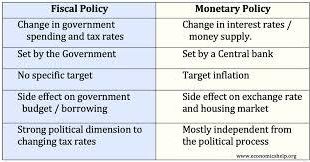

Central banks and fiscal policies Suppose a UK government became extremely irresponsible, and enacted large tax cuts during an economic boom. The Bank would, following its remit, attempt to put the lid on inflationary pressure by raising interest rates. Suppose further that the markets panicked, and refused to buy UK government debt except at ridiculously high interest rates. In that situation I think it is extremely unlikely that the Bank would intervene...

Read More »Mainstream macroeconomics — rigorously irrelevant

Mainstream macroeconomics — rigorously irrelevant There is something about the way macroeconomists construct their models nowadays that obviously doesn’t sit right. One might have hoped that humbled by the manifest failure of its theoretical pretenses during the latest economic-financial crises, the one-sided, almost religious, insistence on axiomatic-deductivist modeling as the only scientific activity worthy of pursuing in economics would give way to...

Read More »An interview with Stephanie Kelton

An interview with Stephanie Kelton Cody Fenwick: What drives the biggest misunderstandings about government debt in our national conversation? Everything is wrong. The way we talk about federal government debt is, from my perspective, we say things like we’re borrowing from China and foreigners. Hillary Clinton said when she was secretary of State that it’s a national security threat. People talk about it representing a liability to all of us, so we hear...

Read More »NAIRU — a non-existent unicorn

NAIRU — a non-existent unicorn In our extended NAIRU model, labor productivity growth is included in the wage bargaining process … The logical consequence of this broadening of the theoretical canvas has been that the NAIRU becomes endogenous itself and ceases to be an attractor — Milton Friedman’s natural, stable and timeless equilibrium point from which the system cannot permanently deviate. In our model, a deviation from the initial equilibrium affects...

Read More »Hicks’ chef-d’oeuvre

When we cannot accept that the observations, along the time-series available to us, are independent, or cannot by some device be divided into groups that can be treated as independent, we get into much deeper water. For we have then, in strict logic, no more than one observation, all of the separate items having to be taken together. For the analysis of that the probability calculus is useless; it does not apply. We are left to use our judgement, making sense of what has...

Read More »Top 15 Economics Blog of The World

Top 15 Economics Blog of The World Random Observations for Students of Economics This blog is run by Gregory Mankiw … Macro Musings Blog Run by David Beckworth, a senior research fellow at George Mason University … Confessions of a Supply-Side Liberal Run by Miles Kimball, the Emeritus Professor Economics at Michigan University … Marginal Revolution Alex Tabarrok and Tyler Cowen, both professors of economics at George Mason University, run this blog …...

Read More »The Deficit Myth

Soon after joining the Budget Committee, Kelton the deficit owl played a game with the staffers. She would first ask if they would wave a magic wand that had the power to eliminate the national debt. They all said yes. Then Kelton would ask, “Suppose that wand had the power to rid the world of US Treasuries. Would you wave it?” This question—even though it was equivalent to asking to wipe out the national debt—“drew puzzled looks, furrowed brows, and pensive expressions....

Read More »The rhetoric of imaginary populations

The rhetoric of imaginary populations The most expedient population and data generation model to adopt is one in which the population is regarded as a realization of an infinite super population. This setup is the standard perspective in mathematical statistics, in which random variables are assumed to exist with fixed moments for an uncountable and unspecified universe of events … This perspective is tantamount to assuming a population machine that spawns...

Read More »Statsskuldsretorikens metaforiska makt

Till det som är tabubelagt i Sverige hör att säga att statens pengar kommer från staten. När finanspolitiken nu expanderar under pandemin har man på ledarsidor kunnat läsa filosofiska resonemang om att de nya pengarna egentligen kommer från skattebetalarna, löntagarna eller företagen. Nationalekonomen John Hassler skrev i Expressen (8 maj) att staten finansierar sina krispaket genom att låna av oss medborgare. Att nämna det uppenbara – att det är nya pengar det handlar om,...

Read More »The ultimate takedown of teflon coated defenders of rational expectations

The ultimate takedown of teflon coated defenders of rational expectations James Heckman, winner of the “Nobel Prize” in economics (2000), did an interview with John Cassidy in 2010. It’s an interesting read (Cassidy’s words in italics): What about the rational-expectations hypothesis, the other big theory associated with modern Chicago? How does that stack up now? I could tell you a story about my friend and colleague Milton Friedman. In the...

Read More » Heterodox

Heterodox