Summary:

Via Business Insider comes this colourful map and chart of CDS spreads worldwide: Those who thought Greek bonds would be the most expensive to insure, since everyone knows it can't pay its debts, need to think again. Venezuela is the most expensive, by a long way. Related to that is this: The yield curve has been deeply inverted all year, but yields at all maturities are now rising: When even the yield on long-dated bonds is heading for 30%, the public finances are completely unsustainable. Venezuela, of course, is monetarily sovereign, since it issues its own currency. Well, in theory. In practice it is burning through reserves at a shocking rate to support its absurd managed exchange rate system: Don't be fooled by the uptick in June. That is because China lent it some dollars. It'll get through those in short order if it continues on its present path. To be sure, Venezuela is still earning FX due to its trade surplus, but its current account is deteriorating. Floating the currency is not really an option. The black market exchange rate is approaching 700 VEF to 1 USD. Inflation in Venezuela is officially nearly 70%, but almost certainly much more, since the central bank has provided no updates since December: some estimates put it over 100%. Whatever it is, it is undoubtedly rising fast despite the pegged exchange rate. The bolivar is currently pegged at 6.

Topics:

Frances Coppola considers the following as important: Debt, default, IMF, Venezuela

This could be interesting, too:

Via Business Insider comes this colourful map and chart of CDS spreads worldwide:Via Business Insider comes this colourful map and chart of CDS spreads worldwide: Those who thought Greek bonds would be the most expensive to insure, since everyone knows it can't pay its debts, need to think again. Venezuela is the most expensive, by a long way. Related to that is this: The yield curve has been deeply inverted all year, but yields at all maturities are now rising: When even the yield on long-dated bonds is heading for 30%, the public finances are completely unsustainable. Venezuela, of course, is monetarily sovereign, since it issues its own currency. Well, in theory. In practice it is burning through reserves at a shocking rate to support its absurd managed exchange rate system: Don't be fooled by the uptick in June. That is because China lent it some dollars. It'll get through those in short order if it continues on its present path. To be sure, Venezuela is still earning FX due to its trade surplus, but its current account is deteriorating. Floating the currency is not really an option. The black market exchange rate is approaching 700 VEF to 1 USD. Inflation in Venezuela is officially nearly 70%, but almost certainly much more, since the central bank has provided no updates since December: some estimates put it over 100%. Whatever it is, it is undoubtedly rising fast despite the pegged exchange rate. The bolivar is currently pegged at 6.

Topics:

Frances Coppola considers the following as important: Debt, default, IMF, Venezuela

This could be interesting, too:

Matias Vernengo writes Milei’s Psycho Shock Therapy

Robert Skidelsky writes Britain’s Illusory Fiscal Black Hole

Matias Vernengo writes Very brief comments on Venezuela

Matias Vernengo writes Argentina on the verge

Those who thought Greek bonds would be the most expensive to insure, since everyone knows it can't pay its debts, need to think again. Venezuela is the most expensive, by a long way.

Related to that is this:

The yield curve has been deeply inverted all year, but yields at all maturities are now rising:

When even the yield on long-dated bonds is heading for 30%, the public finances are completely unsustainable.

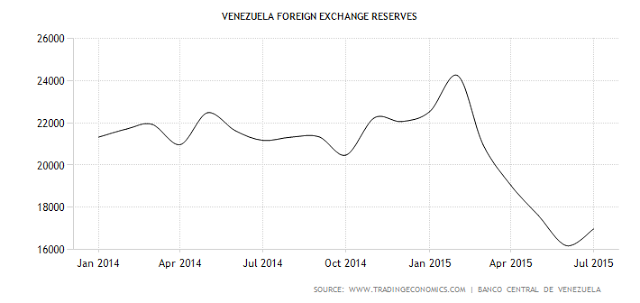

Venezuela, of course, is monetarily sovereign, since it issues its own currency. Well, in theory. In practice it is burning through reserves at a shocking rate to support its absurd managed exchange rate system:

Don't be fooled by the uptick in June. That is because China lent it some dollars. It'll get through those in short order if it continues on its present path. To be sure, Venezuela is still earning FX due to its trade surplus, but its current account is deteriorating.

