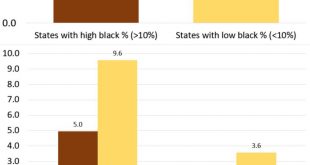

After my recent post on police shootings I was curious and did some googling on the topic. By coincidence, right about that time Peter Moskos (i.e., Cop in the Hood) wrote this: I looked at the Washington Post data of those shot and killed by police in 2015 and 2016 and broke it down by states with more and fewer African-Americans. States that are more than 10 percent African American include 21 states plus D.C. (198 million people, 18 percent black, 36...

Read More »Second Annual Canadian Homelessness Data Sharing Initiative

I’ve just blogged about the Second Annual Canadian Homelessness Data Sharing Initiative. This is now an annual event that takes place in Calgary. It’s co-sponsored by the Calgary Homeless Foundation and the University of Calgary’s School of Public Policy. A summary of the inaugural event (which took place in May 2016) can be found here, while the link to the just-published summary of the 2017 event is here. Enjoy and share:

Read More »The introduction and evolution of child benefits in Canada

Allan Moscovitch and I have co-authored a blog post that looks at the history of child benefits in Canada. Points made in the blog post include the following: -Child benefits can reduce both poverty and homelessness. -When child benefits began in Canada after World War II, one major motivating factor for the federal government was to avoid recession. Another was to fend off social unrest (i.e. Canada’s growing labour movement and the growing popularity of the CCF). The full blog post can be...

Read More »Five emerging trends in affordable housing and homelessness

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »Trump’s Election Win Shows That The Bank Bailouts And Quantitative Easing Have Failed

To all who argued the financial world would’ve collapsed without the bailouts: The political world is collapsing now because of the bailouts — Emanuel Derman (@EmanuelDerman) June 25, 2016 The bigger picture of the early 21st century follows: Western nations experienced a massive blowout bubble of leverage, irrational exuberance, and Hayekian pseudo-money creation. Yet this money was not going to overwhelmingly productive causes. The real output of the Western world did not follow...

Read More »Raising interest rates is not that simple, Lord Hague

The present period of very low interest rates is widely assumed to be temporary, a consequence of the 2008 financial crisis and subsequent central bank action. Because of this, as the financial crisis fades into the mists of time, there is growing political pressure for "normalisation" of interest rates. Here, for example, is William Hague warning that central banks must start to raise rates or face losing their independence: The only way out is for the US Fed to summon the courage to lead...

Read More »A dent in the surface of time

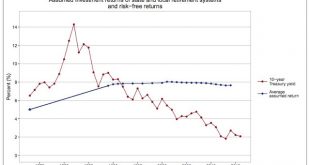

This chart has been fascinating me for ages. It was produced by the Bank of England to illustrate a speech by Andy Haldane. Shock, horror - we have the lowest interest rates for 5,000 years. Even in the Great Depression they were higher than they are now. These are, of course, nominal interest rates. Real interest rates are even lower - though not by much, since inflation is close to zero in all major economies.Note also the divergence of long-term and short-term interest rates. This is...

Read More »If only we could return to the glorious 1990s…..

The chart below comes from Silver Watch on Twitter. I haven't been able to identify the original source, but it illustrates perfectly the point I have been trying to make for quite some time now. Pension funds are not taking on more risky investments because the risk premium has fallen, but because the risk-free rate has fallen: In fact, as the chart shows, the risk-free rate has been falling steadily for over thirty years. This is not a post-crisis blip. It is a secular trend. Yet pension...

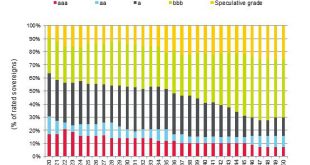

Read More »The safe asset scarcity problem, 2050 edition

This is a silly chart: Why is it silly? Just look at what it implies for government and investor behaviour - and the future of the ratings agency that issued it.S&P forecasts a serious shortage of safe assets by 2050 if the developed nations, in particular, do nothing to adjust their fiscal finances in the light of ageing populations. Clearly, therefore, the price of sovereign bonds in the three "A" categories will rise significantly. S&P doesn't indicate which nations would be the...

Read More »Asset allocation in a period of wealth mean reversion

In-depth analysis on Credit Writedowns Pro. Should FIFAA Be Red-Carded? Absolute Return Letter, November 2015 “When I want your opinion, I will give it to you.” Samuel Goldwyn No, I haven’t gone bonkers – the focus of the Absolute Return Letter has not all of a sudden switched to football. Nor have I lost the ability to spell correctly, although I am sure that there are one or two like-minded readers out there who would also like to see the rear side of Sepp Blatter one final time....

Read More » Heterodox

Heterodox