So when the Saudis widened their discounts on October 5 it looked to me like they were inducing a downward price spiral that would continue until either they altered pricing or their output increased to full capacity so they couldn’t sell any more at those discounts. So far neither has happened: Fundamentally the euro also looks very strong to me, with a large and rising trade surplus vs a rising trade deficit for the US, and negative rates and QE ultimately further remove euro income from...

Read More »Truck tonnage, Philly Fed Coincident Index, ECB policy, Credit Check

Signs of stabilizing: So the ECB threatened more negative rates and QE, both placebos at best, analogous to spraying the crowd with a barrage of blanks, which nonetheless dispersed the crowd. However, with the record and growing euro area 31 billion trade surplus last month and a growing US trade deficit augmented by increased petro imports as domestic production falls, I expect those fundamentals to dominate: Interesting how growth that supported GDP in 2014 peaked as oil price broke...

Read More »Euro Trade Surplus, Euro Inflation

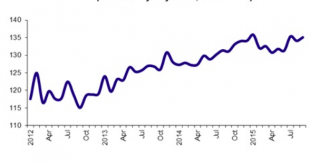

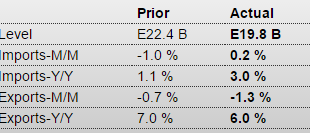

Trade surplus still trending higher along with deflation both make the euro ‘harder to get’ and ‘more valuable’: European Union : Merchandise TradeHighlightsThe seasonally adjusted merchandise trade balance returned a E19.8 billion surplus in August after an unrevised E22.4 billion excess in July. This was the least black ink since March. The unadjusted surplus was E11.2 billion, up from E7.4 billion in August 2014.The headline reduction reflected mainly a 1.3 percent monthly fall in...

Read More »Jensen: How long bonds could actually outperform equities

In-depth analysis on Credit Writedowns Pro. Editor’s note: This was originally published by Absolute Return Partners in late August. So we are a little late in releasing it. Apologies. It is still good reading. The Absolute Return Letter, August/September 2015: Doodles from an eventful summer “There is something deeply troubling when the unthinkable threatens to become routine.” Bank for International Settlements Incidents of the summer 2015 This month’s Absolute Return Letter is a...

Read More »If we don’t understand both sides of China’s balance sheet, we understand neither

In-depth analysis on Credit Writedowns Pro. By Michael Pettis originally published on 1 September 2015. With so much happening in China in the past month it seems that there are a number of very specific topics that any essay on China should focus. I worry, however, that we get so caught up staring at strange clumps of trees that we risk losing sight of the forest. What happened in July this year, and again in August, or in June 2013, or a number of other times, were not unexpected shocks...

Read More »FX Theory: The Trade Surplus and the Real Exchange Rate Mean Reversion

George Dorgan explains why currencies of countries with trade surpluses must appreciate over the long-term. Thanks to these surpluses, inflation and costs of companies rise more slowly than in other countries. In Forex a mean reversion does not exist, but only an inflation-adjusted reversion to the mean: a real exchange rate mean reversion or in short the "real mean reversion."

Read More » Heterodox

Heterodox