Floating the currency is not really an option. The black market exchange rate is approaching 700 VEF to 1 USD. Inflation in Venezuela is officially nearly 70%, but almost certainly much more, since the central bank has provided no updates since December: some estimates put it over 100%. Whatever it is, it is undoubtedly rising fast despite the pegged exchange rate. The bolivar is currently pegged at 6.30 to the USD, though hardly anyone uses that rate: most goods are priced at one of Venezuela's secondary exchange rates. Even those substantially overvalue the bolivar.

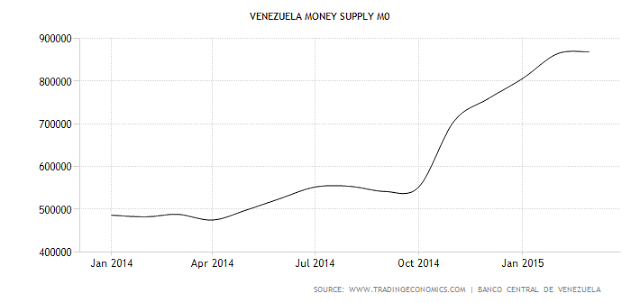

Because of Venezuela's unsustainable public finances, the central bank is monetising the public deficit, which in January was 11.5% of GDP and is probably now much higher. This is the growth in base money in the last year:

Again, don't be fooled by the tapering-off in March. The central bank, like the government, is no longer providing reliable figures.

Unpegging the bolivar would almost certainly trigger hyperinflation. But unless the bolivar is allowed to float, Venezuela faces a FX crisis despite its trade surplus. Either way, default appears a near-certainty. Hence the astronomically expensive CDS and the wildly inverted yield curve. Dollarising the economy - which would mean surrendering control of monetary policy to the Fed - has been ruled out by President Maduro.

That's the financial story. But underlying it is a political crisis. It is hard to obtain neutral reports on the political situation: captive media claims that Maduro is set to win the December elections with a landslide are not remotely credible. But reports in American press that Maduro's personal popularity has fallen to 25% and his Socialist party would fail to gain a majority are also suspect, given the Maduro administration's claim that the country's economic problems have been engineered by the US government to bring down the regime - though the fact that Maduro is now ruling by decree with the support of the military does suggest that he doesn't have much in the way of a democratic mandate. Personally, I think it is unlikely that the Maduro government would survive disorderly default, hyperinflation and economic collapse, which seem likely to be Venezuela's fate within the next couple of years. But what would replace it?

There are no good answers. The history of Latin America suggests that a military coup is likely, though not inevitable. Years of political chaos is a second possibility. And a third is the election of a much more radical government, right or left, which opts for near-autarky and a highly authoritarian command economy. All of these have been experienced by countries in Latin America over the last half century. All have proved disastrous. US hegemony, Colombia-style, is a fourth option which might prove more successful, though opponents of course claim that this is the US's plan, driven by desire to gain effective control of Venezuela's rich natural resources.

Whatever. The real issue here is the human tragedy. Venezuela faces a humanitarian disaster. Even under a new regime, it would need aid as well as restructuring and reform. And without a viable government, it would not qualify for the IMF programme it will almost certainly need. Not that the IMF is exactly up to speed on Venezuela, given that the Article IV consultation has been delayed by 110 months. Only Somalia is further adrift.

But I warned in my previous CC piece about Venezuela that the genesis of disastrous populist governments lies in the wrenching fiscal adjustments typically imposed on defaulting countries by the IMF under the Washington Consensus. People facing the ruin not only of their own lives, but those of their children and grandchildren, do not long tolerate unyielding fiscal austerity. Too many mistakes have been made by the Bretton Woods institutions, both in Latin America and elsewhere. Most recently, the IMF is significantly to blame for the situation in Greece.

There must be no more mistakes. The IMF's primary concern must in future be the wellbeing of people and the restoration of social and economic prosperity, not the repayment of creditors.

Related reading:

The Impending Collapse of Venezuela - Forbes

The IMF's Big Greek Mistake - Ashoka Mody, Bloomberg View