Peter Schiff, the guy who has been so wrong about everything, is now saying that bitcoin is going to zero. This is why you should probably buy every single dip.Remember Schiff's predictions?QE will cause hyperinflation. The Chinese will stop "lending" to us and interest rates will skyrocket. Gold is going to $10,000.And more.Bitcoin is not a bubble. It's a symptom of the world's desire to "de-dollarize." And while it will not become any kind of mainstream currency anytime soon because of its...

Read More »Trade and currency, a Brexiter’s delusion

If there is one industry Brexit has stimulated, it is the production of daft ideas for regenerating the UK economy after its exit from the EU. Many of the offerings have been from people who really like the idea of Britain becoming a European version of Singapore. But the left wing is not short of silly schemes either. This one, from businessman and self-styled economist John Mills, is one of the silliest I have seen.John Mills is chairman of John Mills Limited (JML). On his biography,...

Read More »Mish — Bitcoin vs Dollars: Which One is a Fraud? Which One is a Ponzi Scheme?

MMT Foolishness: Modern Monetary Theory (MMT) suggests that debt does not matter and governments can print at will creating a virtual utopia of constant growth. MMT, Keynesian, and Monetarism all suffer from the same fatal flaw: They promise something for nothing, in various ways. For discussion, please see Debunking MMT, Keynesianism, Monetarism: Reader asks “What theories do you believe?” Mish Reading List. Those who believe in the absurdity that a benevolent government would spend the...

Read More »Tariffs, trade and money illusion

In the past few days, I have read three pieces from Economists for Brexit - now renamed "Economists for Free Trade" - extolling the virtues of "hard" (or "clean") Brexit and calling for the UK to drop all external tariffs to zero unilaterally after Brexit. Two are written by professors of finance (Kent Matthews and Kevin Dowd). The third is from the veteran economist Patrick Minford.All three of these pieces wax lyrical about the benefits to GDP and welfare from unilaterally reducing...

Read More »Bitcoin and bimetallism

I wrote a piece on Forbes recently in which I described a bimetallic system of coinage and suggested how such a system might work - or rather, fail to work - for Bitcoin. These are the relevant paragraphs: In a bimetallic system, there are effectively two currencies which are linked by a fixed exchange rate set by fiat. At the end of the 19th century - the time of Bryan's speech - Britain's copper penny was worth 1/144 of one pound. Other denominations of coin were created by...

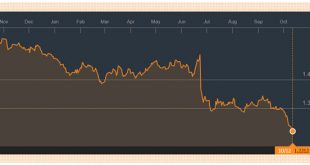

Read More »The dominance of Brexit

Some people have been saying that sterling's fall has nothing to do with the Brexit vote. Sterling was already falling before the vote, they say, because of the UK's wide and growing current account deficit. So I thought I would fact check this.Here is the UK's current account deficit since 1987, courtesy of ONS: Well, ok, it has rarely been anywhere near balance in the current century, and it has been trending downwards since 2011.Now let's look at sterling. Here is sterling's...

Read More »The currency effects of Brexit

Sterling is falling. Predictably, the financial press describe its slide as a "pounding" and gleefully tell us that sterling is the worst-performing currency after the Argentinian peso.But some people are cheering. Falling sterling is good for exports, isn't it? So if the pound keeps falling, the UK's large trade deficit will start to shrink, reducing the UK's dependence on external financing and hence its vulnerability to a "sudden stop".Sadly, it's not that simple. Falling sterling is not...

Read More »Short-run effects of the Brexit shock

The Governor of the Bank of England's opening remarks at the release of today's Financial Stability Report were stark: At its March meeting, the FPC judged that “the risks around the referendum [were] the most significant near-term domestic risks to financial stability.” Some of those risks have begun to crystallise. The Governor was admirably calm and balanced in his press conference. But nevertheless there was a degree of schadenfreude about his remarks. Prior to the referendum, the Bank...

Read More »The titillating and terrifying collapse of the dollar. Again.

In-depth analysis on Credit Writedowns Pro. You are here: Weekly » The titillating and terrifying collapse of the dollar. Again. This post was originally published at China Financial Markets. By Michael Pettis Foreign perceptions about the Chinese economy are far more volatile than the economy itself, and are spread across a fantastic array of forecasts. On one extreme there are still many who hold the view that overwhelmingly dominated the consensus just four...

Read More »Understanding balance of payments crises in a fiat currency system

It's weird. Whenever I say that floating exchange rates can't absorb all shocks and that balance of payments crises can happen even in fiat currency systems, I am accused of gold standard thinking. Gold standard? Me? Perish the thought. I am the world's biggest fan of fiat currencies. And of floating exchange rates, too. But that doesn't mean I regard them as a panacea.Firstly, about gold standards. Under a strict gold standard, the quantity of money circulating in the economy is...

Read More » Heterodox

Heterodox