Sixty years ago Milton Friedman wrote an (in)famous article arguing that (1) the natural rate of unemployment was independent of monetary policy and that (2) trying to keep the unemployment rate below the natural rate would only give rise to higher and higher inflation. The hypothesis has always been controversial, and much theoretical and empirical work has questioned the real-world relevance of the idea that unemployment really is independent of monetary policy and that...

Read More »Die Schuldenbremse gefährdet die Zukunft der jüngeren Generation

Die Schuldenbremse gefährdet die Zukunft der jüngeren Generation .[embedded content]

Read More »Klas Eklunds ‘Vår ekonomi’ — lärobok med stora brister

Klas Eklunds ‘Vår ekonomi’ — lärobok med stora brister Varje höst håller your truly sedan fler år tillbaka en introduktionskurs i nationalekonomi för blivande gymnasielärare i samhällskunskap. Förutom några av mina egna böcker, står även Klas Eklunds Vår ekonomi på litteraturlistan. Den senaste utgåvan av Vår ekonomi kom ut år 2020, och är nu på väg ut i sin 16:e reviderade upplaga. Imponerande och i sig ett bevis på bokens många förtjänster, inte minst de...

Read More »NAIRU — a harmful fairy tale

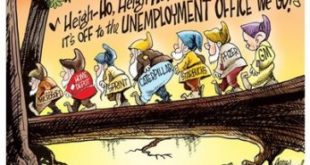

from Lars Syll The NAIRU story has always had a very clear policy implication — attempts to promote full employment are doomed to fail since governments and central banks can’t push unemployment below the critical NAIRU threshold without causing harmful runaway inflation. Although a lot of mainstream economists and politicians have a touching faith in the NAIRU fairy tale, it doesn’t hold water when scrutinized. One of the main problems with NAIRU is that it is essentially a timeless...

Read More »Ekonomisk politik och finanspolitiska ramverk

Ekonomisk politik och finanspolitiska ramverk Clarté Lund bjuder in till en samtalsserie i tre delar om visionär ekonomi. Det första panelsamtalet berör ekonomisk politik och det nya omtalade balansmålet i det finanspolitiska ramverket. Varför fick vi inte ett underskottsmål och vad för konsekvenser får detta för ett Sverige med enorma investeringsbehov? Med hjälp av sakkunniga panelister kommer vi att fördjupa oss i ämnet och reda ut vad som står på...

Read More »NAIRU — a harmful fairy tale

NAIRU — a harmful fairy tale The NAIRU story has always had a very clear policy implication — attempts to promote full employment are doomed to fail since governments and central banks can’t push unemployment below the critical NAIRU threshold without causing harmful runaway inflation. Although a lot of mainstream economists and politicians have a touching faith in the NAIRU fairy tale, it doesn’t hold water when scrutinized. One of the main problems with...

Read More »Isabella Weber on sellers inflation

Isabella Weber on sellers inflation .[embedded content]

Read More »Hur länge ska bankerna få fortsätta blåsa oss?

Hur länge ska bankerna få fortsätta blåsa oss? I det senaste avsnittet av Starta Pressarna pratar Daniel Suhonen och Max Jerneck med Andreas Cervenka om hans nyutkomna bok Fuskbygget. Hur har vi kunnat tillåta att våra bostäder har blivit en handelsvara som gör storbankerna stormrika? Och varför har staten tillåtIt framväxten av ett system som förvandlar ett i grunden mänskligt behov av att ha tak över huvudet till att bli en gratisvinst för bankers i...

Read More »Riksbanken hanterar inflationen fel

Vad beror den ökande inflationen på? Max Jerneck (MJ): Den beror till stor del på ökade priser på energi och livsmedel, som orsakas av saker som hur elmarknaden är reglerad och torka samt kriget i Ukraina. Även priserna på möbler och andra varor, och grundläggande komponenter och insatsvaror som halvledare och stål spelar in. Under pandemin minskade efterfrågan på tjänster samtidigt som den snabbt ökade på varor, vilket tillverkare och leverantörskedjor hade svårt att hantera....

Read More »In Greece, gross fixed investment still is at a pre-industrial level.

Executive summary: if investments are needed, do not reform. Invest. Investments are the reform. Angus Maddison (historical patterns of growth) and Jan Kregel (leading post-Keynesian economist) were the intellectually dominant forces during my economics study in Groningen around 1982. Let´s apply their frameworks to Greece. Growth, as we measure it, has many sources: increasing the productivity of existing activities (the mechanization of the potato harvest), shifting labour from...

Read More » Heterodox

Heterodox