Why Krugman and Stiglitz are no real alternatives to mainstream economics Little in the discipline has changed in the wake of the crisis. Mirowski thinks that this is at least in part a result of the impotence of the loyal opposition — those economists such as Joseph Stiglitz or Paul Krugman who attempt to oppose the more viciously neoliberal articulations of economic theory from within the camp of neoclassical economics. Though Krugman and Stiglitz have...

Read More »Neoliberalism and mainstream economics

Neoliberalism and mainstream economics Oxford professor Simon Wren-Lewis isn’t pleased with heterodox attacks on mainstream economics. One of the reasons is that he doesn’t share the heterodox view that mainstream economics and neoliberal ideas are highly linked. In a post on his blog, Wren-Lewis defends the mainstream economics establishment against critique waged against it by Phil Mirowski: Mirowski overestimates the extent to which neoliberal ideas have...

Read More »Beating a dead horse

Beating a dead horse If I ask myself what I could legitimately assume a person to have rational expectations about, the technical answer would be, I think, about the realization of a stationary stochastic process, such as the outcome of the toss of a coin or anything that can be modeled as the outcome of a random process that is stationary. I don’t think that the economic implications of the outbreak of World war II were regarded by most people as the...

Read More »Feynman’s trick and Leibniz rule (student stuff)

Feynman’s trick and Leibniz rule (student stuff) In his autobiography Surely you’re joking, Mr. Feynman, Richard Feynman among other things discussed his box of tools, and mentioned a wonderful little tool by which he was able to differentiate under the integral sign more easily than by the methods usually taught at our universities: [embedded content] The more standard procedure is well described here: [embedded content] Advertisements...

Read More »What can economists know?

What can economists know? The early concerns voiced by such critics as Keynes and Hayek, while they may indeed have been exaggerated, were not misplaced. I believe that much of the difficulty economists have encountered over the past fifty years can be traced to the fact that the economic environment we seek to model are sometimes too messy to be fitted into the mold of a well-behaved, complete model of the standard kind. It is not generally the case that...

Read More »The Euler-Lagrange equation (student stuff)

The Euler-Lagrange equation (student stuff) [embedded content] Excellent lecture! Advertisements

Read More »Reasons to reject the standard rationality axioms in economics

Reasons to reject the standard rationality axioms in economics Those axioms—and you can find a whole series of people from Pareto onwards who make the same argument—come from economists’ introspection and what they think is necessary for their work, not from observation of what people are doing. Some of these axioms seem natural, at least at first sight. For example, transitivity seems a natural idea—if you prefer A to B and B to C, you also prefer A to C....

Read More »Modern macroeconomics — a walk down a blind alley

Modern macroeconomics — a walk down a blind alley I would say that macroeconomic theory has gone down a blind alley in the sense that we have locked onto a particular model: general equilibrium. But it is not really general equilibrium, I mean, it is a one-man model! In particular, it has become mathematically sophisticated without representing the fundamental features of the macro-economy. So I would say that people like Kydland and Prescott, and so forth,...

Read More »Solving the fundamental problem of decision theory (wonkish)

Solving the fundamental problem of decision theory (wonkish) Currently the dominant formalism for treating the [general gamble] problem is utility theory. Utility theory was born out of the failure of the following behavioral null model: individuals were assumed to optimize changes in the expectation values of their wealth. We argue that this null model is a priori a bad starting point because the expectation value of wealth does not generally reflect what...

Read More »Has economics really become an empirical science?

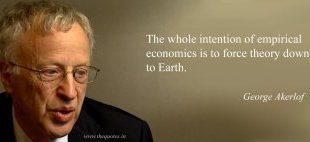

Has economics really become an empirical science? As I see it, a rational predictor should use a combination of theory and empirics. But theory should also be informed by data – there are lots of theories, and in general they can’t all apply to the same situation, so you need evidence to tell you which one(s) to use. So a rational predictor’s predictions should always be tied as closely as possible to empirical evidence. Discounting empirical evidence …...

Read More » Heterodox

Heterodox