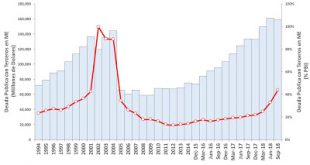

The big question in the case of Argentina, as always is when it will explode. If the current developments are an indicator of anything, it should be sooner rather than later. Note that the fundamental problems regarding the possible crisis and default are associated to the external debt in dollars (one has to repeat this all the time). It does not mean that there weren't other problems with the Argentine economy, but the domestic issues do NOT lead to a default (yes, that means the fiscal...

Read More »Hollow Promises

Today, I bring you the sad tale of a crypto lender that promised safety and high returns to its depositors, but whose promises have proved to be as hollow as its name. Donut Inc., a self-proclaimed DeFi" lender, has a "Proof of Reserves" section on its website. This is supposed to reassure customers that their deposits are matched one for one by the platform's liquid assets. I am firmly of the opinion that "Proof of Reserves" statements prove nothing without a corresponding statement of...

Read More »The Biden administration should ignore the debt ceiling

The administration run excessive budget deficits, and accumulated too much debt in the face of successive economic crises. As a result, it was forced to compromise politically in order to avoid a catastrophic default, and the subsequent political crisis brought about chaos, and the collapse of the established institutions. Of course, this is not a cautionary tale about the United States. It is a description of the economic crisis that led to the French Revolution.But in spite of the...

Read More »What went wrong at intu?

In June this year, a company called intu (no capitalisation) collapsed. Most people had never heard of it. But they knew what it did. It was the owner of many of the UK's biggest shopping centres. Lakeside in Thurrock, Metro Centre in Newcastle, and the Trafford Centre in Manchester - all of these were owned by intu. Indeed, they still are. At the time of writing, no disposals have been made. So intu is the landlord of a significant part of the UK's retail sector. And it is dead, killed by...

Read More »What went wrong at intu?

In June this year, a company called intu (no capitalisation) collapsed. Most people had never heard of it. But they knew what it did. It was the owner of many of the UK's biggest shopping centres. Lakeside in Thurrock, Metro Centre in Newcastle, and the Trafford Centre in Manchester - all of these were owned by intu. Indeed, they still are. At the time of writing, no disposals have been made. So intu is the landlord of a significant part of the UK's retail sector. And it is dead, killed by...

Read More »Debt default or negotiated solution?

An Argentinean default is neither new, nor a surprise, perhaps, even for a casual observer of the ups and downs of international bond markets. One may want to follow Oscar Wilde’s Victorian governess advice and omit the chapter on the fall of the peso as being ‘too sensational.’ But an Argentinean default now, after the Great Shutdown provoked by the coronavirus pandemic, would be the harbinger of a generalized sovereign debt crisis for emerging markets that would engulf the global economy,...

Read More »What to expect from the incoming government in Argentina

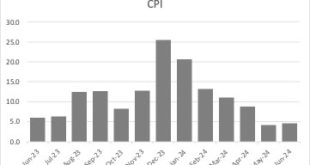

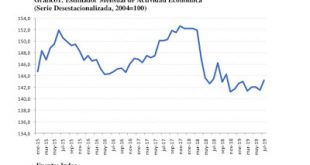

The government in Argentina has less than two weeks at this point. It is too early to pass judgment. But we can look at the legacy of the Macri administration, and indicate a few things about the current strategy. A paper I have just received from Fabian Amico, that will soon be published in Circus, will be invaluable for my very brief comments here (the new issue of Circus and his paper will eventually be linked here, in Spanish).The first thing that should be evident is that the 4 years...

Read More »The return of populism or Argentina on the verge of collapse

The Argentinean primary elections, which are very peculiar and take place all at once with all parties, were last Sunday. The primaries made some sense when the Peronist party was all divided and that allowed the main candidate to proceed, but with the move of Cristina Kirchner to the vice-presidential spot next to Alberto Fernández, and the unification of a good part of Peronism (in particular Sergio Massa), the primaries become essentially an anticipated election. And Peronism won...

Read More »Michael Hudson— The Coming Savings Meltdown

Debts that can’t be paid, won’t be. That point inevitably arrives on the liabilities side of the economy’s balance sheet. But what of the asset side? One person’s debt is a creditor’s claim for payment. This is defined as “savings,” even though banks simply create credit endogenously on their own computers without needing any prior savings. When debts can’t be paid and debtors default, what happens to these creditors? Michael Hudson — On Finance, Real Estate And The Powers Of...

Read More »Argentina, Financial Times and the next default

It's been a while since I wrote about Argentina. In all fairness, because it is difficult given all the mistakes of the last few years since Macri's victory. I discussed the prospects of what to expect back then. Since then I posted here and here on the supposed improvement in 2017, and the beginning of the still unfolding crisis in 2018. And this could simply be an "I told you so post," since I did warn about most things that would happen. But there are important and interesting news about...

Read More » Heterodox

Heterodox