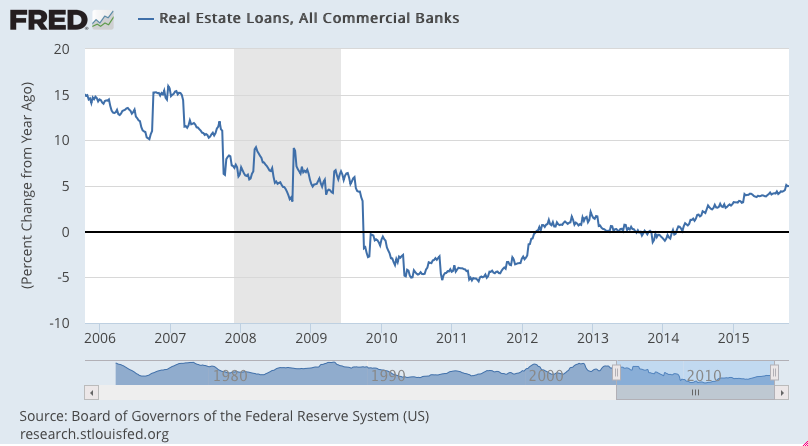

The growth rate remains historically very low (particularly given the ultra low rates?). Some of the increase is due to the drop in ‘all cash’ purchases, some due to the higher sales prices, etc.

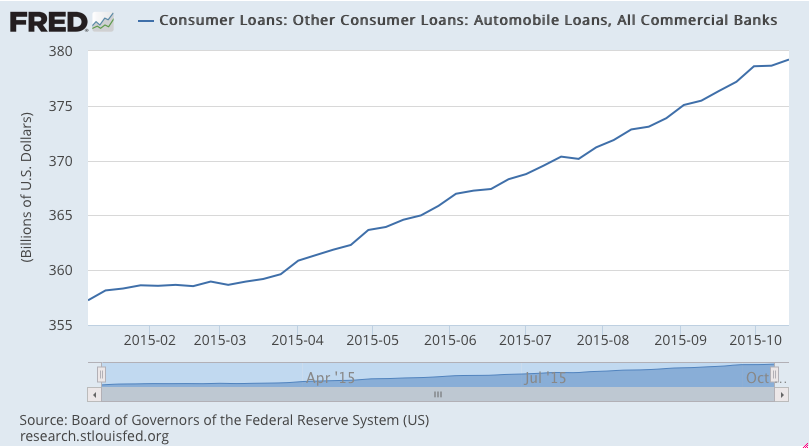

The growth rate has picked up some as it tends to do when entering a recession and consumers borrow extra for a while as incomes are stretched before breaking: