The U.S. has long held an external balance sheet that is comprised of foreign equity assets, mainly in the form of direct investment (DI), and liabilities held abroad primarily in the form of debt, including U.S. Treasury securities. This composition is known “long equity, short debt.” Pierre-Olivier Gourinchas of UC-Berkeley and Hélène Rey of the London Business School claim that this allocation has allowed the U.S. to serve as the “world’s venture capitalist,” issuing short-term debt in...

Read More »A Better Way to Think about the “Twin Deficits”

L. Randall Wray | November 13, 2018 (These remarks will be delivered today at the UBS European Conference in London.) Q: These questions about deficits are usually cast as problems to be solved. You come from a different way of framing the issue, often referred to as MMT, which—at the risk of oversimplifying—says that we worry far too much about debt issuance. Can you help us understand where fears may be misplaced? Wray:...

Read More »Timothy Taylor — Some Facts on Global Current Account Balances

Maybe the trade war with China isn't actually about MAGA at all, but just economic warfare against a rising competitor. If trade surplus are so "unfair," why is the focus not on Germany given the figures, enquiring minds want to know. Or, do Donald Trump and his economic team not realize this?Conversable EconomistSome Facts on Global Current Account BalancesTimothy Taylor | Managing editor of the Journal of Economic Perspectives, based at Macalester College in St. Paul, Minnesota

Read More »Bank Underground — A prince not a pauper: the truth behind the UK’s current account deficit

Bank of England — Bank UndergroundA prince not a pauper: the truth behind the UK’s current account deficit Rachana Shanbhogue, Macroprudential Strategy and Support Division, and Stephen Burgess, Macrofinancial Risks Division

Read More »Peter Cooper — Open Economy Considerations: The Balance of Payments

One suggestion in the comments to the ongoing “short & simple” series is to cover the balance of payments. This will be covered at some point in the introductory series, but I am still considering how best to present it in brief, simple form. With that in mind, it seemed worth attempting a regular post on the topic. The post is still intended to be elementary in nature, but is perhaps at about the introductory university level. The post is also too long to qualify as “short”, even...

Read More »Why Macron Should Not (and Cannot) Follow the German Model

Jörg Bibow | June 2, 2017 The Economist‘s analysis of Germany’s job market miracle of the past ten years offered in “What the German economic model can teach Emmanuel Macron” is more balanced than the usual accounts one hears in Germany itself. Germans are in love with the idea that structural reform of their labor market and persistent budgetary austerity were solely responsible for the German economy’s superior performance...

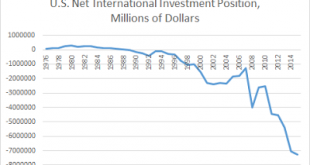

Read More »US Net International Investment Position

Nothing much changed since I posted on this a couple of years ago. The U.S. net international investment position at the end of the first quarter of 2016 was −$7.5 trillion, which corresponds to about 40% of GDP, higher than two years ago. But no real problem in my view Note that this is the sort of number that economists show when they want to suggest a possible run on the dollar, and the demise of its role as a reserve currency. The last report by the Bureau of Economic Analysis (BEA) is...

Read More »Not sustainable: India’s trade and current account deficits

New paper by Suranjana Nabar-Bhaduri published by PERI. From the abstract:India’s trade balance and current account have shown persistent deficits for a major part of its post-independence period. Since the mid-2000s, trade deficits have increased perilously, with a sharp rise in both oil and non-oil imports. This has increased the magnitude of the current account deficit, as net earnings from services and remittances have been insufficient to offset the trade deficits. India has relied on...

Read More »Carry Trade: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view: 1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions 2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions. We will present both alternatives.

Read More » Heterodox

Heterodox