This was faster than even I expected (for my views on what Macri meant as soon as he was elected see this and for a more recent assessment go to this post). Let me first say that I don't think is quite like the 2001/02 crisis. It is unlikely that there will be a default anytime soon. The level of reserves is at about US$ 56 billion, and the IMF is happy to finance the very Neoliberal government of Macri (because the IMF has changed a lot, remember?).The economy with Macri has not performed...

Read More »Sisyphus,Tantalus and a prisoner’s dilemma

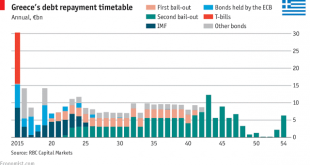

Should Greece leave the Euro? That was the title of the Oxford debate at the Prague Summit in which I had the pleasure of participating yesterday.But this is the wrong question. Unless there is a considerable shift in Eurozone politics, Greece WILL leave the Euro - eventually. The question is when, and how.To see this, we need to look at the motivations of all the players involved in the negotiations. The Greek negotiations resemble a "prisoner's dilemma", in which the best outcome for...

Read More »Argeo Quiñones and Ian Seda on the crisis in Puerto Rico

Argeo Quiñones-Pérez and Ian Seda-Irizarry discuss the crisis in this piece. They correctly point out the neocolonialist solution being imposed by the US administration. I find the imposition of a Fiscal Control Board (FCB) particularly problematic. Back when Argentina defaulted in 2002, Rudi Dornbusch had suggested something similar. At that time I sent the letter below to the Financial Times that had published his proposal. LETTERS TO THE EDITOR: Mystery of about-turn on Argentina ...

Read More »Never mind Greece, look at Venezuela

Via Business Insider comes this colourful map and chart of CDS spreads worldwide: Those who thought Greek bonds would be the most expensive to insure, since everyone knows it can't pay its debts, need to think again. Venezuela is the most expensive, by a long way. Related to that is this: The yield curve has been deeply inverted all year, but yields at all maturities are now rising: When even the yield on long-dated bonds is heading for 30%, the public finances are completely...

Read More »The Great Greek Bank Drama, Act I: Schaeuble’s Sin Bin

Greece's banks have been closed since 29th June. The closure followed the ECB's decision not to increase ELA funding after talks broke down between the Greek government and the Eurogroup.The closure is doing immense economic damage. The cash withdrawal limit of 60 euros per bank card per day is restricting spending in the Greek economy to a trickle. Media generally focus more on the hardship that the cash limit causes for households: but far worse is the inability of businesses to...

Read More »This is the Framework of a Potential Greek Compromise Taking Shape

In-depth analysis on Credit Writedowns Pro. By Marc Chandler Through the venomous comments and erosion of trust, the broad framework of what couple prove to be a workable compromise over Greece’s financial crisis may be emerging. This is not to suggest that the eurozone finance ministers meeting will reach any important decision. Indeed, the Greek Prime Minister has already reduced his finance minister’s role in the negotiations, and it appears Merkel has done something vaguely...

Read More »Mario Draghi and the Holy Grail

In a reply to a comment on my recent post about Target2 and ELA, I said this:There are no "Greek euros" or "German euros". There are only European euros. So the ECB is not exchanging Greek and German euros at par. Both countries are using the same currency, which is produced by the Eurosystem. The NCBs are not autonomous entities, they are part of the Eurosystem. They do not create their own currencies : collectively, they create the single currency.This is how a single currency works. If...

Read More » Heterodox

Heterodox