from Steven Klees I am quite sure that this year’s three Nobel Laureates in economics — Daron Acemoglu, Simon Johnson and James Robinson – are very competent new institutionalist economists. Lars Syll offers a thoughtful critique of their substantive arguments, but he misses the main point for me. New institutional economics, by and large, is nonsense. We used to have many sensible institutional economists who offered a qualitative, sociological-type analysis of the role of economic...

Read More »How to deal with inflation?

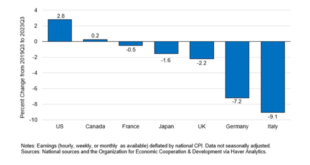

In Europe (the Euro area, to be precise), both unemployment and inflation are down, according to Eurostat,. Which, again, shows that the Phillips curve, a crucial concept behind neoclassical macroeconomic thinking that assumes a more or less stable negative relation between unemployment and inflation (high unemployment will bring inflation down), is not the place to go when predicting or analysing inflation. Sometimes, this relation is specified as a relation between wage increases and...

Read More »Brenner’s satisfactory

from Peter Radford “Mathematics is the art of the perfect. Physics is the art of the optimal. Biology, because of evolution, is the art of the satisfactory”. That’s Sydney Brenner speaking. He should know a thing or two. He won a Nobel Prize. It’s a shame, is it not? Economies are always changing. Not just in terms of innovation and all the normal things we think of as change, but also in more simple terms: in the people making up an economy change. They are born and they die. And...

Read More »The Road Not Taken

from Lars Syll We all heterodox economists who have chosen the road ‘less traveled by’ know that this choice comes at a price. Fewer opportunities to secure ample research funding or positions at prestigious institutes or universities. Nevertheless, yours truly believes that very few of us regret our choices. One doesn’t bargain with one’s conscience. No amount of money or prestige in the world can replace the feeling of looking in the mirror and liking what one sees. My friend Axel...

Read More »Milton Friedman – economic visionary or scourge of the world?

The Spectator, 13 January 2024 Monetarism, with which his name is associated, has long defined economic policy. But what would Friedman have made of the banking collapse, so soon after his death in 2006? The Keynesian economist Nicholas Kaldor called Milton Friedman one of the two most evil men of the 20th century. (Friedman was in distinguished company.) The ‘scourge’ he inflicted on the world was monetarism, a product of what Kaldor called Friedman’s Big Lie – of which more later....

Read More »Britain’s Illusory Fiscal Black Hole

Project Syndicate 18th of September, 2024 “Shortly after taking office, the United Kingdom’s new Labour government announced the discovery of a massive shortfall in public finances. While much of the political debate has centered on the size of this fiscal hole, the real culprit is the set of arbitrary rules that British governments have imposed on themselves since 1997.“ LONDON – Shortly after taking office, the United Kingdom’s new Labour government announced the discovery of a...

Read More »In praise of pluralism

from Lars Syll Recognition of the speculative value of counterfactualizing provides the grounding for a defense of theoretical pluralism in economics. The existence of multiple contending theories in economics is inconvenient, of course. It casts doubt on the truth content of the counterfactual scenarios generated by the predominant approach and challenges the predominant causal claims … But that is precisely the virtue of contending theoretical perspectives in economics. They serve to...

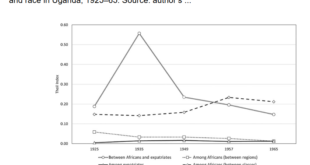

Read More »Using the Theil inequality index to show and analyse increased colonial exploitation

Some time ago, I delved into the unique advantages of the Theil index of inequality over the Gini index, when data is available. The Theil index offers a distinct advantage in its ability to provide a consistent quantitative deconstruction of inequality. It does so by utilizing various concepts such as class, region, gender, or any other relevant factor. This feature allows for a comprehensive explanation of (changes in) inequality using the same set of concepts. The Theil index...

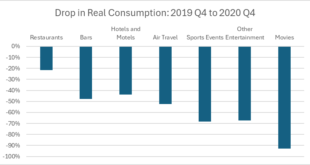

Read More »The great economy Trump left Biden

from Dean Baker We have been seeing numerous stories in the media about how people support Donald Trump because he did such a great job with the economy. Obviously, people can believe whatever they want about the world, but it is worth reminding people what the world actually looked like when Trump left office (kicking and screaming) and Biden stepped into the White House. Trump’s Legacy: Mass Unemployment The economy had largely shut down in the spring of 2020 because of the pandemic. It...

Read More »Catherine Rampell of WaPo notes the U.S. economy “looks remarkably good.”

Prof. Heather giving a news report on the economy and what people are believing based on their politics. The economy has weathered a pandemic, inflation, supply chain events, a war in eastern Europe, dysfunctional Republicans, politics, trump, and it keeps on ticking. I expected more of a 2008 scenario with Congress and the Fed ravishing Labor as the troublemakers. October 27, 2023, Letters from an American, Prof. Heather Cox Richardson An...

Read More » Heterodox

Heterodox