Ah, those pesky words. They do not mean what we think they do. And sometimes we say one thing, but people think we mean another. And so it is that David Glasner, in a beautifully crafted takedown of my previous post, has managed to miss my point entirely.I did, in fact, read carefully all of David's quotation from Ralph Hawtrey, though I did not quote all of it. Hawtrey's point is that what appeared to be destructive competitive devaluation as countries left the gold standard was in fact...

Read More »Competitive devaluation is not a free lunch

It's not often I disagree with David Glasner. Or, for that matter, with Ralph Hawtrey. But I fear I have to take issue with both of them over competitive devaluation. "Bring it on", says David. No, please don't. It's a terrible idea.Hawtrey's pictorial explanation of why competitive devaluation is a good idea seems both charming and plausible: This competitive depreciation is an entirely imaginary danger. The benefit that a country derives from the depreciation of its currency is in the...

Read More »Negative rates and bank profitability

Banks are complaining. "Negative interest rates hurt our margins," they moan. Here's Commerzbank, for example, in its recent results announcement (my emphasis): Mittelstandsbank attained a solid result in a challenging market environment. The operating profit declined in the 2015 financial year to EUR 1,062 million (2014: EUR 1,224 million), yet remains at a high level. The fourth quarter accounted for EUR 212 million (Q4 2014: EUR 251 million). The full year revenues before loan loss...

Read More »Why China cares about Japan’s negative rates

In-depth analysis on Credit Writedowns Pro. By Frances Coppola originally posted at Coppola Comment Japan has just introduced negative rates on reserves, following the example of the Riksbank, the Danish National Bank, the ECB and the Swiss National Bank. The Bank of Japan has of course been doing QE in very large amounts for quite some time now, and interest rates have been close to zero for a long time. But this is its first experiment with negative rates. The new negative rate...

Read More »Japan’s negative rates: the China connection

Japan has just introduced negative rates on reserves, following the example of the Riksbank, the Danish National Bank, the ECB and the Swiss National Bank. The Bank of Japan has of course been doing QE in very large amounts for quite some time now, and interest rates have been close to zero for a long time. But this is its first experiment with negative rates. The new negative rate framework is complicated, to say the least. The Bank of Japan has helpfully produced a pretty picture to...

Read More »“Quantitative Tightening” is a myth

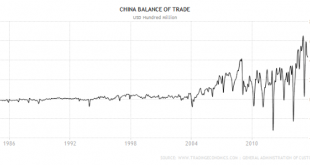

(But that doesn't mean we don't have a problem).Deutsche Bank has frightened everyone by warning that if China sold substantial quantities of US Treasuries (USTs) to support the yuan, this would amount to a substantial tightening of US monetary policy.The reason why China accumulated USTs in the first place was because of its trade surplus: The excess of exports over import sucked dollars into China, where the People’s Bank of China (PBoC) exchanged them for domestic currency (yuan). The...

Read More »Do markets determine the value of the RMB?

In-depth analysis on Credit Writedowns Pro. By Michael Pettis Last Tuesday the PBoC surprised the markets with a partial deregulation of the currency regime, prompting a great deal of discussion and debate about the value of the RMB. Part of the discussion was informed by a consensus developing in one part of the market that the RMB is no longer undervalued but is in fact overvalued. Why? Because if left to the “market”, that is if the PBoC stopped intervening, the excess of dollar supply...

Read More »Variable geometry bites back: Schäuble’s motives

In-depth analysis on Credit Writedowns Pro. By Fabio Ghironi As originally written at Vox. Success of the German-inspired solution for the latest Greek crisis is far from assured. If it fails, the Eurozone may be changed forever. This column argues that the failure would lead to an outcome that has been favoured for decades by Germany’s Finance Minister, Wolfgang Schäuble. Perhaps the package the Eurozone agreed is just a backdoor way of getting to the ‘variable geometry’ and monetary...

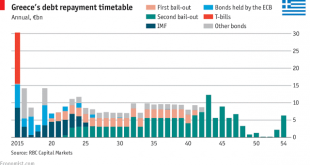

Read More »The Great Greek Bank Drama, Act I: Schaeuble’s Sin Bin

Greece's banks have been closed since 29th June. The closure followed the ECB's decision not to increase ELA funding after talks broke down between the Greek government and the Eurogroup.The closure is doing immense economic damage. The cash withdrawal limit of 60 euros per bank card per day is restricting spending in the Greek economy to a trickle. Media generally focus more on the hardship that the cash limit causes for households: but far worse is the inability of businesses to...

Read More »Who would win and who would lose from Grexit?

Guest post by Tom StreithorstVladimir Illych Lenin may well be the most destructive political theorist of the 20th century. His glorification of a conspiratorial party as agent of a glorious future legitimised mass murder from Bolshevik Russia to Nazi Germany to Cambodia's Khmer Rouge. Nonetheless, he did invent an analytical tool political scientists and economists should use more often: “Kto Kovo”, or “who beats whom”. In examining any policy, Lenin suggests the first...

Read More » Heterodox

Heterodox