The issue is back in the news. This time in Brazil (it was briefly an issue here when Trump did not reappoint Yellen, and then complained about Powell's interest rate where too high). At any rate, I always thought that there were good reasons for skepticism about central bank independence (CBI). As noted by Massimo Pivetti in this old piece on the Maastricht Accord and the, at that time, plan for the euro, the main reason to be doubtful is related to the interaction of monetary policy and...

Read More »Roger Farmer — Economic Window Why deficits are sustainable and inflation has a life of its own

My new working paper “The Fiscal Theory of the Price Level in Overlapping Generations Models” is now available here. The paper, joint with Pawel Zabczyk of the IMF, is also available as CEPR Discussion Paper 13432 and as NBER Working Paper 23445. Here is a teaser from the abstract…. Given the recent publicity for deficit spending by Olivier Blanchard writing on his PIIE blog, or the interview with Stephanie Kelton in Barrons, we think our paper is timely. We demonstrate that sensible...

Read More »Brad DeLong — Sunday Morning Twitter: Functional Finance/A Better World Is Possible Tweeting…

This is a good Twitter thread and I suggest reading it. I am sure MMT economists will jump in.Here's an excerpt. ... Brad DeLong: MMT is Abba Lerner's Functional Finance with bells & whistles & some confusions. Manipulate G to stabilize Y & π, manipulate M to get an i to make debt finance sustainable, and rely on π to tell you if your policies are sustainable... If π↑ need G↓ Suresh Naidu: Clearest exposition of MMT in a tweet. Fight me deficit owls! ... BDL has thought...

Read More »Lara-Resende, Cochrane and the Brazilian Recession

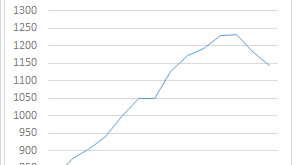

GDP has collapsed by a bit more than 7% in real terms over the last two years in Brazil (graph below show more recent data). This constitutes the worst crisis in recorded macroeconomic history, worse than the debt crisis of the early 1980s, and even the Great Depression. The reasons for this crisis are entirely self-inflicted. I discussed those issues before here (and here). The problem is not fiscal, which resulted from the crisis, nor external, since there was no real issue in financing...

Read More » Heterodox

Heterodox